Earnings results often indicate what direction a company will take in the months ahead. With Q1 behind us, let’s have a look at Xerox (NASDAQ: XRX) and its peers.

The Hardware & Infrastructure sector will be buoyed by demand related to AI adoption, cloud computing expansion, and the need for more efficient data storage and processing solutions. Companies with tech offerings such as servers, switches, and storage solutions are well-positioned in our new hybrid working and IT world. On the other hand, headwinds include ongoing supply chain disruptions, rising component costs, and intensifying competition from cloud-native and hyperscale providers reducing reliance on traditional hardware. Additionally, regulatory scrutiny over data sovereignty, cybersecurity standards, and environmental sustainability in hardware manufacturing could increase compliance costs.

The 9 hardware & infrastructure stocks we track reported a slower Q1. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 0.7% above.

Luckily, hardware & infrastructure stocks have performed well with share prices up 22.3% on average since the latest earnings results.

Xerox (NASDAQ: XRX)

Pioneering the modern office copier and inventing technologies like Ethernet and the laser printer, Xerox (NASDAQ: XRX) provides document management systems, printing technology, and workplace solutions to businesses of all sizes across the globe.

Xerox reported revenues of $1.46 billion, down 3% year on year. This print was in line with analysts’ expectations, but overall, it was a softer quarter for the company with a significant miss of analysts’ EPS estimates.

"In a quarter marked by increasing levels of macroeconomic and trade policy uncertainty, our team remained focused on what we can control: the balanced execution of our Reinvention and delivering client success," said Steve Bandrowczak, chief executive officer at Xerox.

Interestingly, the stock is up 33.3% since reporting and currently trades at $5.88.

Read our full report on Xerox here, it’s free.

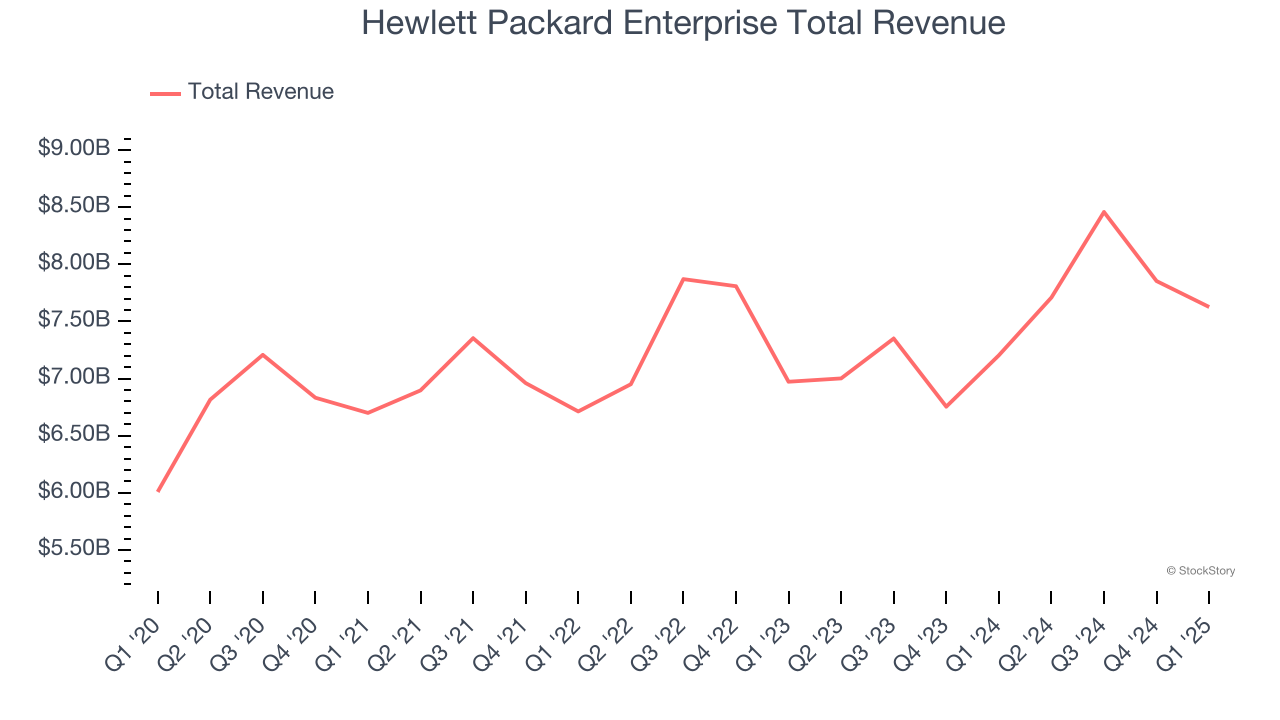

Best Q1: Hewlett Packard Enterprise (NYSE: HPE)

Born from the 2015 split of the iconic Silicon Valley pioneer Hewlett-Packard, Hewlett Packard Enterprise (NYSE: HPE) provides edge-to-cloud technology solutions that help businesses capture, analyze, and act upon their data across hybrid IT environments.

Hewlett Packard Enterprise reported revenues of $7.63 billion, up 5.9% year on year, outperforming analysts’ expectations by 2.3%. The business had a very strong quarter with an impressive beat of analysts’ ARR and EPS estimates.

Hewlett Packard Enterprise scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 20.8% since reporting. It currently trades at $21.34.

Is now the time to buy Hewlett Packard Enterprise? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: HP (NYSE: HPQ)

Born from the legendary Silicon Valley garage startup founded by Bill Hewlett and Dave Packard in 1939, HP (NYSE: HPQ) designs and sells personal computers, printers, and related technology products and services to consumers, businesses, and enterprises worldwide.

HP reported revenues of $13.22 billion, up 3.3% year on year, exceeding analysts’ expectations by 0.9%. Still, it was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

As expected, the stock is down 4.7% since the results and currently trades at $26.

Read our full analysis of HP’s results here.

IonQ (NYSE: IONQ)

Founded by quantum physics pioneers from the University of Maryland and Duke University in 2015, IonQ (NYSE: IONQ) develops quantum computers that process information using trapped ions to solve complex computational problems beyond the capabilities of traditional computers.

IonQ reported revenues of $7.57 million, flat year on year. This print topped analysts’ expectations by 0.9%. It was a strong quarter as it also recorded revenue guidance for next quarter exceeding analysts’ expectations.

IonQ delivered the highest full-year guidance raise among its peers. The stock is up 52.1% since reporting and currently trades at $44.39.

Read our full, actionable report on IonQ here, it’s free.

Super Micro (NASDAQ: SMCI)

Founded in Silicon Valley in 1993 and known for its modular "building block" approach to server design, Super Micro Computer (NASDAQ: SMCI) designs and manufactures high-performance, energy-efficient server and storage systems for data centers, cloud computing, AI, and edge computing applications.

Super Micro reported revenues of $4.6 billion, up 19.5% year on year. This number came in 2.7% below analysts' expectations. It was a slower quarter as it also recorded a significant miss of analysts’ operating income estimates.

Super Micro scored the fastest revenue growth but had the weakest performance against analyst estimates among its peers. The stock is up 47.7% since reporting and currently trades at $48.59.

Read our full, actionable report on Super Micro here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.