The waste services market is buoyed by the rising consumer costs for trash collection, which rose 6.9% for the year. For the third quarter, core prices climbed 6.6%, while garbage collection and disposal volumes increased 0.3%.

Amid this, Waste Management, Inc. (WM), a pioneer in environmental solutions regarding waste management, reported strong third-quarter results. The company’s revenue improved 2.4% year-over-year to $5.20 billion. Its adjusted EPS came in at $1.63, up 4.5% from the prior-year quarter, topping the analyst estimate of $1.61.

Given such robust results, let’s look at the trends of WM’s key financial metrics to understand why investing in the stock might be wise.

Analyzing the Steady Financial Growth of Waste Management, Inc. from 2020 to 2023

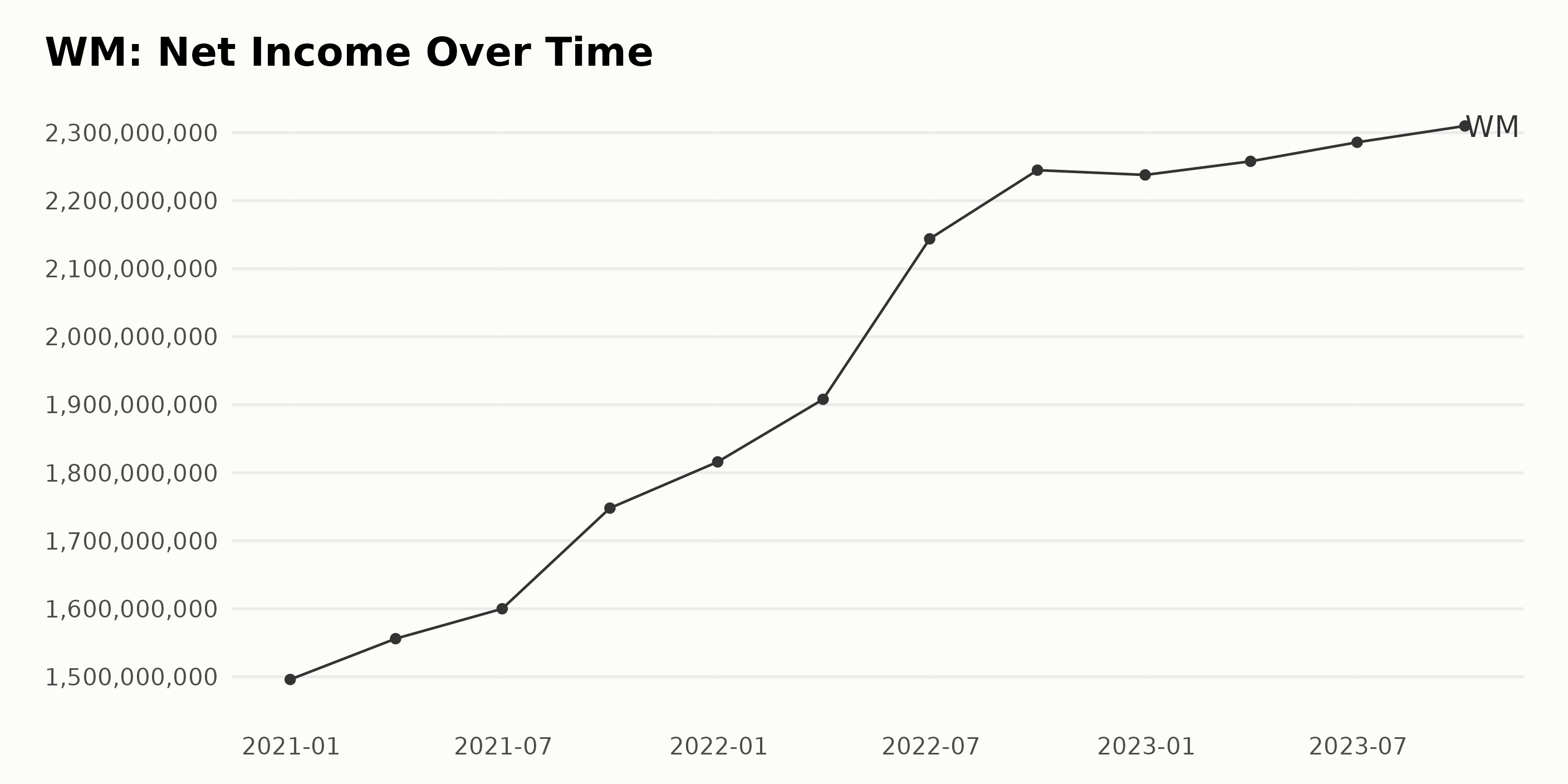

The data on WM’s trailing-12-month net income shows a steady upward trend from December 2020 to September 2023. Here are the key takeaways:

- In December 2020, WM's net income was at $1.50 billion. Over the course of the next few years, it showed a steady increase.

- By the end of the first quarter of 2021 (March 31), the net income rose to $1.56 billion, representing growth over the previous quarter.

- The net income continued its upward trend throughout 2021, reaching $1.82 billion by December 31, 2021.

Taking into account the first value in December 2020 and the last value in Sep 2023, WM saw a steady ascending trend in net income. The growth rate calculated from the initial value of $1.50 billion to the final value of $2.31 billion marks a significant increase over this period. However, it is critical to note occasional fluctuations, such as a slight dip observed at the end of 2022.

