Global professional services company Jacobs Solutions (NYSE: J) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 12.3% year on year to $3.29 billion. Its non-GAAP profit of $1.53 per share was 1.8% above analysts’ consensus estimates.

Is now the time to buy Jacobs Solutions? Find out by accessing our full research report, it’s free.

Jacobs Solutions (J) Q4 CY2025 Highlights:

- Revenue: $3.29 billion vs analyst estimates of $3.09 billion (12.3% year-on-year growth, 6.5% beat)

- Adjusted EPS: $1.53 vs analyst estimates of $1.50 (1.8% beat)

- Adjusted EBITDA: $302.6 million vs analyst estimates of $300.1 million (9.2% margin, 0.8% beat)

- Operating Margin: 7.1%, in line with the same quarter last year

- Free Cash Flow Margin: 11.1%, up from 3.3% in the same quarter last year

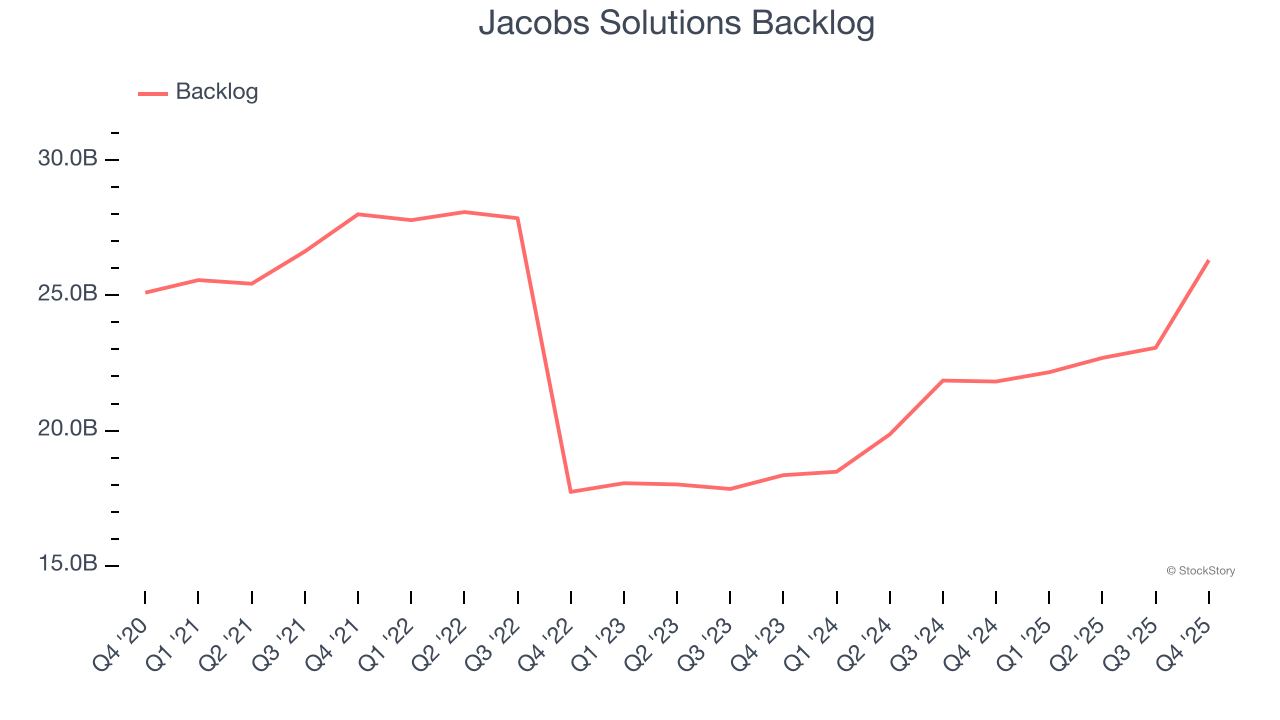

- Backlog: $26.31 billion at quarter end, up 20.6% year on year

- Market Capitalization: $16.16 billion

Jacobs' Chair and CEO Bob Pragada commented, "We delivered excellent first quarter results driven by revenue strength in both Infrastructure & Advanced Facilities (I&AF) and PA Consulting. Within I&AF, growth was led by the Life Sciences, Data Center, Semiconductor, Water and Transportation sectors. PA Consulting also continues to capitalize on strong demand for its digital consulting services, with revenue increasing 16% year-on-year in the first quarter. We are excited to advance our strategy to redefine the asset lifecycle through the recently announced transaction to fully own the business. We are off to a great start in FY26 and strong results in Q1 give us confidence to increase our outlook for the fiscal year."

Company Overview

With a workforce of approximately 45,000 professionals tackling complex challenges from water scarcity to cybersecurity, Jacobs Solutions (NYSE: J) provides engineering, consulting, and technical services focused on infrastructure, sustainability, and advanced technology solutions.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $12.39 billion in revenue over the past 12 months, Jacobs Solutions is larger than most business services companies and benefits from economies of scale, enabling it to gain more leverage on its fixed costs than smaller competitors. This also gives it the flexibility to offer lower prices. However, its scale is a double-edged sword because finding new avenues for growth becomes difficult when you already have a substantial market presence. To accelerate sales, Jacobs Solutions likely needs to optimize its pricing or lean into new offerings and international expansion.

