Trustmark has had an impressive run over the past six months as its shares have beaten the S&P 500 by 7.4%. The stock now trades at $44.28, marking a 15% gain. This performance may have investors wondering how to approach the situation.

Is now the time to buy Trustmark, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Trustmark Not Exciting?

We’re glad investors have benefited from the price increase, but we're swiping left on Trustmark for now. Here are three reasons there are better opportunities than TRMK and a stock we'd rather own.

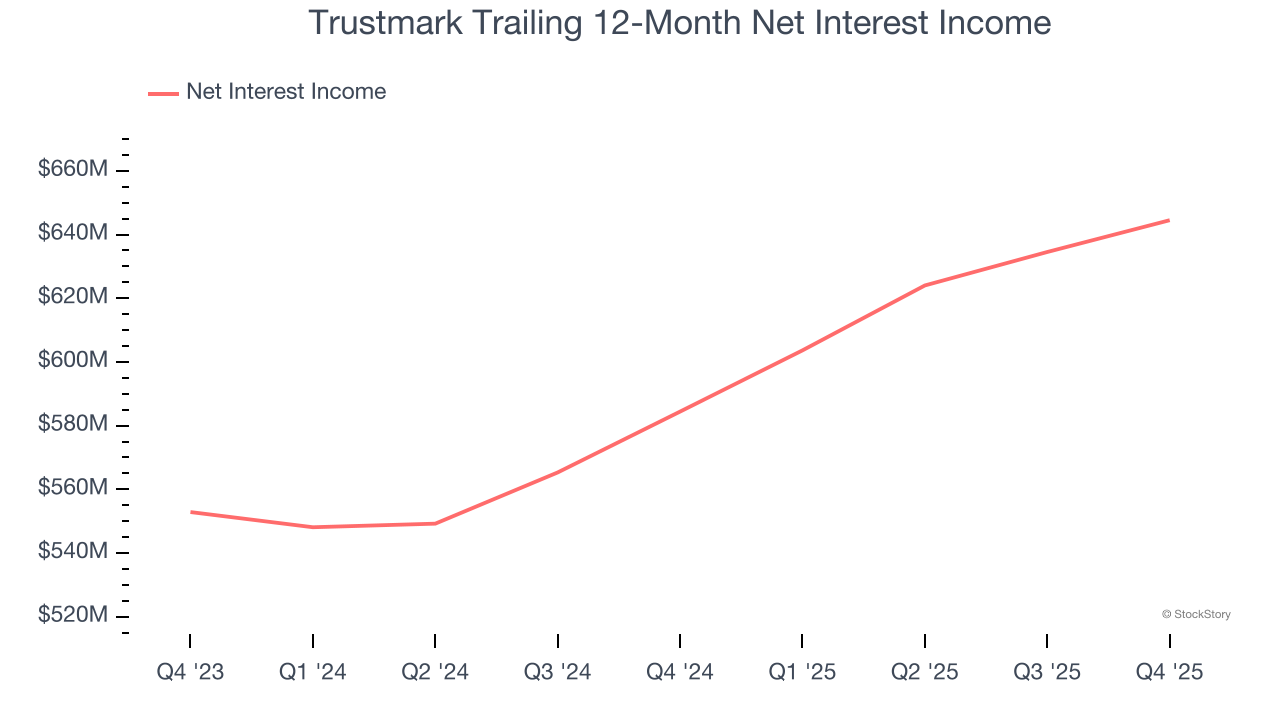

1. Net Interest Income Points to Soft Demand

Markets consistently prioritize net interest income over non-recurring fees, recognizing its superior quality compared to the more unpredictable revenue streams.

Trustmark’s net interest income has grown at a 8.6% annualized rate over the last five years, slightly worse than the broader banking industry. Its growth was driven by both an increase in its outstanding loans and net interest margin, which represents how much a bank earns in relation to its outstanding loan book.

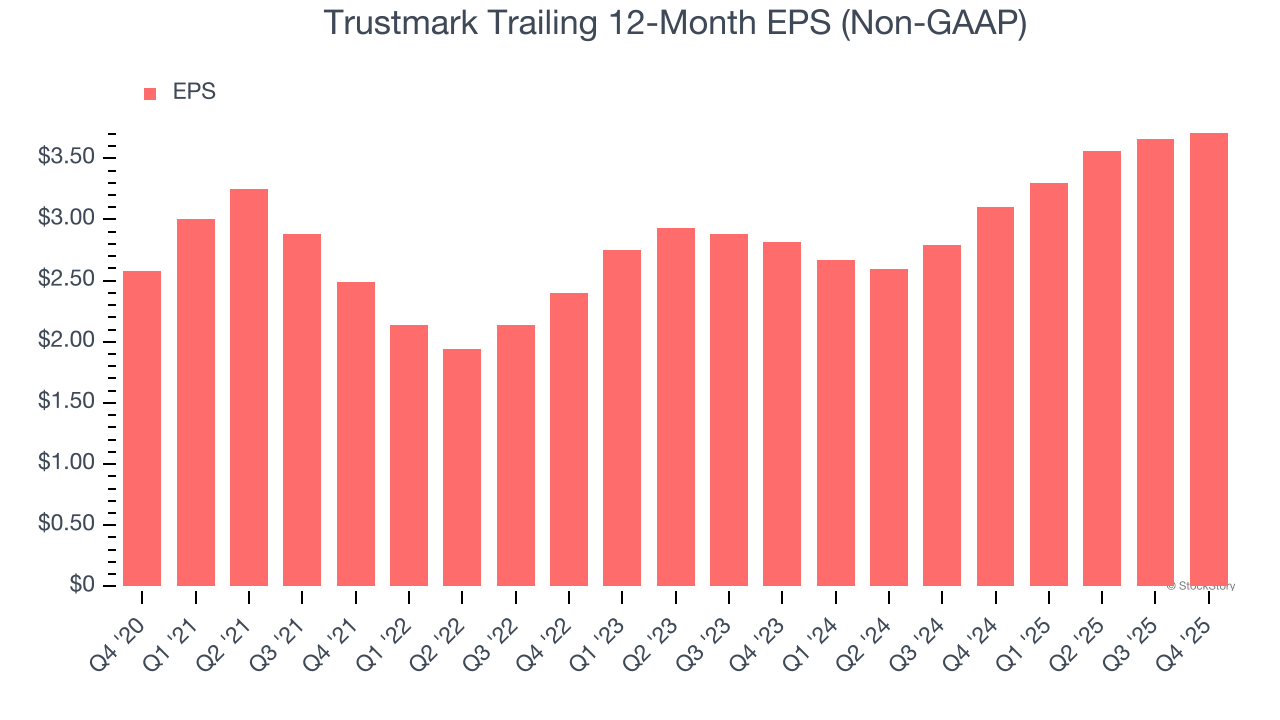

2. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Trustmark’s EPS grew at an unimpressive 7.5% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 2.7% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

3. Previous Growth Initiatives Haven’t Impressed

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, Trustmark has averaged an ROE of 7.1%, uninspiring for a company operating in a sector where the average shakes out around 7.5%.

Final Judgment

Trustmark isn’t a terrible business, but it isn’t one of our picks. With its shares beating the market recently, the stock trades at 1.1× forward P/B (or $44.28 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. We’d recommend looking at one of our top software and edge computing picks.

Stocks We Would Buy Instead of Trustmark

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.