Pawn store operator FirstCash Holdings (NASDAQ: FCFS) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 19.8% year on year to $1.06 billion. Its non-GAAP profit of $2.64 per share was 4.2% above analysts’ consensus estimates.

Is now the time to buy FirstCash? Find out by accessing our full research report, it’s free.

FirstCash (FCFS) Q4 CY2025 Highlights:

- Revenue: $1.06 billion vs analyst estimates of $1.02 billion (19.8% year-on-year growth, 3.5% beat)

- Pre-tax Profit: $142.8 million (13.5% margin)

- Adjusted EPS: $2.64 vs analyst estimates of $2.53 (4.2% beat)

- Market Capitalization: $7.59 billion

Mr. Rick Wessel, chief executive officer, stated, “FirstCash generated record fourth quarter and full year revenue and earnings results. Driven by strong fourth quarter revenue growth of 20%, the Company marked its first fiscal quarter in history in which consolidated revenues exceeded $1 billion, resulting in a 26% increase in fourth quarter earnings per share.

Company Overview

Offering a financial lifeline to the unbanked and credit-constrained since 1988, FirstCash (NASDAQ: FCFS) operates pawn stores across the U.S. and Latin America while also providing retail point-of-sale payment solutions for credit-constrained consumers.

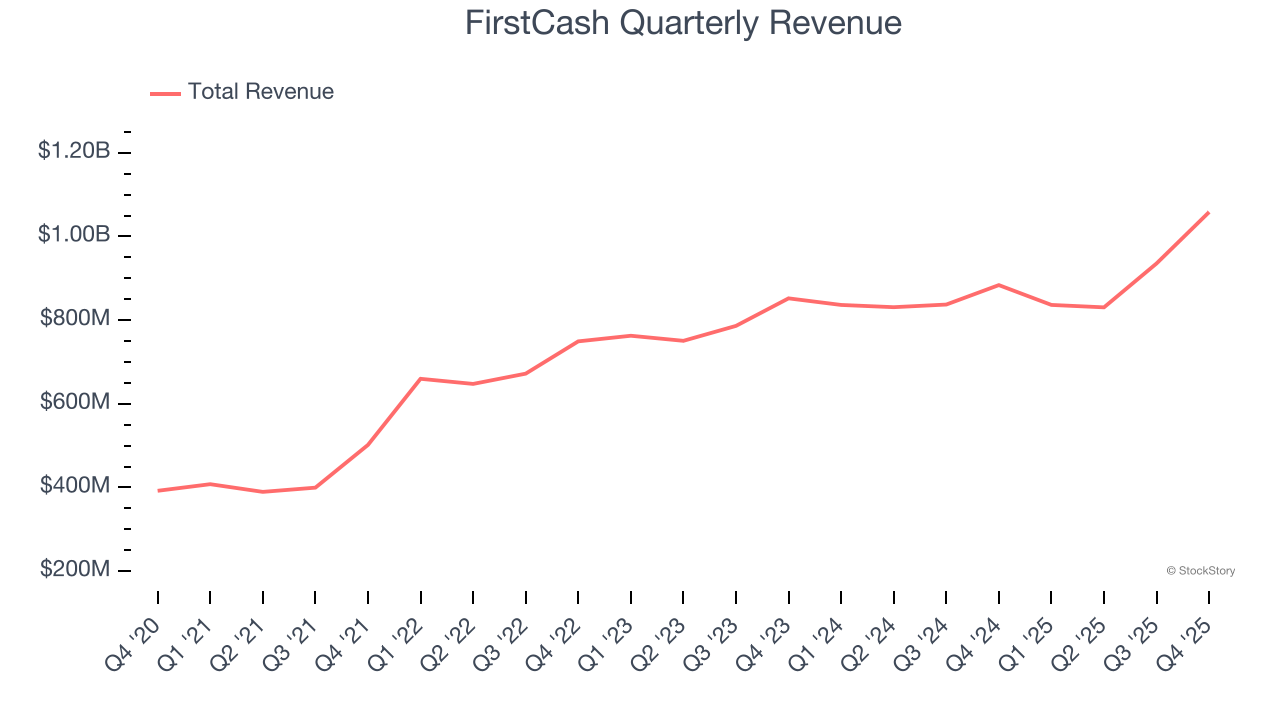

Revenue Growth

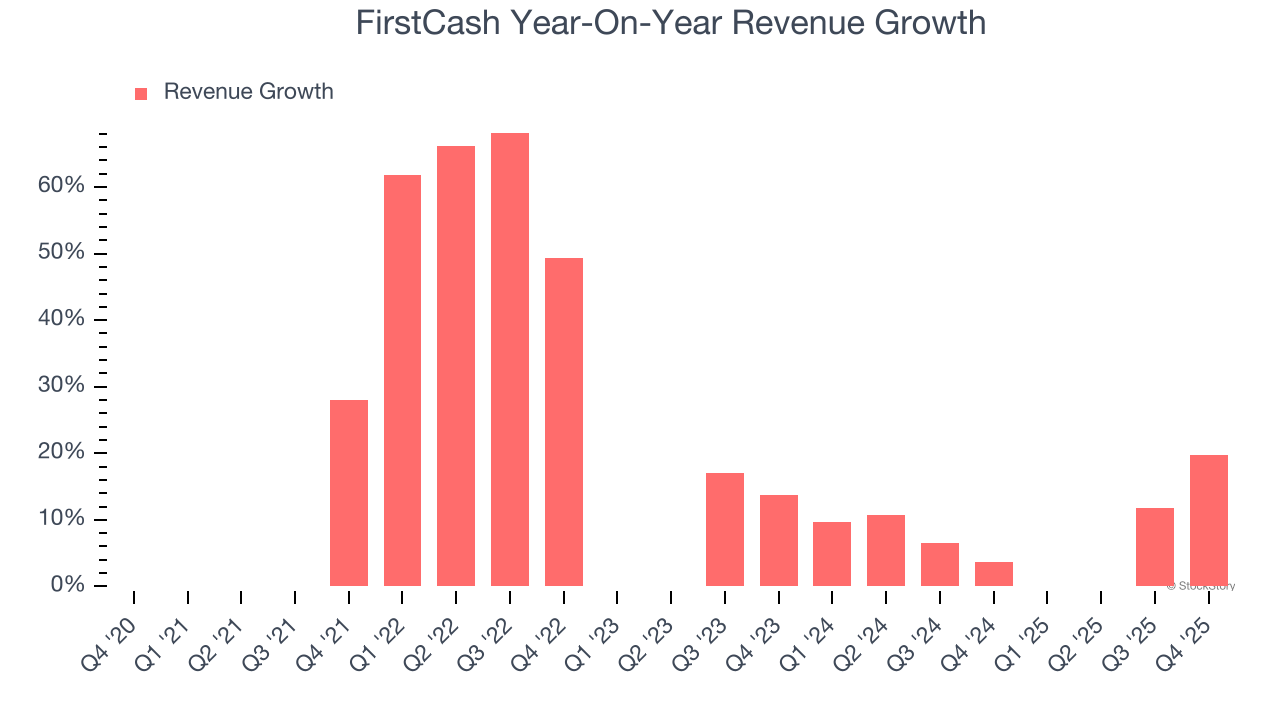

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, FirstCash’s 17.5% annualized revenue growth over the last five years was impressive. Its growth beat the average financials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. FirstCash’s annualized revenue growth of 7.8% over the last two years is below its five-year trend, but we still think the results were respectable.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, FirstCash reported year-on-year revenue growth of 19.8%, and its $1.06 billion of revenue exceeded Wall Street’s estimates by 3.5%.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Key Takeaways from FirstCash’s Q4 Results

It was encouraging to see FirstCash beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $171.80 immediately following the results.

So should you invest in FirstCash right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).