OceanFirst Financial trades at $18.65 and has moved in lockstep with the market. Its shares have returned 14.2% over the last six months while the S&P 500 has gained 10%.

Is now the time to buy OceanFirst Financial, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Do We Think OceanFirst Financial Will Underperform?

We're cautious about OceanFirst Financial. Here are three reasons we avoid OCFC and a stock we'd rather own.

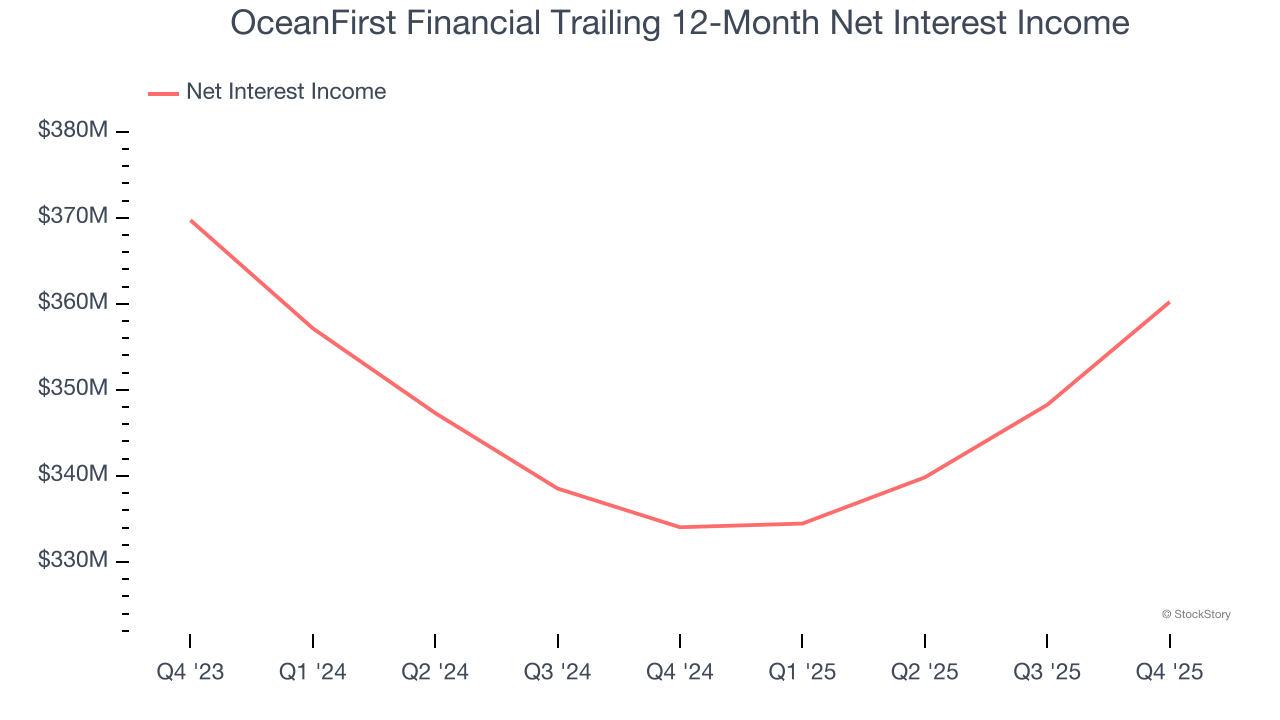

1. Net Interest Income Points to Soft Demand

Our experience and research show the market cares primarily about a bank’s net interest income growth as one-time fees are considered a lower-quality and non-recurring revenue source.

OceanFirst Financial’s net interest income has grown at a 2.9% annualized rate over the last five years, much worse than the broader banking industry. This was driven by its loan growth as its net interest margin, which represents how much a bank earns in relation to its outstanding loan book, declined throughout that period.

