Build-A-Bear Workshop, Inc. (BBW) has exemplified resilience and growth amidst challenging macroeconomic conditions, reporting record-breaking numbers when other specialty retailers struggled to maintain sales. Following dwindling sales during the initial phase of the global pandemic, the company has exhibited a noteworthy recovery. BBW's broadening consumer base is a testament to its success and popularity.

“Our record first half 2023 results follow our record-setting results for both 2021 and 2022 and demonstrate our ability to grow the Build-A-Bear brand at a sustainably higher level of profitability,” CEO Sharon Price John said. Moreover, the company looks well-positioned to maintain this positive momentum in the second half.

BBW is sleighing the holiday season with the release of its movie, “Glisten and the Merry Mission,” and new launches like its first-ever interactive furry friend, Bearlieve Bear.

Given Build-A-Bear Workshop's robust standing within the industry, this stock appears promising for inclusion in investment portfolios as it is about to release its third-quarter earnings. The following key data points underscore my optimistic outlook regarding BBW.

An In-Depth Analysis of Build-A-Bear Workshop Inc.'s Financial Performance (2021 - 2023)

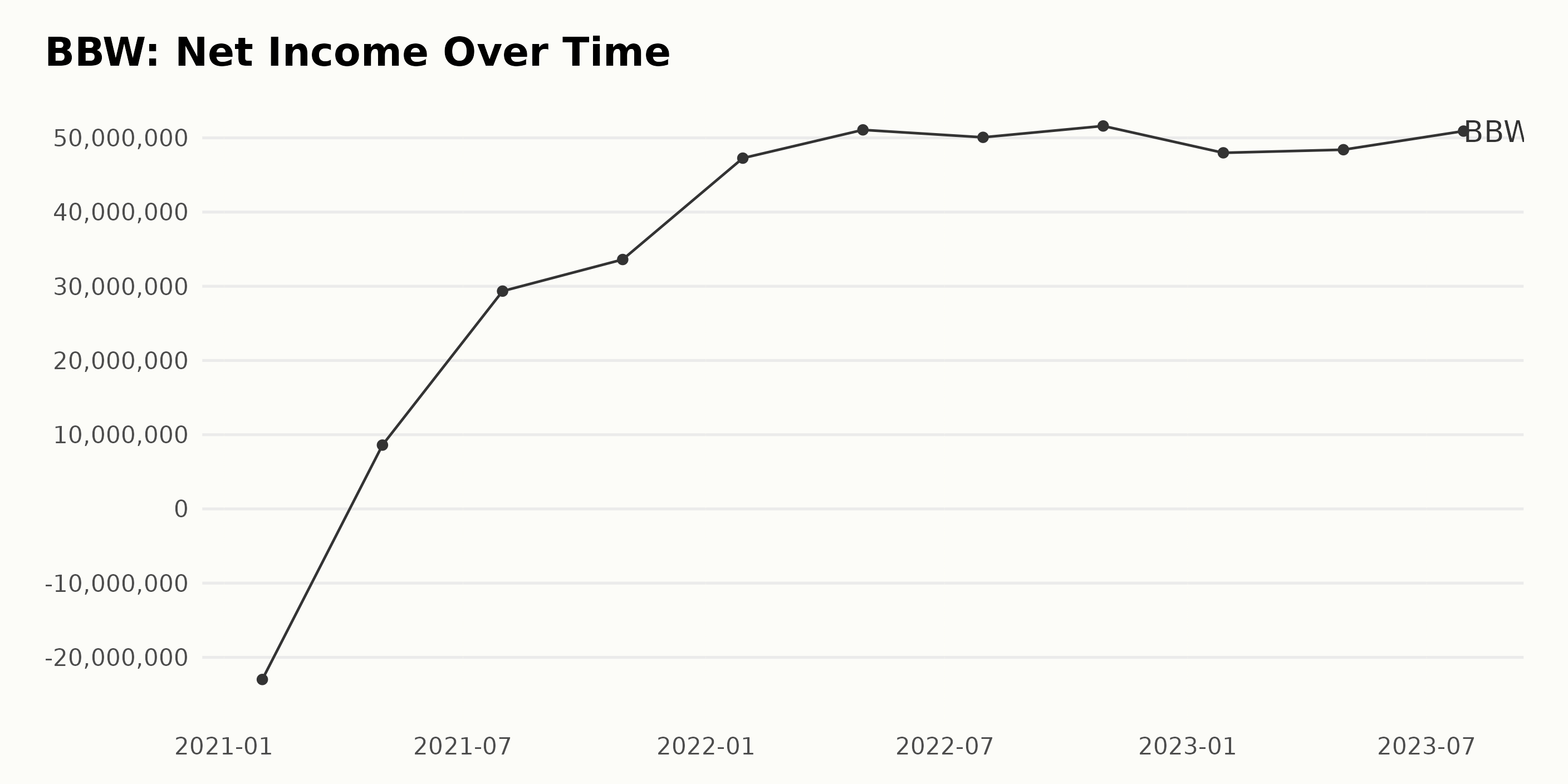

Examining the series data for Build-A-Bear Workshop Inc. (BBW)'s trailing-12-month Net Income from 2021 to 2023, a pattern of growth and occasional fluctuations is evident. Here is a brief summary:

- BBW's net income was -$22.98 million on January 30, 2021, and gradually surged to an impressive $51.60 million by October 29, 2022.

- Despite some dip in earnings thereafter, the net income has stabilized and consistently maintained over the $47.98 million mark from the start of 2023, peaking at $50.91 million towards July 29, 2023.

Observations about BBW's net income reveal:

- A turning point occurred on May 1, 2021, when the company returned from a deficit, reporting a net income of $8.60 million.

- By the end of July 2021, a notable upward trend began as the net income more than tripled to $29.34 million.

- Through 2022, BBW experienced substantial growth, with net income increasing and hitting a high of $51.60 million in October.

- However, a slight downward trend started from early 2023, with net income dropping to $47.98 million, but eventually recovering and maintaining relatively steady figures around the $48-50 million region till July 2023.

To calculate the growth rate between the first value and the last value in this series, we find a significant surge from -$22.98 million to $50.91 million, suggesting a phenomenal recovery and growth during this period. Please note that emphasis was placed on more recent data in accordance with the provided instructions.

