(Please enjoy this updated version of my weekly commentary from the Reitmeister Total Return newsletter).

What is a shadow stock market correction?

One where things seem just fine and dandy on the surface. But lurking in the shadows things are not quite so well. So let me show you 2 images that show this shadow correction at play.

Here is picture #1 showing the returns of the S&P 500 year to date.

Looks like pretty smooth sailing for the bull market. Right?

WRONG!

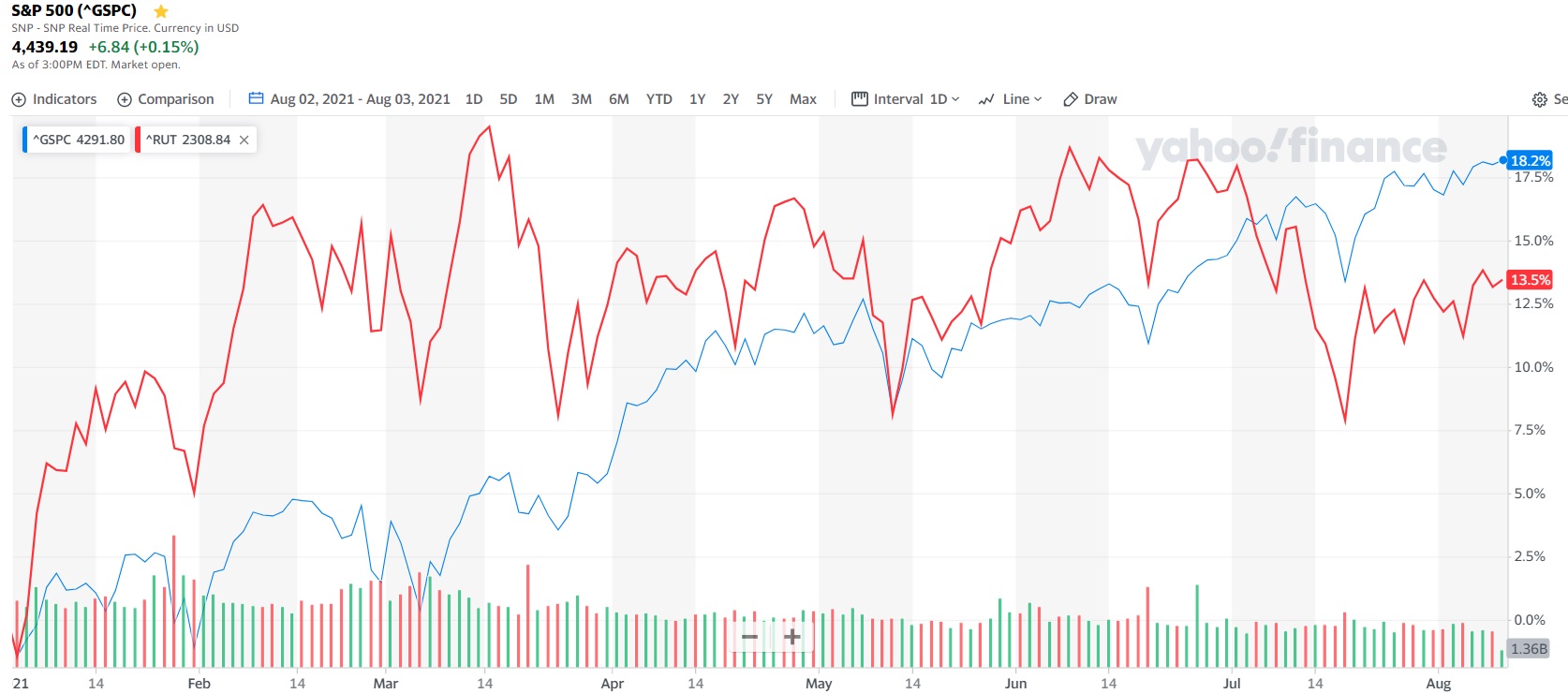

This is a false illusion as the broader market has been slipping since early March. That comes to light with this second chart comparing the S&P 500 (blue) to the Russell 2000 (red) in the same time frame.

The Russell 2000 is still well below the March highs. That’s because at that time investors started becoming a bit more cautious. That notion only picked up steam the last several weeks with the rise of the Delta variant.

Instead of investors running for the hills by a move to cash, they simply traded in many of their smaller, riskier, higher beta selections for the safety of the S&P 500. In particular, the FAANG stocks which is the modern equivalent of buying defensive positions like Kimberly Clark, Proctor & Gamble and J&J.

Both of these are a picture of the past. But I don’t believe a good picture of what lies ahead.

That’s because even as the Delta variant does lead to higher cases across the country (and the globe for that matter) it is not leading to economic shutdowns. Instead more companies and local governments are asking people to put on masks again. That is a far cry from the spring of 2020 when we all hid under our beds at home waiting for the danger to pass.

This is making investors feel a bit more convinced that the economy will stay on track and time to get back to more bullish investing practices. Like the strategy of overweighting small cap and Risk On stocks that led the way to start the year

Go back to the second chart above again and see how the Russell 2000 was actually 3X better than the S&P in March. I believe that kind of outperformance very well could be a sign of things to come as investors shed their defensive holdings in large caps and get back to riding the bull in more aggressive fashion.

That certainly is the strategy we are employing in the Reitmeister Total Return portfolio that has enjoyed a serious outperformance of +5.06% since the close on Wednesday 8/4 when the S&P moved less than 1%. (And up +27.22% year to date).

And why shouldn’t investors get more bullish when you consider the most recent slate of economic reports. For example, ISM Services was up from 60.1 last month to a scorching hot 64.1 this time around. On top of that New Orders at 63.7 points to more good times ahead. Lastly, the employment part of the index jumped from 49.3 to 53.8.

The strength of employment found there was echoed in Friday’s Government Employment Situation report where 943,000 jobs were added to the economy. This resulted in the unemployment rate dropping all the way from 5.9% to 5.4% in one month.

That kind of month over month improvement almost never happens...which is the point. The economy is improving at a stronger than expected pace and that should lead to a more aggressive form of bull market emerging...and why my investment strategy, noted above, should have you on the right side of the market action moving forward.

What To Do Next?

The Reitmeister Total Return portfolio has outperformed the market by a wide margin this year.

Why such a strong outperformance?

Because I hand-pick the very best stocks from across the POWR Ratings universe. In fact right now there are 12 Buy rated stocks and 2 ETFs in the portfolio ready to excel in the days and weeks ahead.

If you would like to see the current portfolio, then start a 30 day trial by clicking the link below.

About Reitmeister Total Return newsletter & 30 Day Trial

Wishing you a world of investment success!

Steve Reitmeister

…but everyone calls me Reity (pronounced “Righty”)

CEO, Stock News Network and Editor, Reitmeister Total Return

shares rose $0.70 (+0.16%) in premarket trading Wednesday. Year-to-date, has gained 19.38%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post The Shadow Stock Market Correction appeared first on StockNews.com