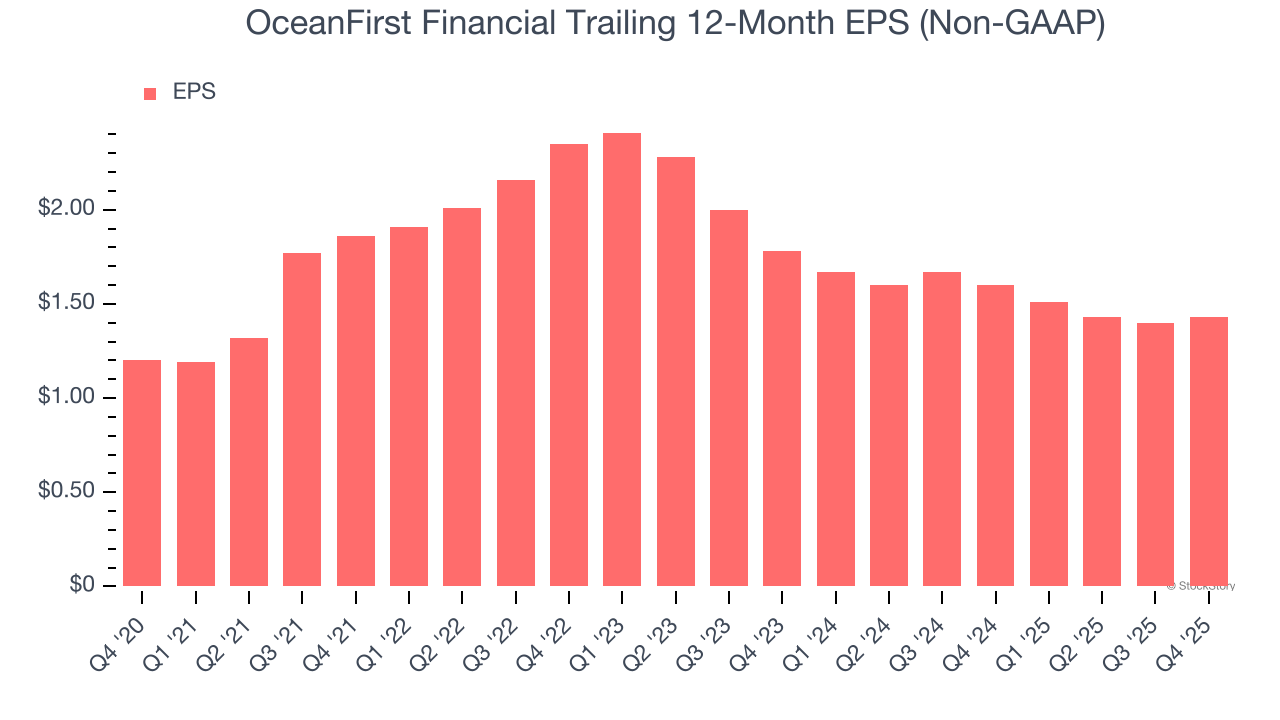

2. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

OceanFirst Financial’s weak 3.6% annual EPS growth over the last five years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

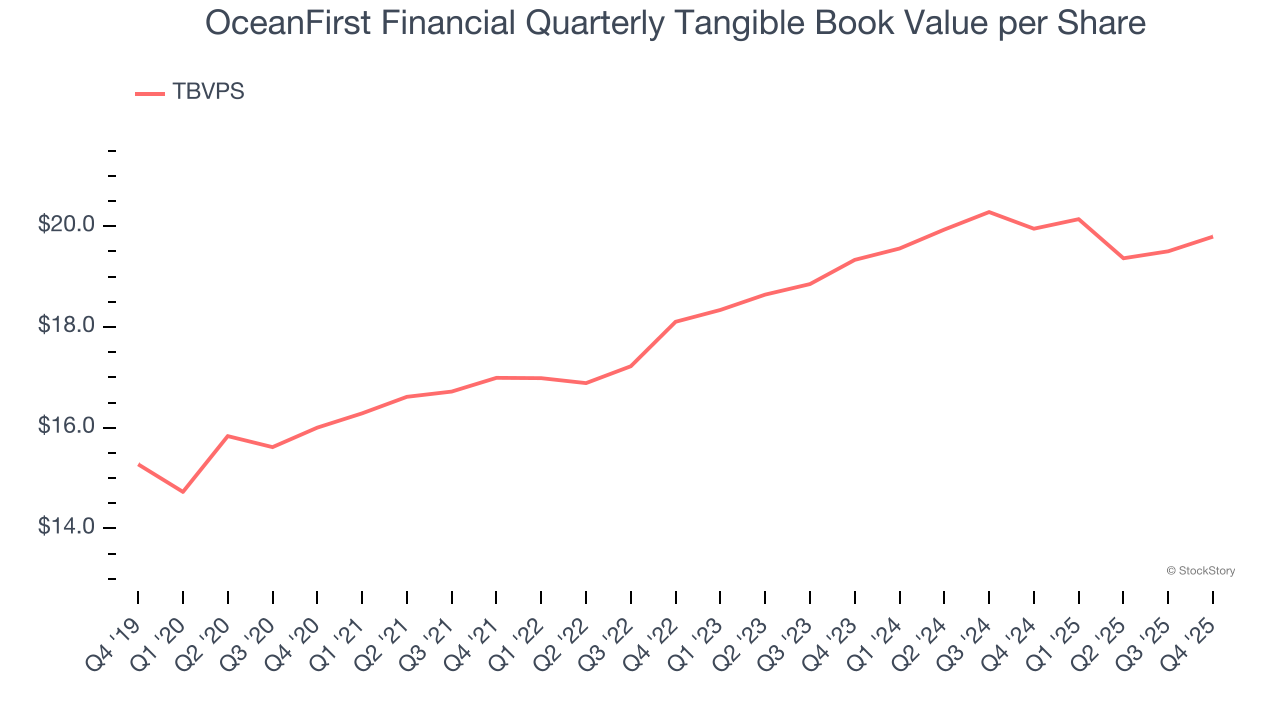

3. TBVPS Projections Show Stormy Skies Ahead

Tangible book value per share (TBVPS) growth is driven by a bank’s ability to earn more than its cost of capital through lending activities while maintaining a strong balance sheet.

Over the next 12 months, Consensus estimates call for OceanFirst Financial’s TBVPS to shrink by 2.2% to $19.36, a sour projection.

Final Judgment

We cheer for all companies supporting the economy, but in the case of OceanFirst Financial, we’ll be cheering from the sidelines. That said, the stock currently trades at 0.7× forward P/B (or $18.65 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now. We’d suggest looking at a top digital advertising platform riding the creator economy.

Stocks We Like More Than OceanFirst Financial

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.