Audio technology Sonos company (NASDAQ: SONO) announced better-than-expected revenue in Q4 CY2025, but sales were flat year on year at $545.7 million. Its non-GAAP profit of $0.93 per share was 36.8% above analysts’ consensus estimates.

Is now the time to buy Sonos? Find out by accessing our full research report, it’s free.

Sonos (SONO) Q4 CY2025 Highlights:

- Revenue: $545.7 million vs analyst estimates of $537.5 million (flat year on year, 1.5% beat)

- Adjusted EPS: $0.93 vs analyst estimates of $0.68 (36.8% beat)

- Adjusted EBITDA: $132.1 million vs analyst estimates of $117.2 million (24.2% margin, 12.8% beat)

- Operating Margin: 18.4%, up from 8.7% in the same quarter last year

- Free Cash Flow Margin: 28.8%, up from 26% in the same quarter last year

- Market Capitalization: $1.78 billion

“Fiscal 2026 is off to a good start for Sonos as we make progress toward a return to growth,” said Tom Conrad, Chief Executive Officer of Sonos.

Company Overview

A pioneer in connected home audio systems, Sonos (NASDAQ: SONO) offers a range of premium wireless speakers and sound systems.

Revenue Growth

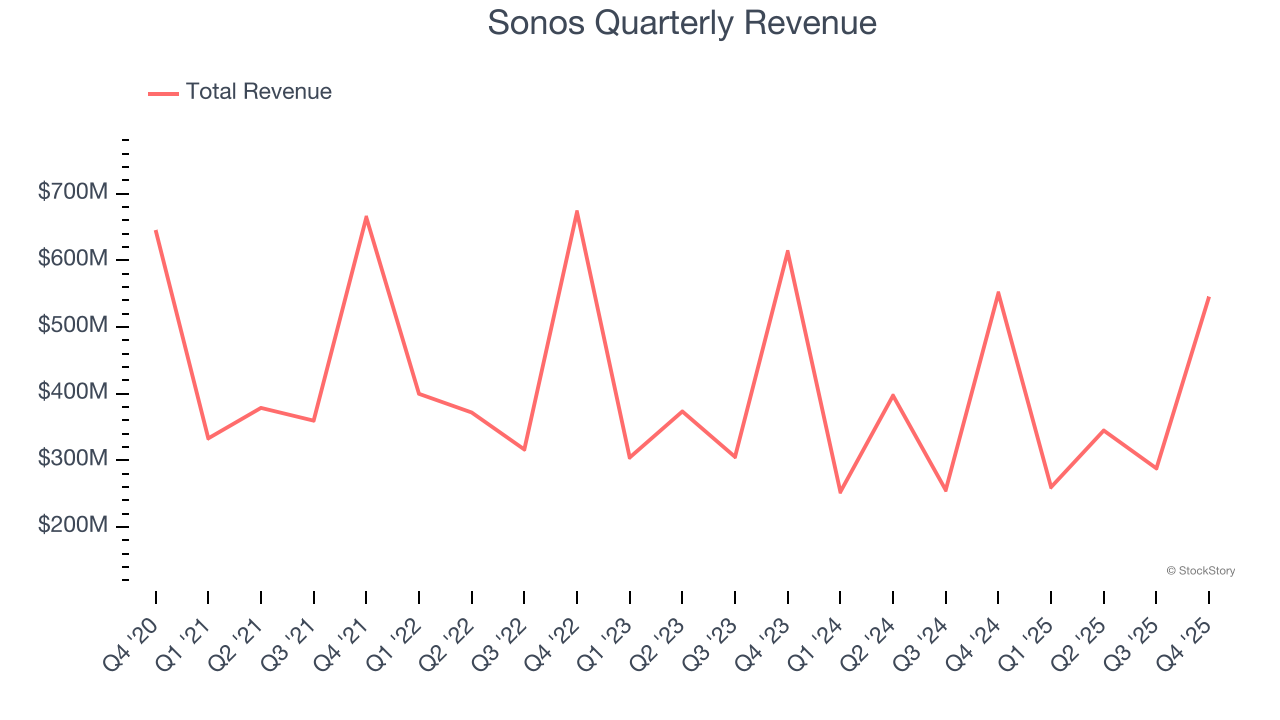

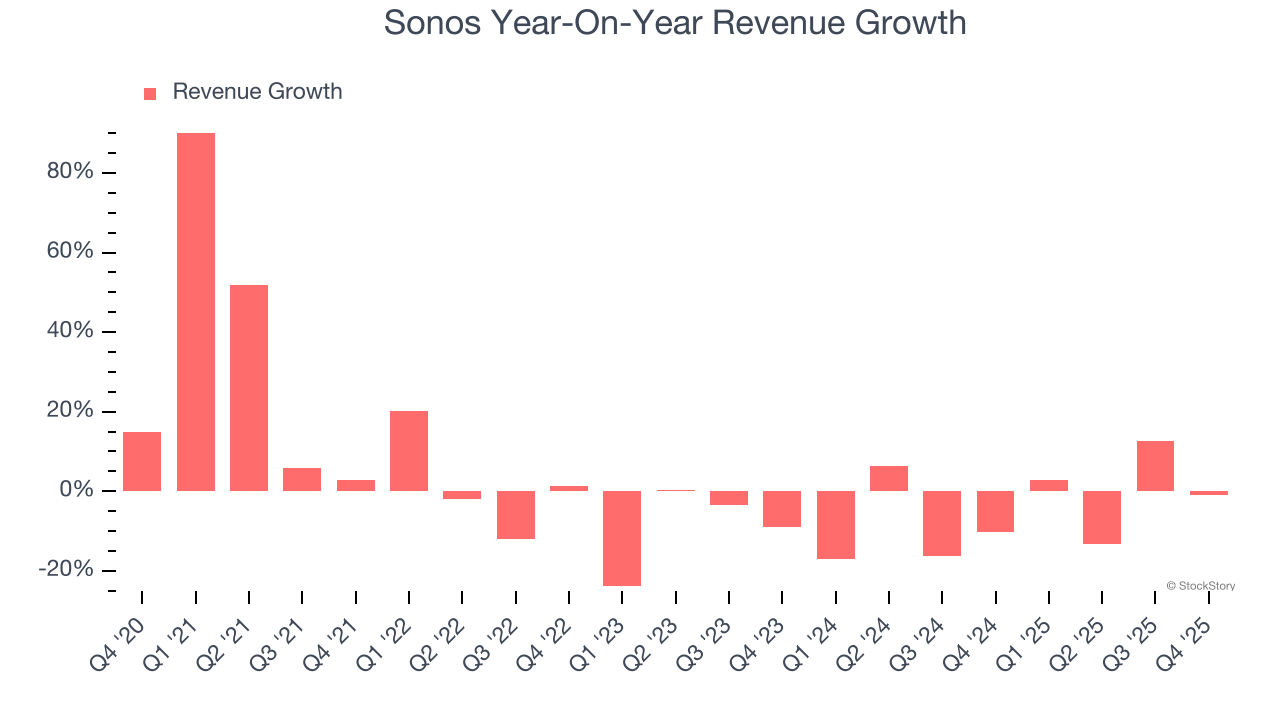

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Sonos struggled to consistently increase demand as its $1.44 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Sonos’s recent performance shows its demand remained suppressed as its revenue has declined by 5.1% annually over the last two years.