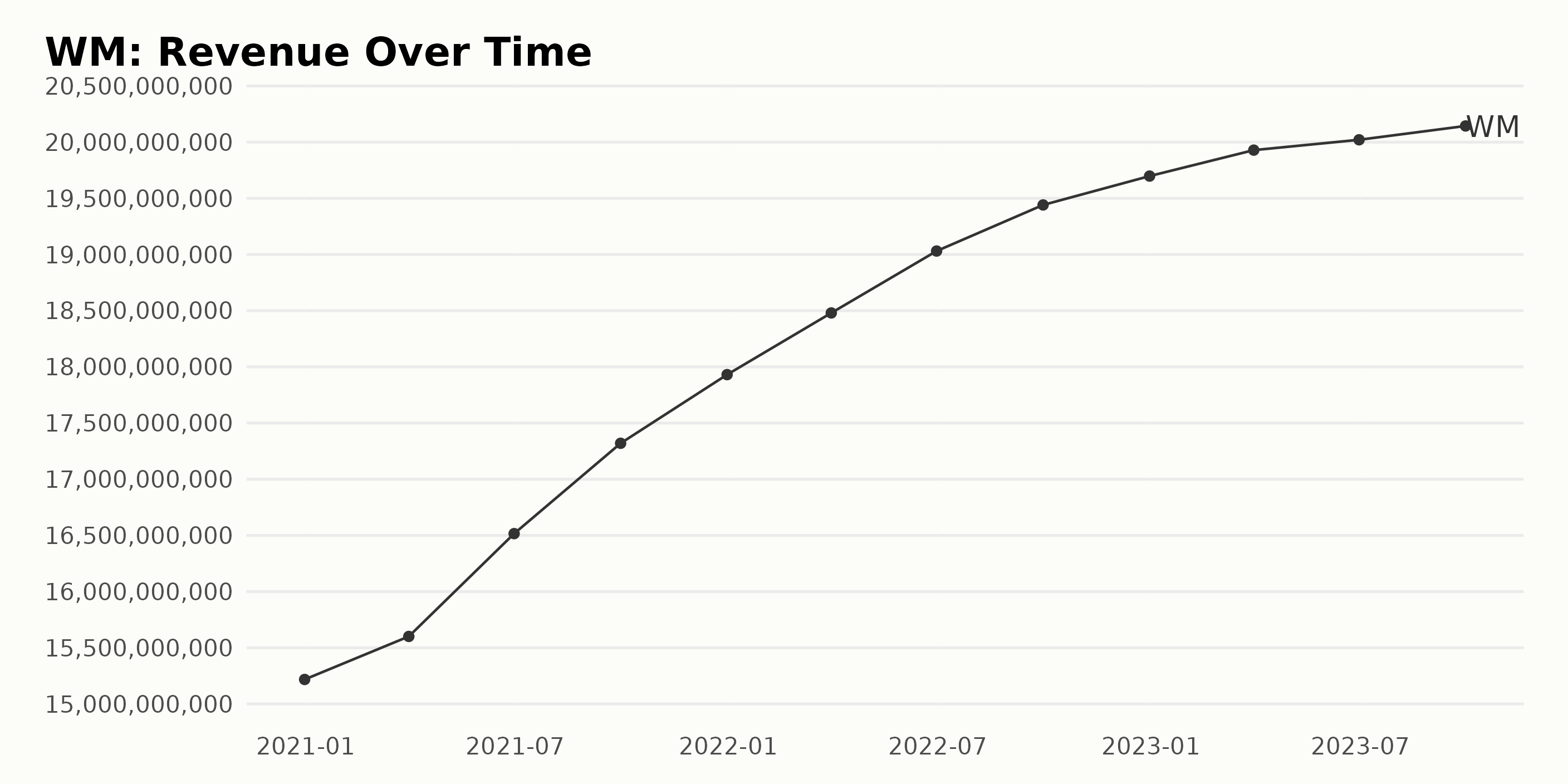

The trailing-12-month revenue of WM has demonstrated a consistent uptrend from 2020 to 2023, showing steady growth over these years. Here, we put emphasis on more recent data and analyze it in more detail:

- December 31, 2020 - Revenue was $15.22 billion.

- March 31, 2021 - A slight increase is seen, with the revenue reaching $15.60 billion.

- June 30, 2021 - The revenue further climbs to $16.52 billion.

- September 30, 2021 - An upward trend continued, with revenue hitting $17.32 billion.

- December 31, 2021 - Revenue rose to $17.93 billion at the end of the year.

- March 31, 2022 - The first quarter ended with revenue at $18.48 billion.

- June 30, 2022 - The revenue increases further to $19.03 billion.

- September 30, 2022 - There is another rise in revenue to $19.44 billion.

- December 31, 2022 - Revenue ends the year at $19.70 billion.

- March 31, 2023 - The first quarter of 2023 closes with revenue at $19.93 billion.

- June 30, 2023 - A relatively minor increase sees revenue at $20.02 billion.

- September 30, 2023 - Most recently, in September 2023, the revenue reached $20.14 billion.

Between December 2020 and September 2023, WM's revenue increased from $15.22 billion to $20.14 billion. This represents a total growth of approximately 32%. Overall, the data shows continuous growth in revenue for WM over this period, with no discernible downtrend in any quarter.