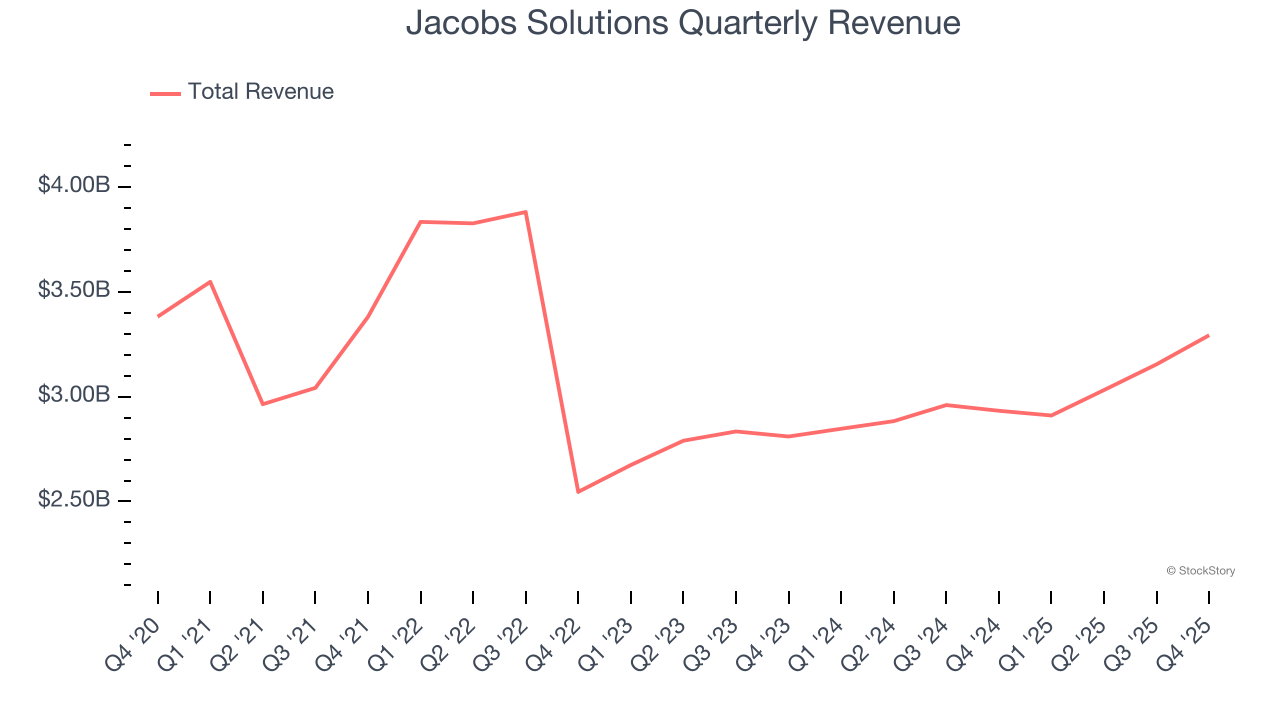

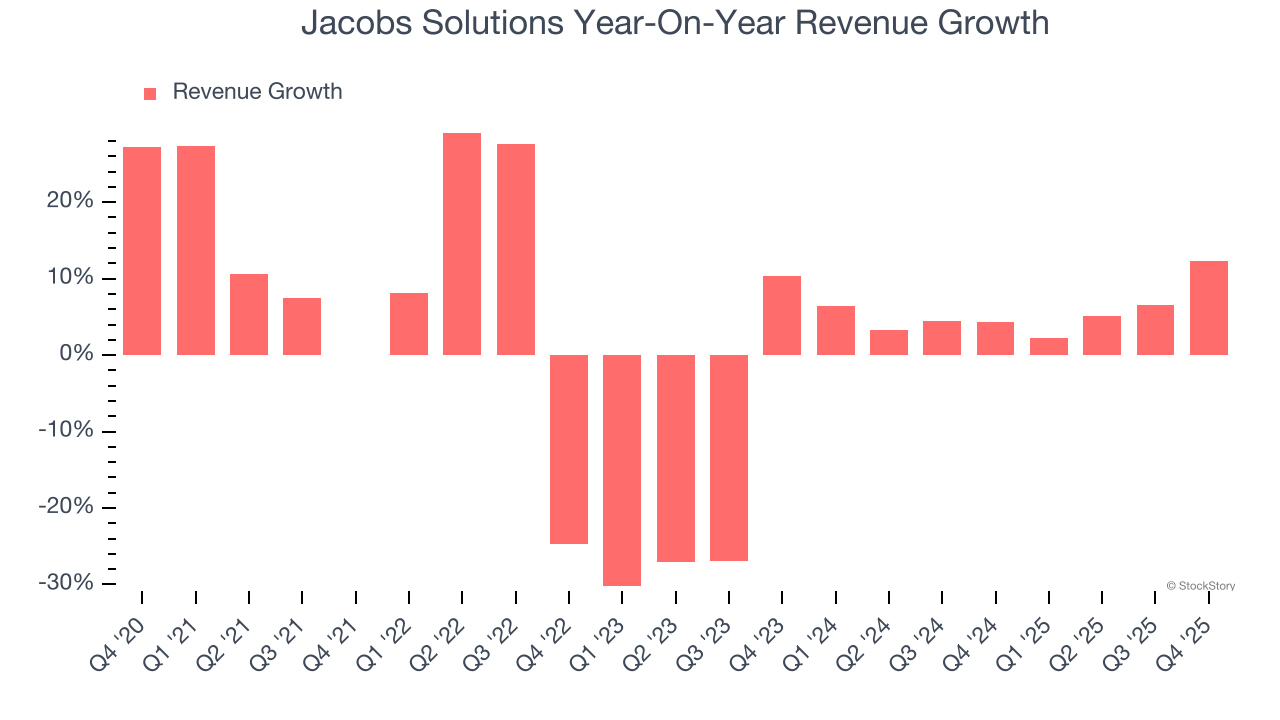

As you can see below, Jacobs Solutions grew its sales at a sluggish 1.2% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Jacobs Solutions’s annualized revenue growth of 5.6% over the last two years is above its five-year trend, suggesting some bright spots.