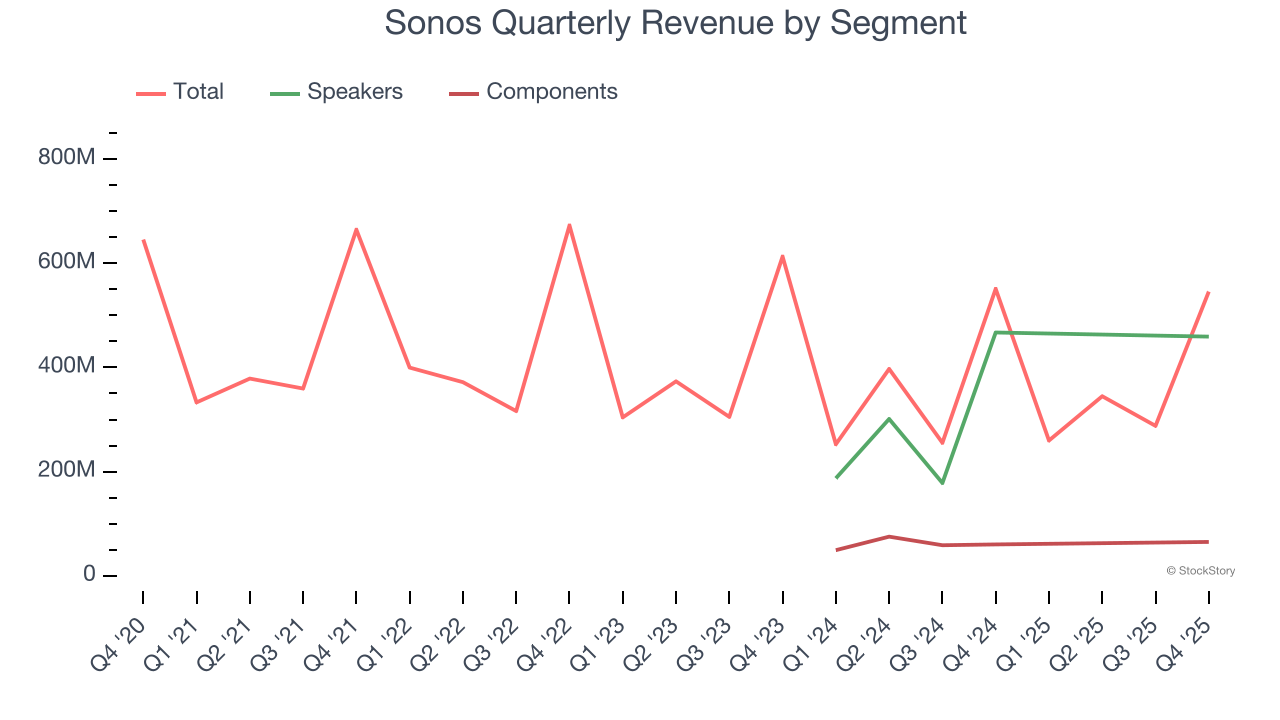

Sonos also breaks out the revenue for its most important segments, Speakers and Components, which are 84.2% and 11.9% of revenue. Over the last two years, Sonos’s Speakers revenue (main product) averaged 1.7% year-on-year declines. On the other hand, its Components revenue (ancillary product) averaged 7.9% growth.

This quarter, Sonos’s $545.7 million of revenue was flat year on year but beat Wall Street’s estimates by 1.5%.

Looking ahead, sell-side analysts expect revenue to grow 5.2% over the next 12 months. While this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