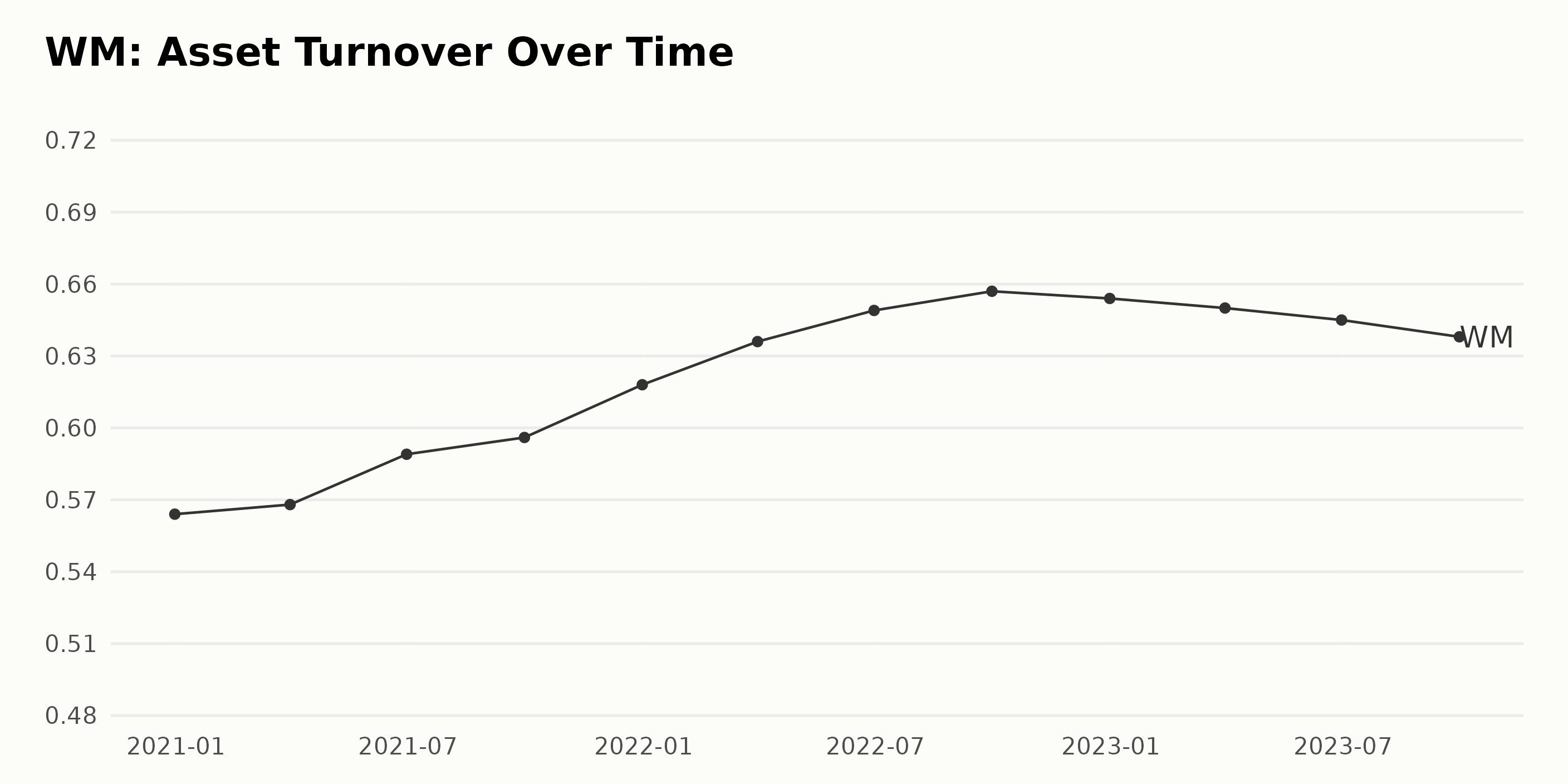

Here's the summarized trend and fluctuations for WM based on their reported asset turnover data:

- Starting value: The asset turnover of WM as of December 31, 2020, stands at 0.564.

- Rising Phase: A steady rise in the value was observed in the subsequent timeframes, where it rose to 0.636 by March 31, 2022, marking a growth rate of 12.8%.

- Highest point: The highest value of asset turnover reached during this period was 0.657 as of September 30, 2022.

- Declining Phase: Following the peak, there has been a noticeable decline over the next quarters. By September 30, 2023, the asset turnover dropped to 0.638.

- Most recent value: As of the last reported timeframe, which is September 30, 2023, the asset turnover stands at 0.638, showing an overall growth of 13.1% when measured from the first value.

The highlighted emphasis remains on the more recent data. It shows a declining trend in the WM asset turnover, starting from its peak in the third quarter of 2022 and continuing through to the third quarter of 2023.