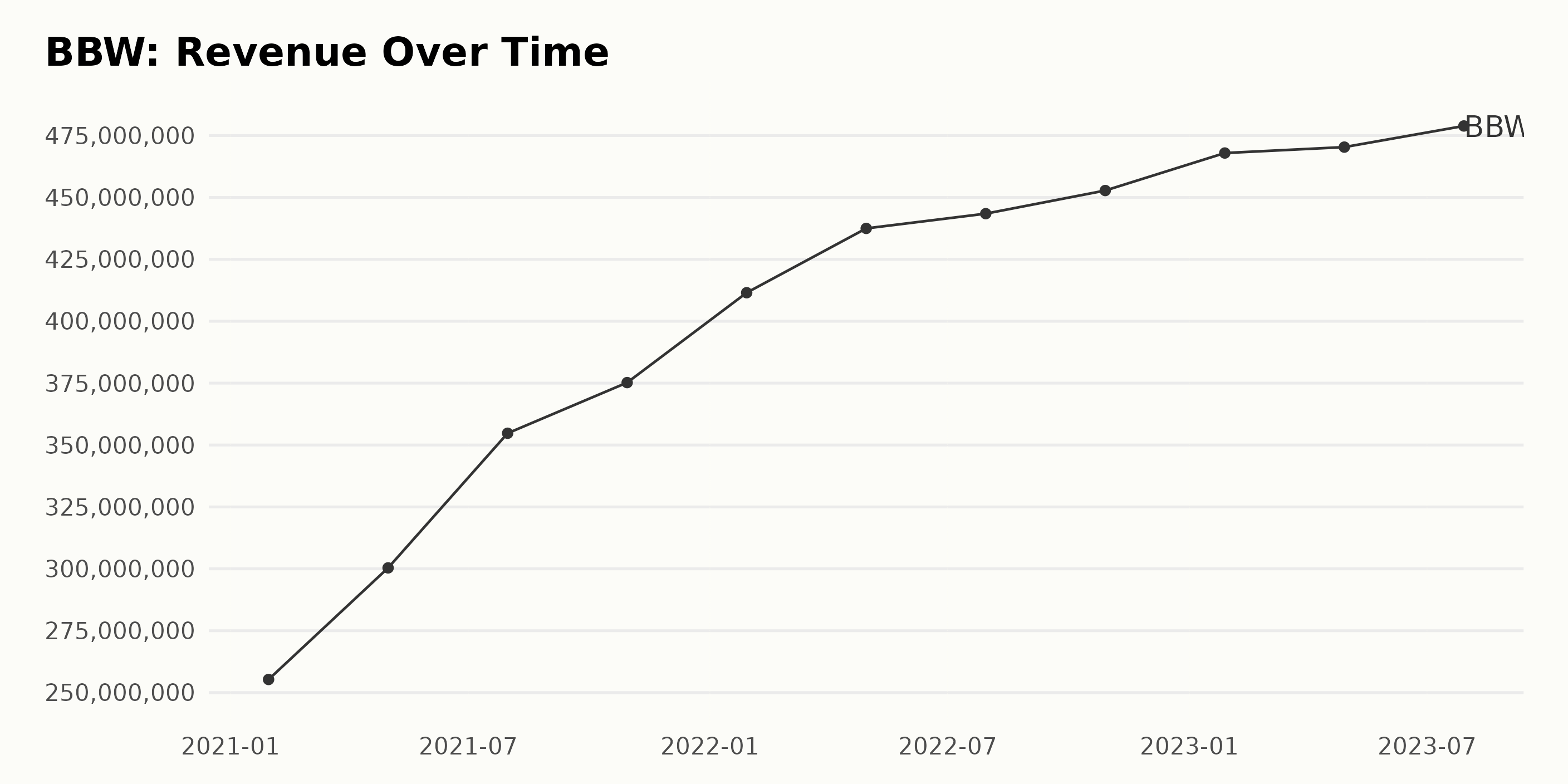

- On January 30, 2021, Build-A-Bear Workshop Inc. (BBW) recorded a trailing-12-month Revenue of $255.31 million.

- There was steady growth over the next year, with Revenue peaking at $411.52 million on January 29, 2022.

- This upward trend continued into 2023, with BBW's Revenue reaching a record high of $478.87 million in July.

In general, BBW experienced positive growth in its Revenue over the period, increasing from $255.31 million in January 2021 to $478.87 million in July 2023. This corresponds to an approximate growth rate of 87.6%. Especially noteworthy is the recent growth; from 2022 to 2023, there was an increase from $452.79 million in October 2022 to $470.33 million in April 2023 and then to $478.87 million in July 2023. The data reveal a generally upward trend in BBW's Revenue earnings, signifying healthy fiscal performance over this period. However, despite the overall growth, there have been periods of apparent stabilization. For instance, the revenue increased from $467.94 million in January 2023 to $470.33 million in April 2023, marking a very minimal rise over a three-month span. It's worth monitoring if these fluctuations will develop into a more pronounced pattern in the future.

