Light & Wonder trades at $98.23 and has moved in lockstep with the market. Its shares have returned 7.7% over the last six months while the S&P 500 has gained 4.1%.

Is LNW a buy right now? Find out in our full research report, it’s free.

Why Does Light & Wonder Spark Debate?

With names as crazy as Ultimate Fire Link Power 4 for its products, Light & Wonder (NASDAQ: LNW) is a gaming company supplying the casino industry with slot machines, table games, and digital games.

Two Things to Like:

1. Outstanding Long-Term EPS Growth

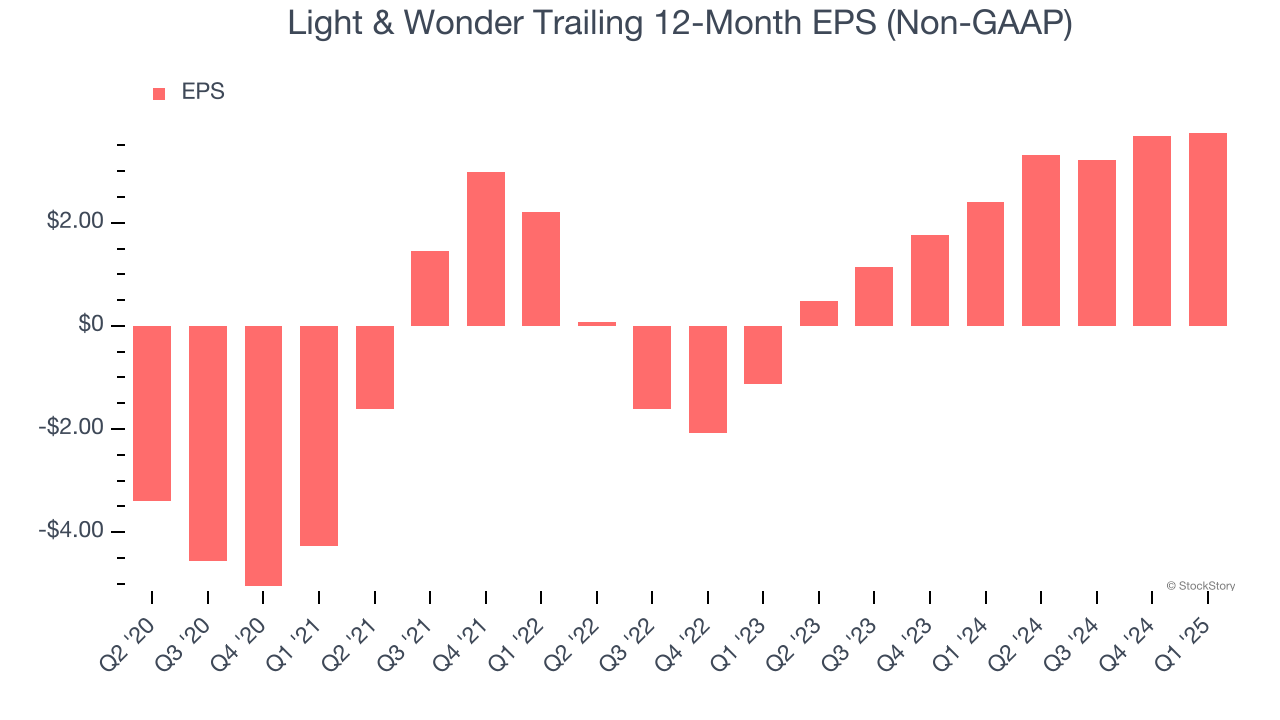

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Light & Wonder’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