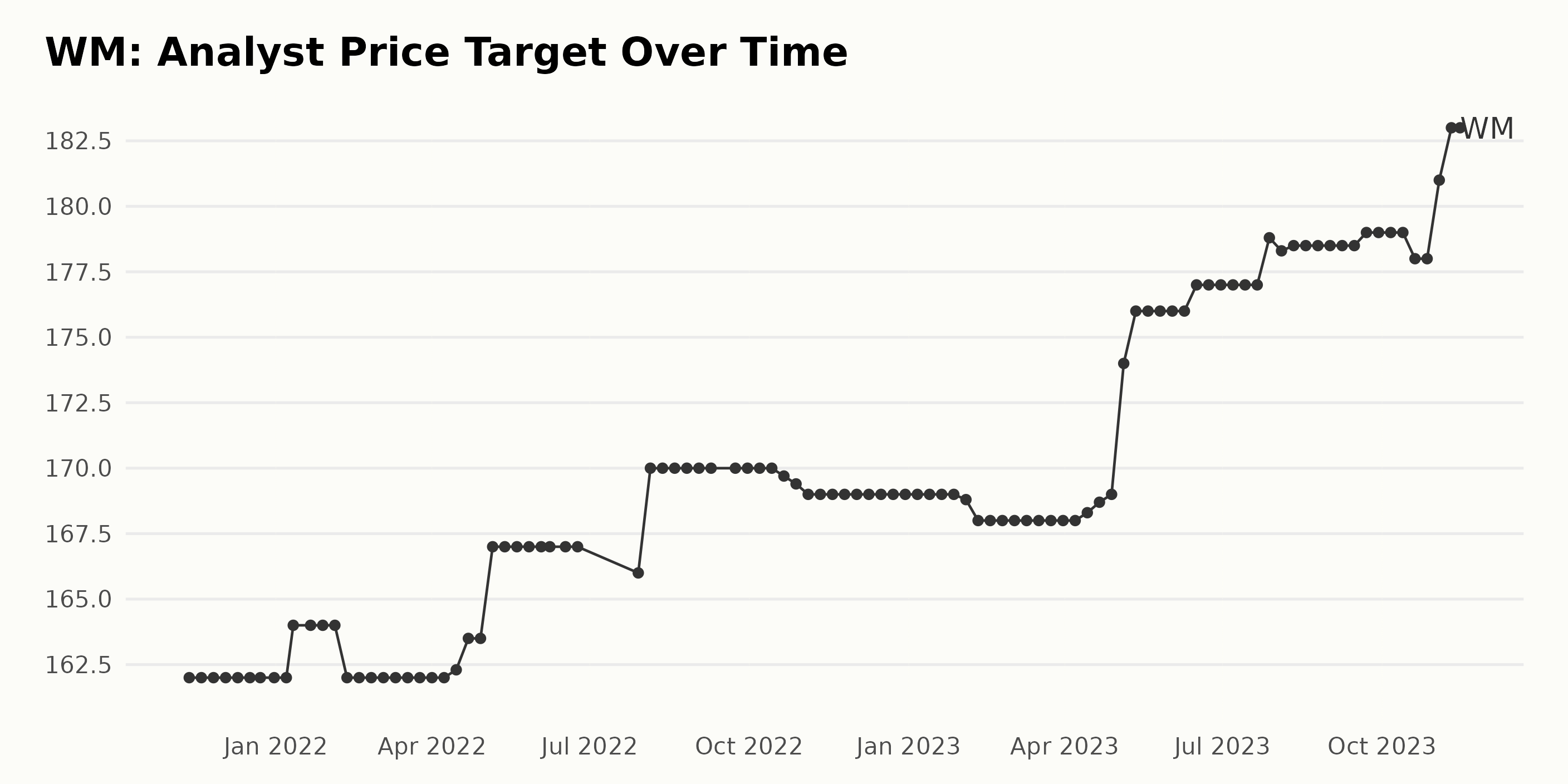

The analyst price target for WM showed a slow but steady increase from November 2021 to November 2023. Here is a summarized trend and fluctuation overview:

- On November 12, 2021, the price target was set at $162. This value remained constant throughout the month and into early January 2022.

- The price target took a minor upward shift to $164 in the second week of January 2022, where it remained constant till the second week of February 2022, when it returned to $162.

- An upward trend was noticed in April 2022, where the price target increased to $163.50 by the month's end. By May, this rose to $167 and stayed constant before dipping marginally to $166 in July.

- From August to September 2022, the analyst price target plateaued at $170 before a gradual decrease to $169 in October and November 2022. The target resided at $169 as 2022 ended and throughout most of January 2023.

