What a fantastic six months it’s been for Sally Beauty. Shares of the company have skyrocketed 53.7%, hitting $15.37. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy Sally Beauty, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think Sally Beauty Will Underperform?

We’re glad investors have benefited from the price increase, but we don't have much confidence in Sally Beauty. Here are three reasons why SBH doesn't excite us and a stock we'd rather own.

1. Lack of New Stores, a Headwind for Revenue

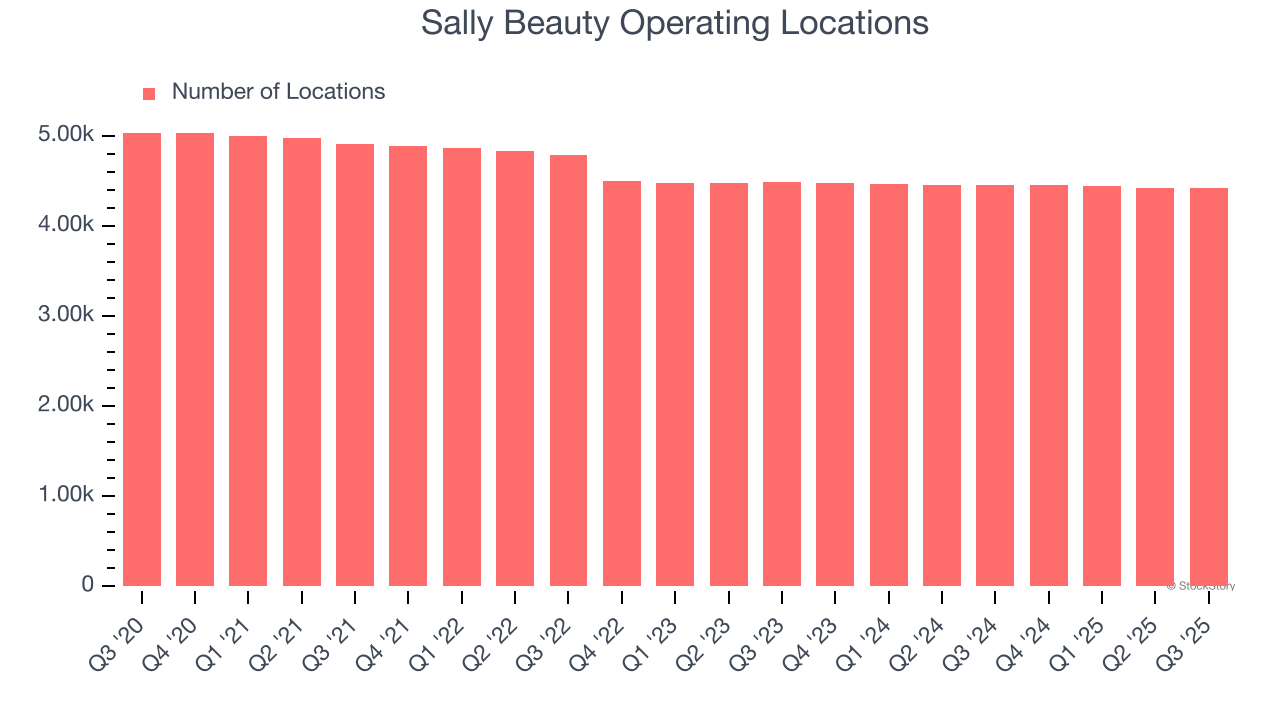

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Sally Beauty listed 4,422 locations in the latest quarter and has kept its store count flat over the last two years while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

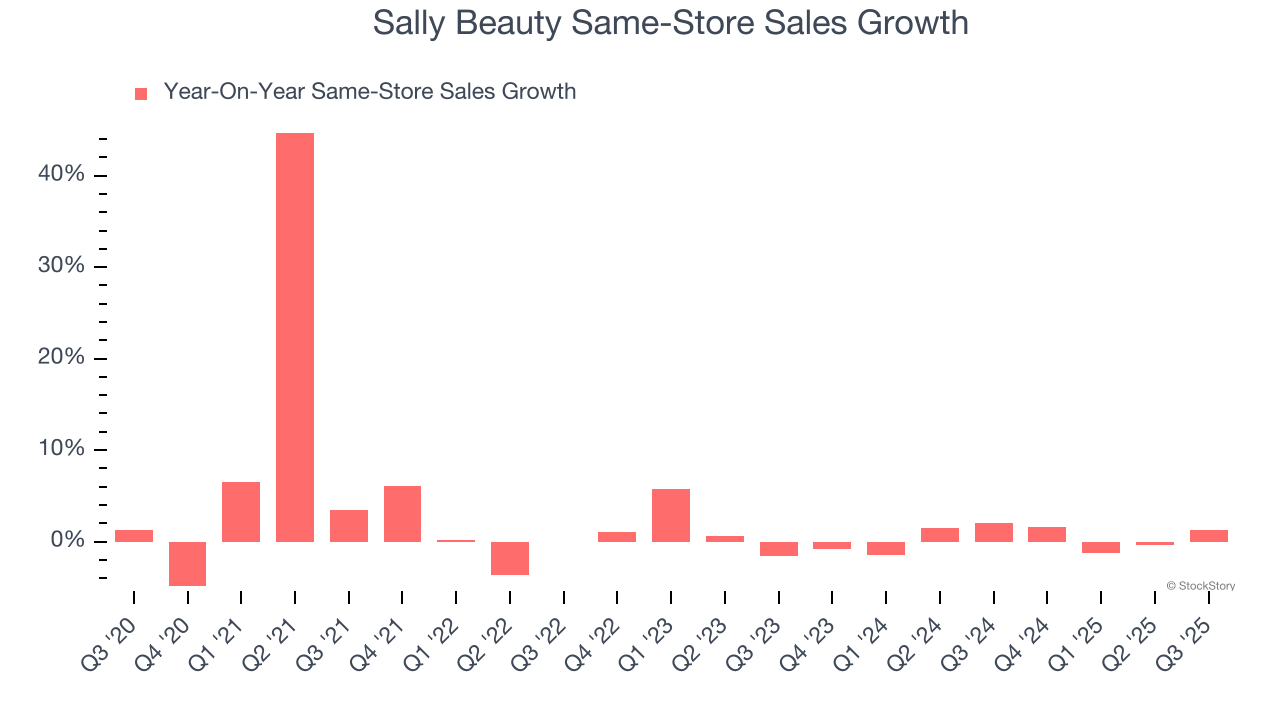

2. Flat Same-Store Sales Indicate Weak Demand

Same-store sales is a key performance indicator used to measure organic growth at brick-and-mortar shops for at least a year.

Sally Beauty’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat.

3. Fewer Distribution Channels Limit its Ceiling

With $3.70 billion in revenue over the past 12 months, Sally Beauty is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

Final Judgment

Sally Beauty doesn’t pass our quality test. Following the recent surge, the stock trades at 7.1× forward P/E (or $15.37 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now. We’d recommend looking at the most entrenched endpoint security platform on the market.

Stocks We Like More Than Sally Beauty

Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.