Jacobs Solutions also reports its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Jacobs Solutions’s backlog reached $26.31 billion in the latest quarter and averaged 14.3% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for Jacobs Solutions’s products and services but raises concerns about capacity constraints.

This quarter, Jacobs Solutions reported year-on-year revenue growth of 12.3%, and its $3.29 billion of revenue exceeded Wall Street’s estimates by 6.5%.

Looking ahead, sell-side analysts expect revenue to grow 6.1% over the next 12 months, similar to its two-year rate. This projection is above average for the sector and implies its newer products and services will help support its recent top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

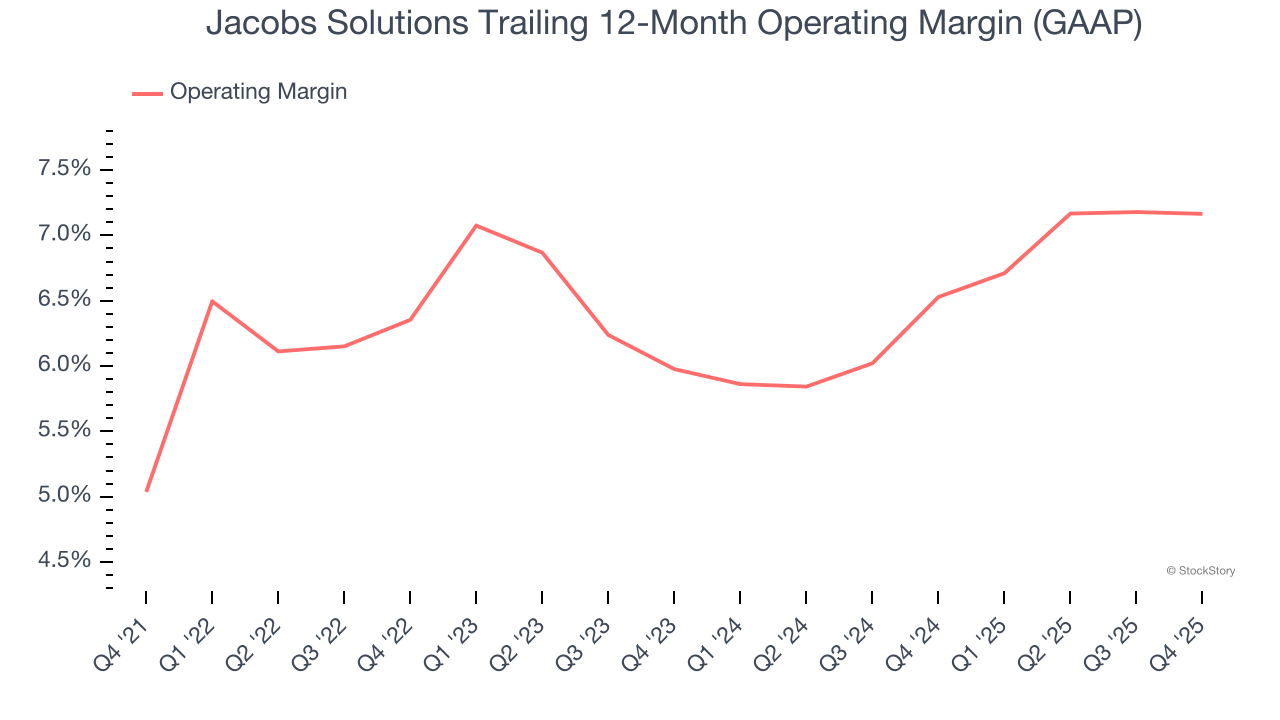

Jacobs Solutions was profitable over the last five years but held back by its large cost base. Its average operating margin of 6.2% was weak for a business services business.