- In the second quarter of 2023, the price target steadily rose from $168 to $176 in May, peaking at $177 in June and staying the same through July.

- A significant increase occurred towards the end of July 2023 to $178.8. The price target maintained an upward trend, situating at $179 in September 2023.

- A brief dip was witnessed during October 2023 to $178. However, it quickly rebounded and continued the upward trajectory to $183 in mid-November 2023.

Calculating from the first to the last values indicates a growth rate of approximately 12.96%.

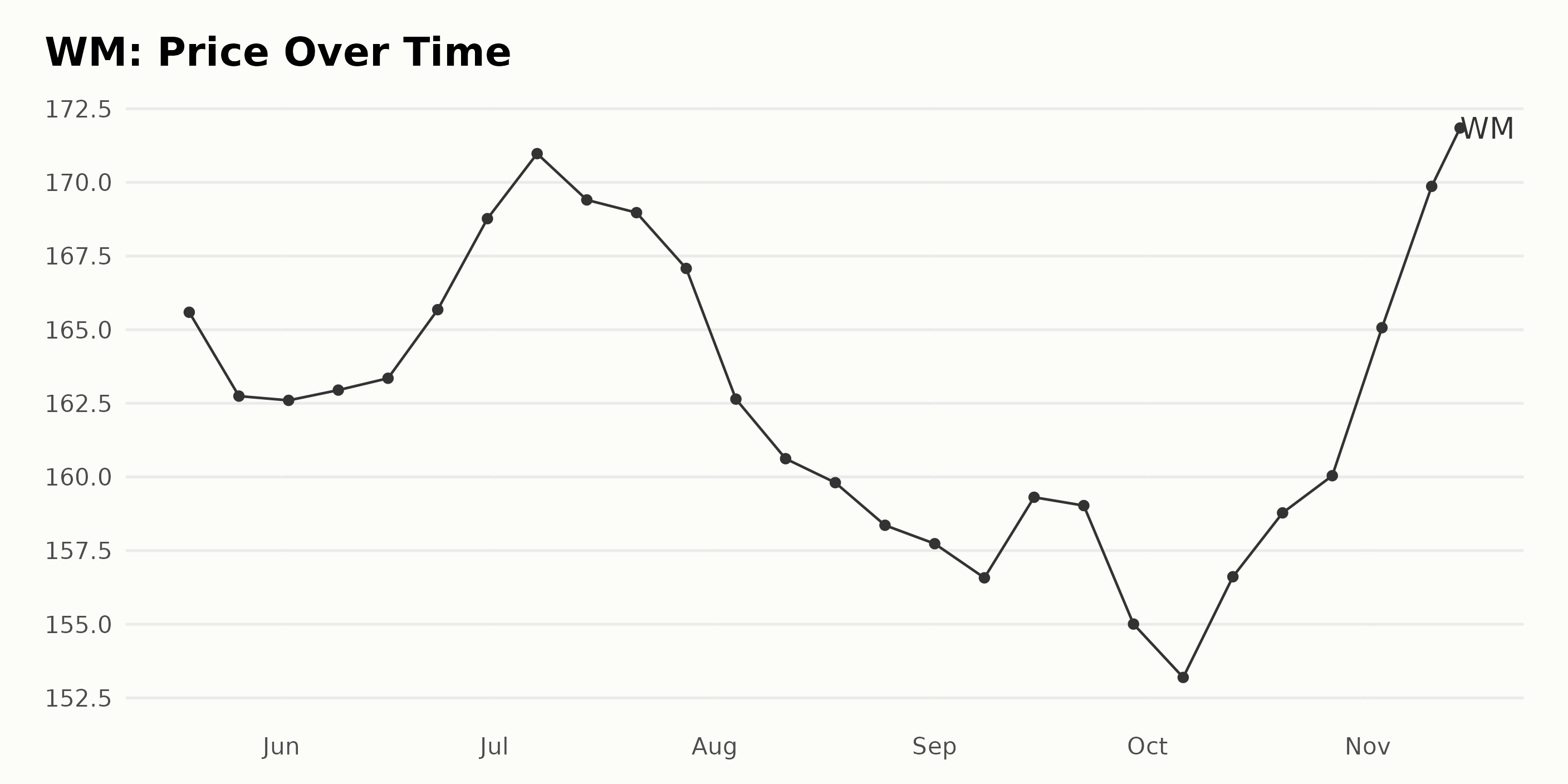

Fluctuating Journey: Waste Management, Inc.'s Share Price Analysis from May-November 2023

Analyzing the provided share price data for WM, the following trend is evident:

- On May 19, 2023, the share price was $165.59.