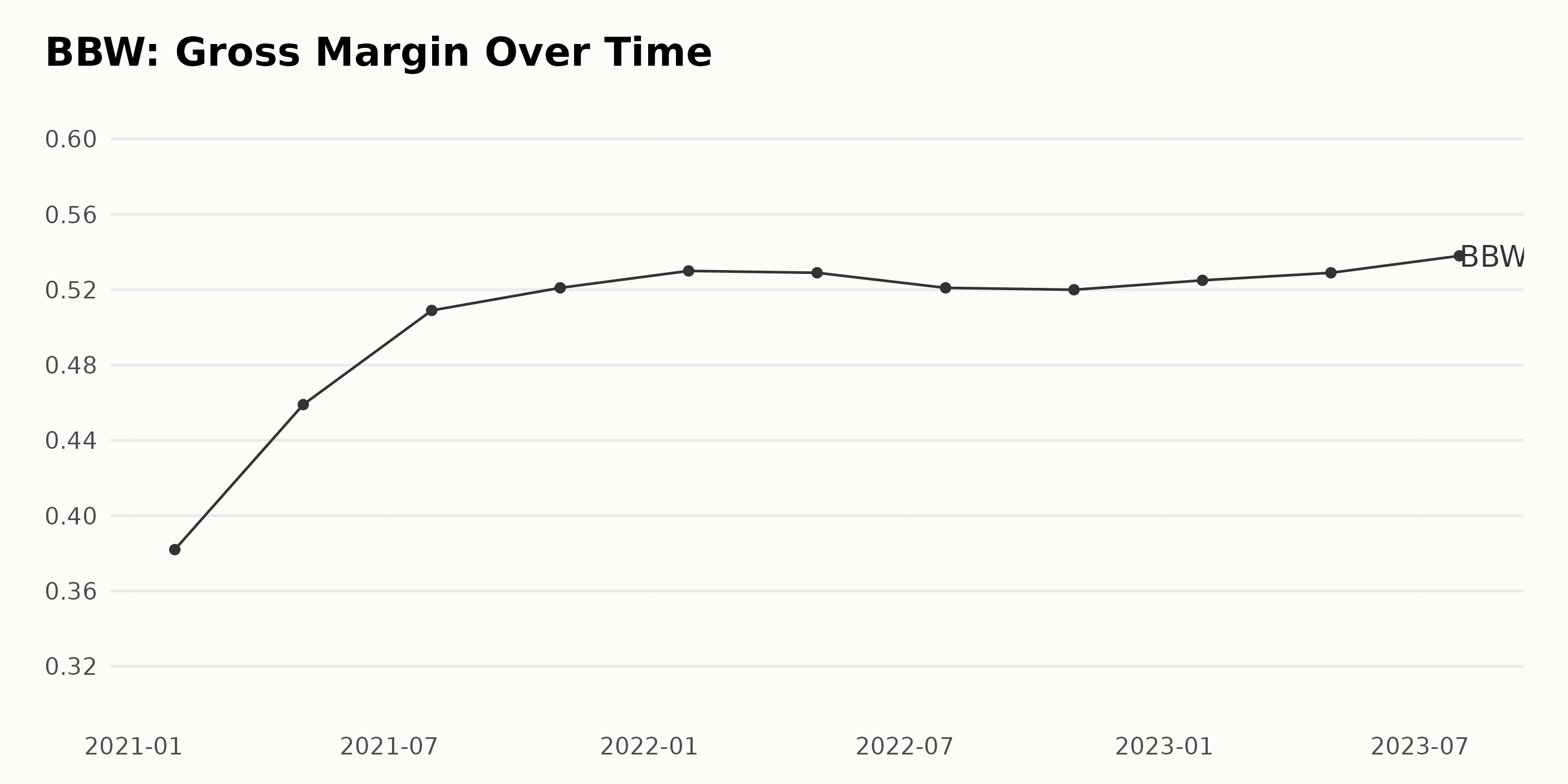

The Gross Margin of BBW has shown a general upward trend over the period from January 30, 2021, to July 29, 2023, with some fluctuations.

- January 2021 witnessed a Gross Margin of 38.2%

- In May 2021, this increased to 45.9%, showing a significant boost

- The rise continued and hit 50.9% by July 2021

- Until the end of October 2021, it slightly increased, reaching 52.1%

- Even in 2022, the Gross Margin was pretty stable, with minor fluctuations between 52.9% to 52.1%.

- Into mid-2023, there has been a steady increase from 52.5% in January to 53.8% by July 2023.

Notably, the Gross Margin seemed to peak at 52.9% in April 2022 and then experienced a minor decline before regaining momentum in 2023, demonstrating some degree of volatility. However, from January 2021 to July 2023, the Gross Margin grew from 38.2% to 53.8%, which translates into a growth rate of roughly 41%. This reflects a strong increase during the review period, notwithstanding the fluctuations.