On the plus side, Jacobs Solutions’s operating margin rose by 2.1 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, Jacobs Solutions generated an operating margin profit margin of 7.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

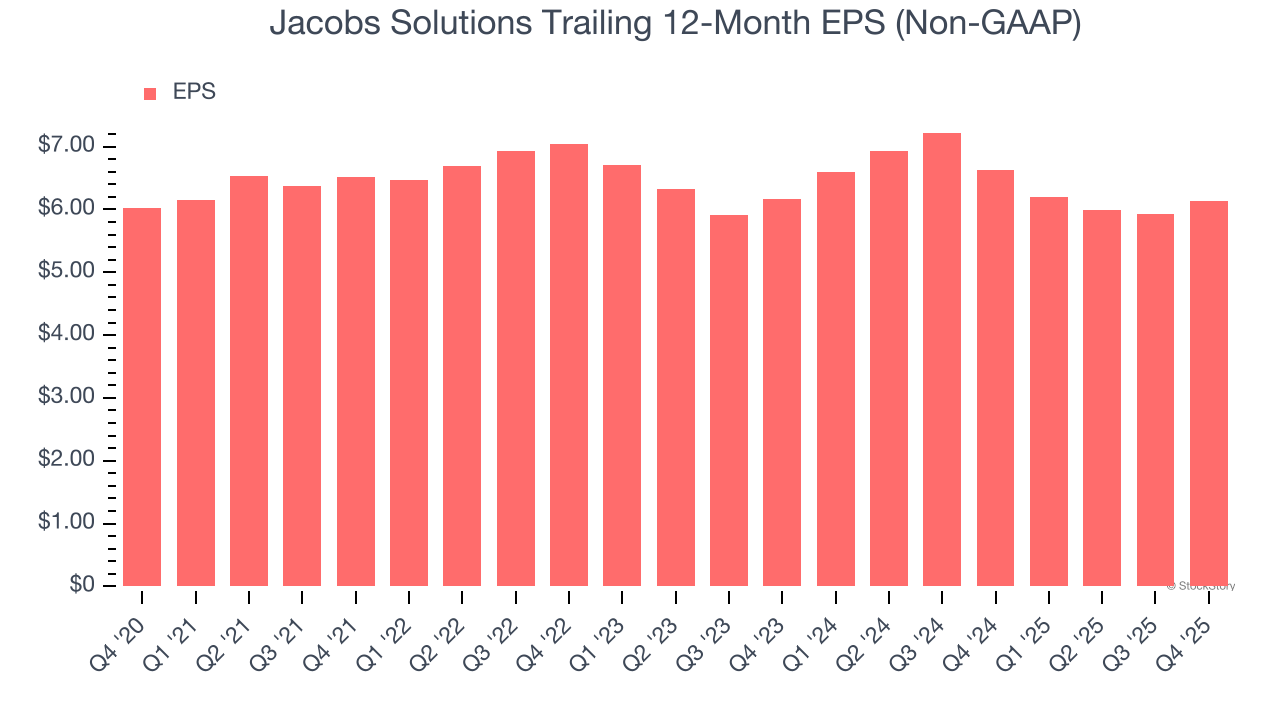

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Jacobs Solutions’s flat EPS over the last five years was below its 1.2% annualized revenue growth. We can see the difference stemmed from higher interest expenses or taxes as the company actually improved its operating margin and repurchased its shares during this time.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Unfortunately for Jacobs Solutions, things didn’t get any better over the last two years as its EPS didn’t budge. We hope its earnings can grow in the coming years.

In Q4, Jacobs Solutions reported adjusted EPS of $1.53, up from $1.32 in the same quarter last year. This print beat analysts’ estimates by 1.8%. Over the next 12 months, Wall Street expects Jacobs Solutions’s full-year EPS of $6.13 to grow 19.8%.

Key Takeaways from Jacobs Solutions’s Q4 Results

We were impressed by how significantly Jacobs Solutions blew past analysts’ backlog expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 1.7% to $135.00 immediately after reporting.

Indeed, Jacobs Solutions had a rock-solid quarterly earnings result, but is this stock a good investment here? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).