- The price dipped slightly to $162.74 by May 26, 2023.

- The trend in June 2023 shows minimal fluctuations but ends on a rising note, with the price on June 30, 2023, being $168.77.

- In July, the price peaks at $170.98 (July 7, 2023) before falling to $167.078 on July 28, 2023.

- August 2023 saw a consistent downward trend in prices, with a drop from $162.64 (August 4, 2023) to $158.36 (August 25, 2023).

- In September 2023, the price fell to a low of $155.01 by the end of the month.

- October shows an overall upward trend, with the price increasing to $160.04 by October 27, 2023.

- November 2023 showcased strong growth; the share price rose to $172.14 by November 14, 2023, marking the highest point in this data set.

Overall, the share price of WM shows noticeable fluctuations with both upward and downward trends. From May to November 2023, the share price overall grew from $165.59 to $172.14. Amid some periods of dip and recovery, the growth rate of WM’s stock is not stable during this period.

It starts high, goes down mid-term, then ends significantly higher, but there isn't a steady, accelerating or decelerating trend, thus indicating the volatile nature of the given share price. Here is a chart of WM's price over the past 180 days.

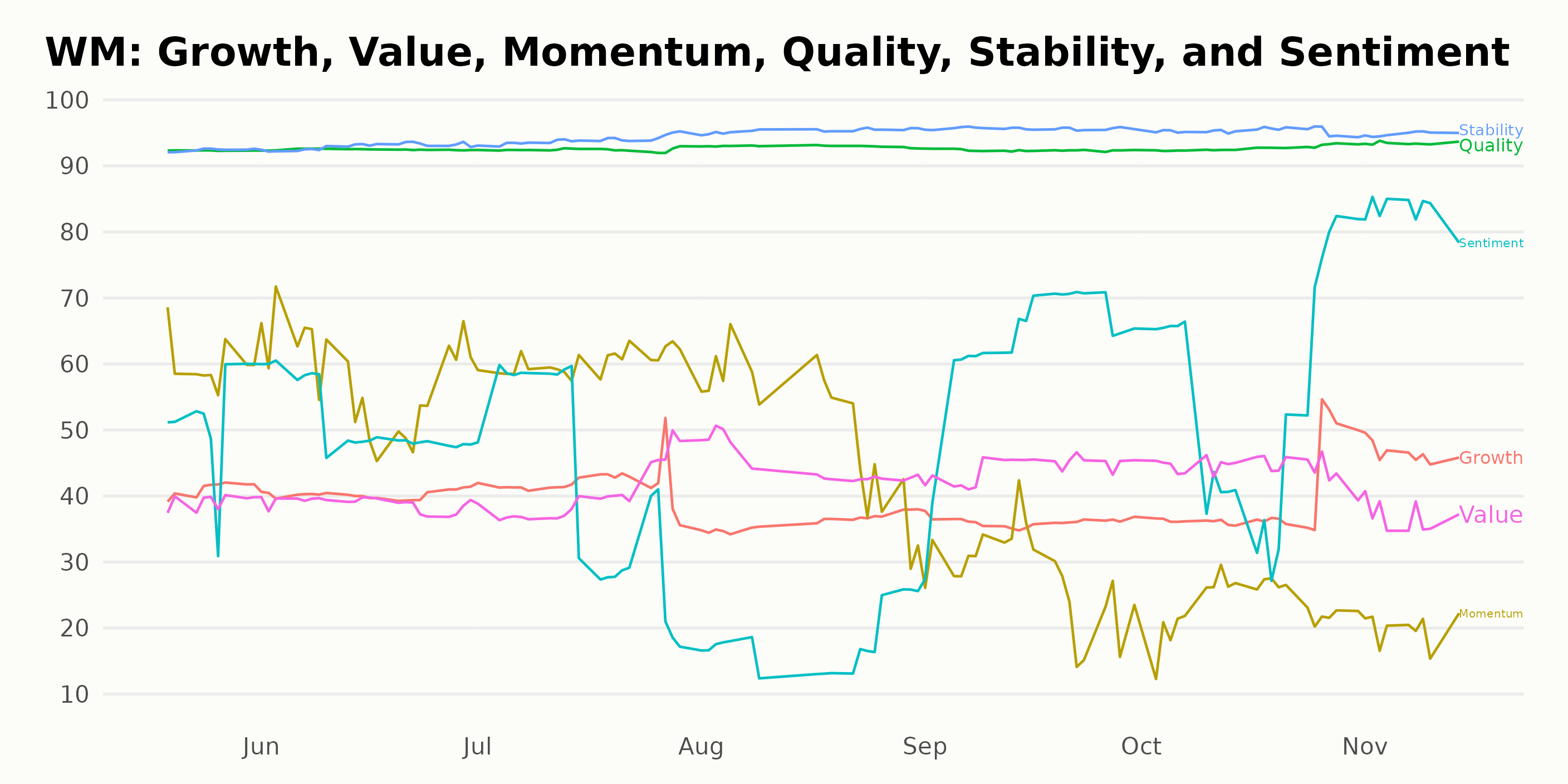

Analyzing Waste Management, Inc.'s POWR Ratings: Quality, Stability and Momentum Trends

Based on the data provided, let's analyze the POWR Ratings grade of WM, which falls under the 14-stock Waste Disposal category.

- As of its latest values on November 15, 2023, WM holds a POWR grade of B (Buy).

- Inspecting its progression over the period from May 20, 2023, the POWR grade has consistently stayed at B (Buy).

- The latest available data on this rank indicates that WM occupies the second position.

Observing the trends over time, there was a gradual improvement in the rank-in-category. It moved from #4 during May 2023 to occupying #2 in late September 2023 and has maintained this rank till the most recent reading in November 2023.