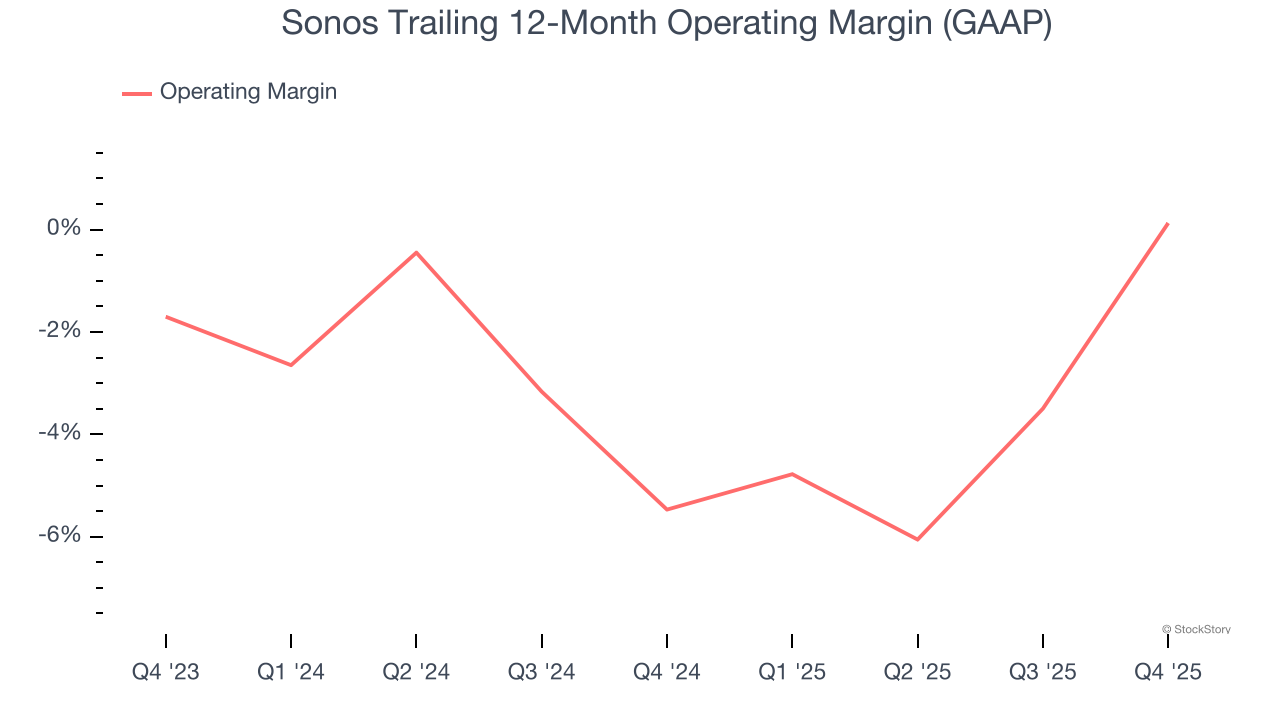

Sonos’s operating margin has been trending up over the last 12 months, but it still averaged negative 2.7% over the last two years. This is due to its large expense base and inefficient cost structure.

This quarter, Sonos generated an operating margin profit margin of 18.4%, up 9.7 percentage points year on year. This increase was a welcome development and shows it was more efficient.

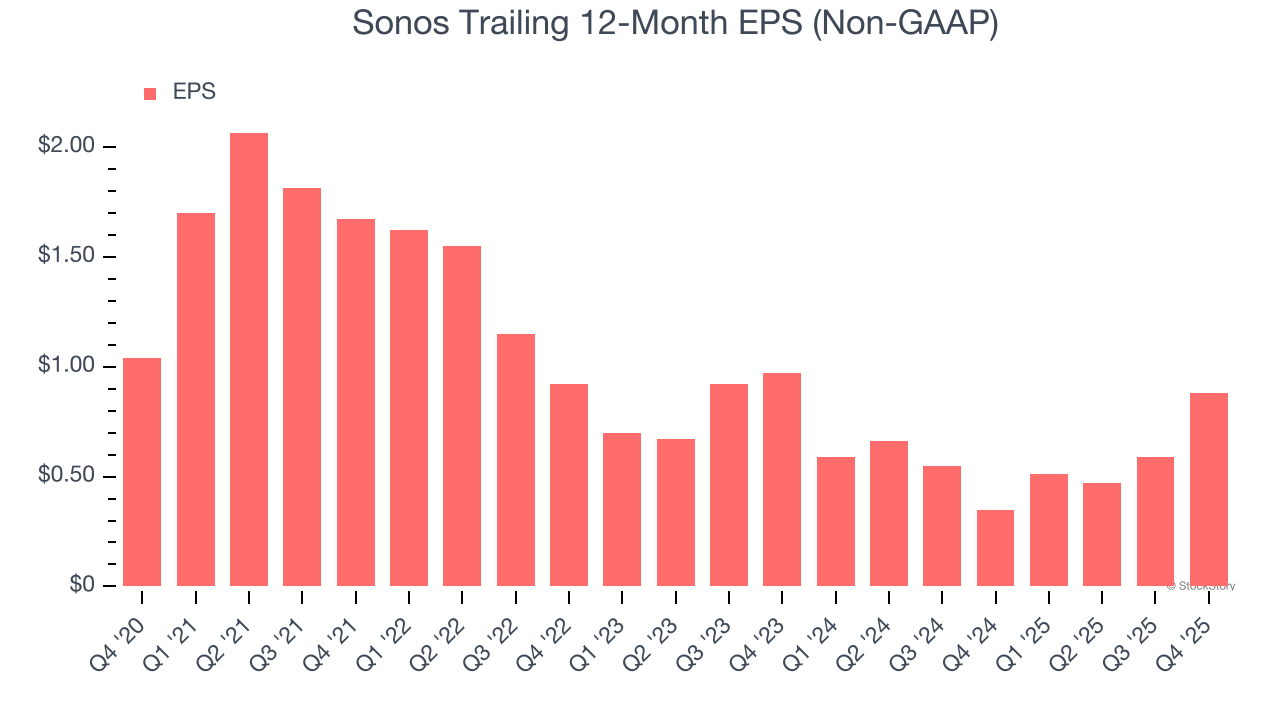

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Sonos, its EPS declined by 3.3% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

In Q4, Sonos reported adjusted EPS of $0.93, up from $0.64 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Sonos’s Q4 Results

It was good to see Sonos beat analysts’ EPS expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $14.71 immediately after reporting.

Sure, Sonos had a solid quarter, but if we look at the bigger picture, is this stock a buy? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).