2. New Investments Bear Fruit as ROIC Jumps

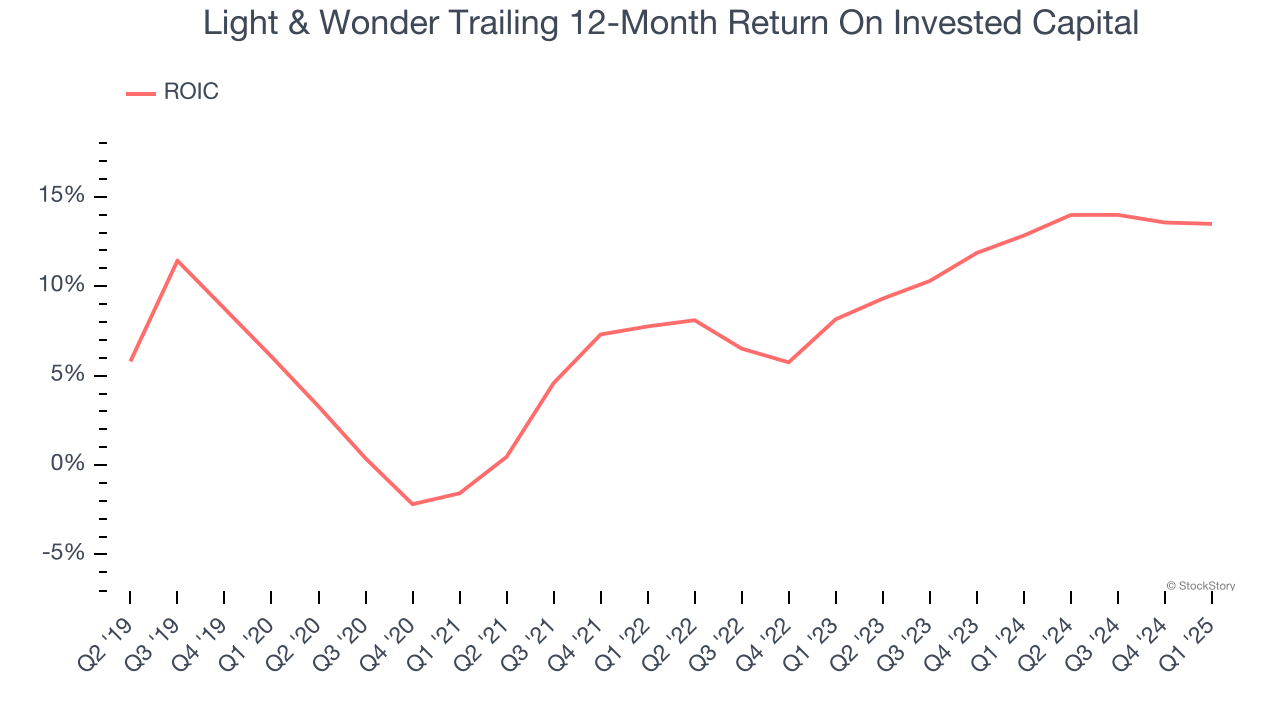

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Light & Wonder’s ROIC has increased significantly over the last few years. its rising ROIC is a good sign and could suggest its competitive advantage or profitable growth opportunities are expanding.

One Reason to be Careful:

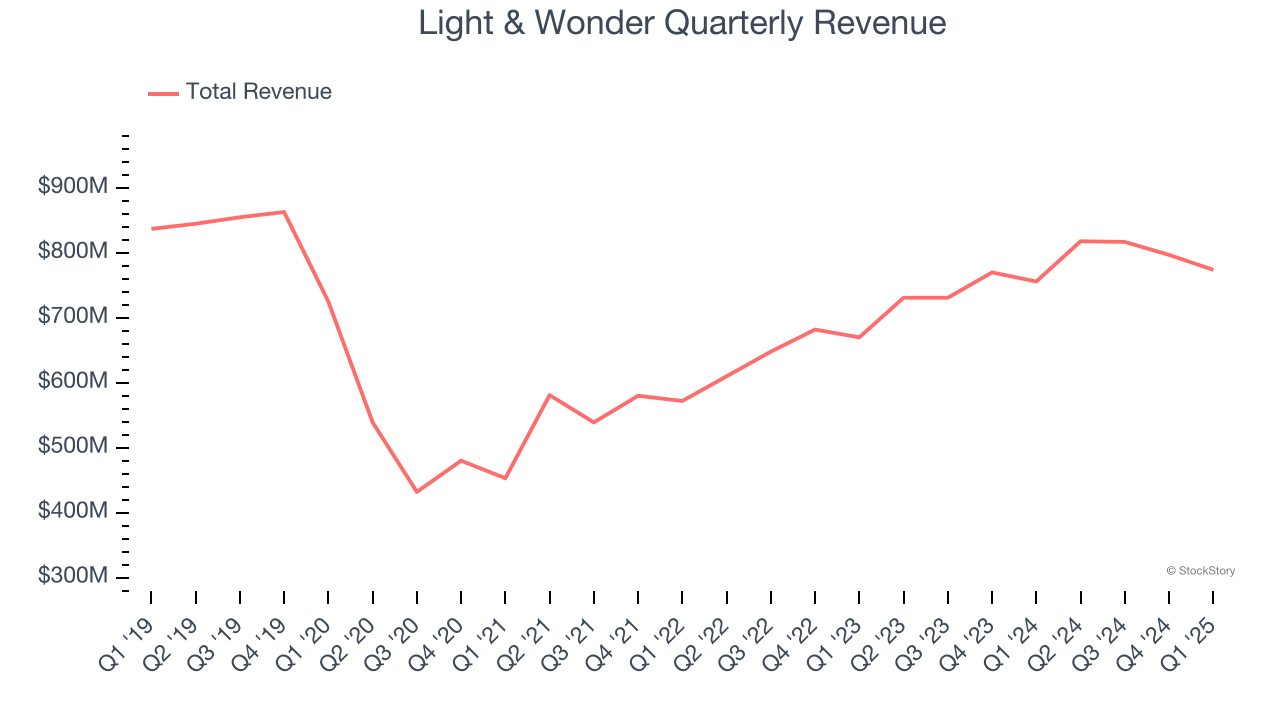

Long-Term Revenue Growth Flatter Than a Pancake

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Light & Wonder struggled to consistently increase demand as its $3.21 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result, but there are still things to like about Light & Wonder.

Final Judgment

Light & Wonder’s positive characteristics outweigh the negatives, but at $98.23 per share (or 16.8× forward P/E), is now the right time to buy the stock? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Light & Wonder

Trump’s April 2024 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.