To summarize, WM seems to be faring comparatively well with a steady POWR grade of B (Buy) and an improving rank within its category.

The POWR Ratings for WM in three noteworthy dimensions - Quality, Stability, and Momentum show distinct patterns over time.

Quality: The Quality dimension appears to be the strongest, maintaining high values consistently. From May to November 2023, the Quality value steadily ranged between 92 and 93, indicating that WM has continued to demonstrate strong performance and reliability.

Stability: For Stability, WM shows a gradual rising trend. Starting from 92 in May 2023, it escalates progressively, reaching up to 96 in September 2023, and then slightly dips to 95 for October and November. This signifies that WM's financial stability improved considerably during this period.

Momentum: The Momentum dimension, however, displays a fluctuating trend. After peaking at 60 in May and July 2023, it drops sharply to 24 by October and further down to 20 in November. This indicates that WM experienced varied phases of Momentum over these months and a clear decreasing trend towards the end of the year.

These varying ratings suggest that while Waste Management Inc. exhibits solid Quality and Stability, its Momentum appears to be notably volatile.

How does Waste Management, Inc. (WM) Stack Up Against its Peers?

Other stocks in the Waste Disposal sector that may be worth considering are Concrete Pumping Holdings, Inc. (BBCP), Republic Services, Inc. (RSG), and Ecolab Inc. (ECL) - they have an overall A (Strong Buy) or B (Buy) POWR grade. Click here to explore more Waste Disposal stocks.

What To Do Next?

43 year investment veteran, Steve Reitmeister, has just released his 2024 market outlook along with trading plan and top 11 picks for the year ahead.

WM shares were unchanged in premarket trading Wednesday. Year-to-date, WM has gained 11.22%, versus a 18.64% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

The post Trash to Treasure: Why Waste Management (WM) Deserves Your Investment appeared first on StockNews.com