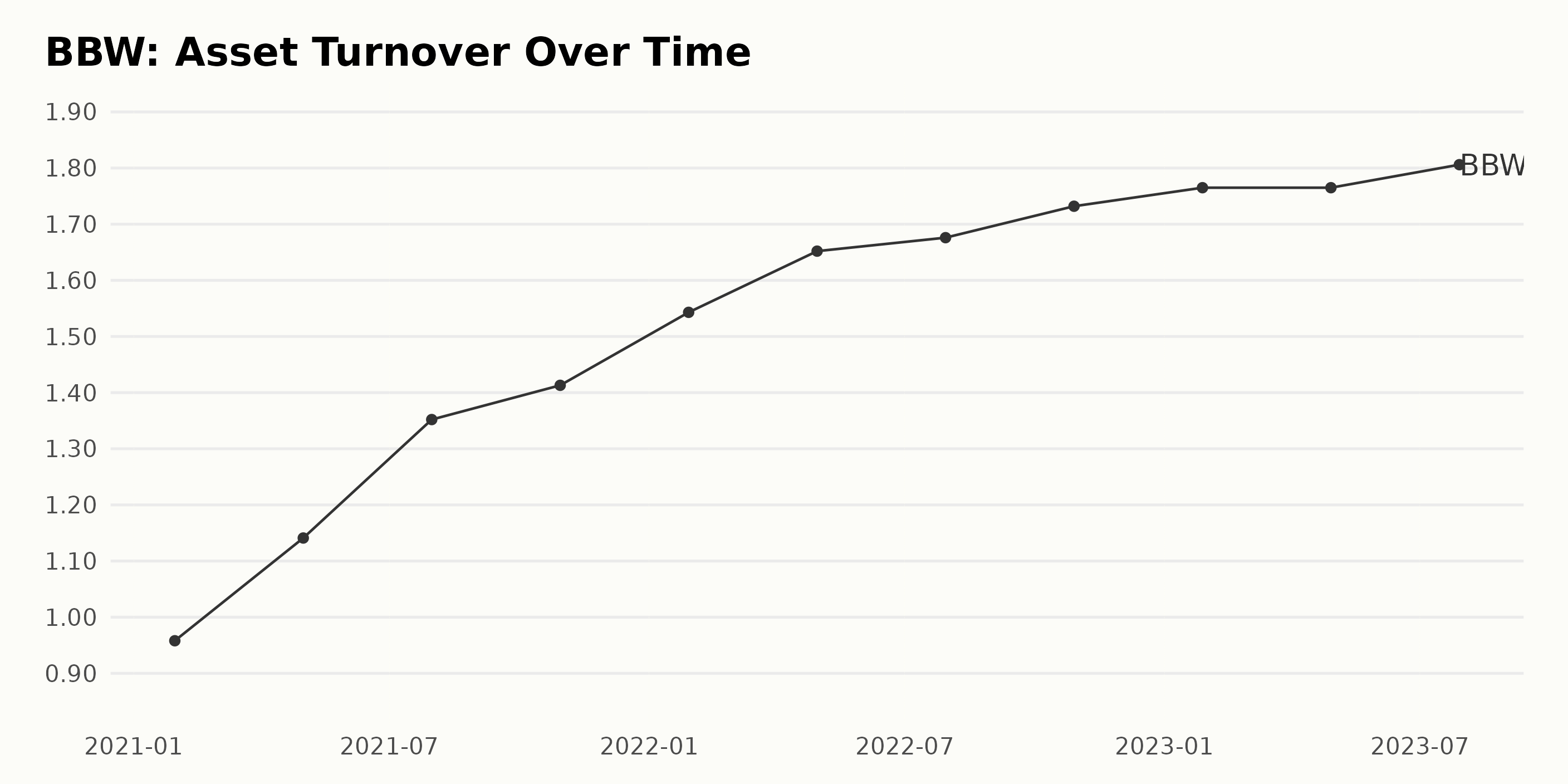

The reported Asset Turnover of BBW has followed a generally upward trend for the period in consideration. The analysis of the data from January 2021 through to July 2023 reveals the following:

- January 2021: The Asset Turnover stood at 0.96.

- May 2021: An increase in Asset Turnover was noted, reaching 1.14, representing a growth rate of 19% from the start of the year.

- July 2021: A further rise to 1.35 occurred, marking a surge of approximately 18% from May 2021.

Over the subsequent period, a steady increase followed, with periodic fluctuations:

- October 2021: The Asset Turnover experienced a slight increase to 1.41.

- January 2022: A notable jump was observed as the value climbed to 1.54, showing nearly a 9% rise from October 2021.

- April 2022 to July 2022: This period saw comparatively smaller increments coming to a standstill in July 2022 with an Asset Turnover of 1.68.

- October 2022: A resumption in the increment was noted as the value reached 1.73.

Conversely, the period from late 2022 to mid-2023 witnessed minimal soon leading to stagnation:

- January 2023: There was a slight increase in the Asset Turnover, ending at 1.77.

- April 2023: The Asset Turnover stagnated and remained at 1.77.

- July 2023: A marginal increase to 1.81 was noted towards the end of the series.

Overall, from January 2021 to July 2023, BBW's Asset Turnover has experienced an 89% increase. The more recent data in 2023 indicates the growth has slowed, with a mere 2% rise reported in the first half of the year.

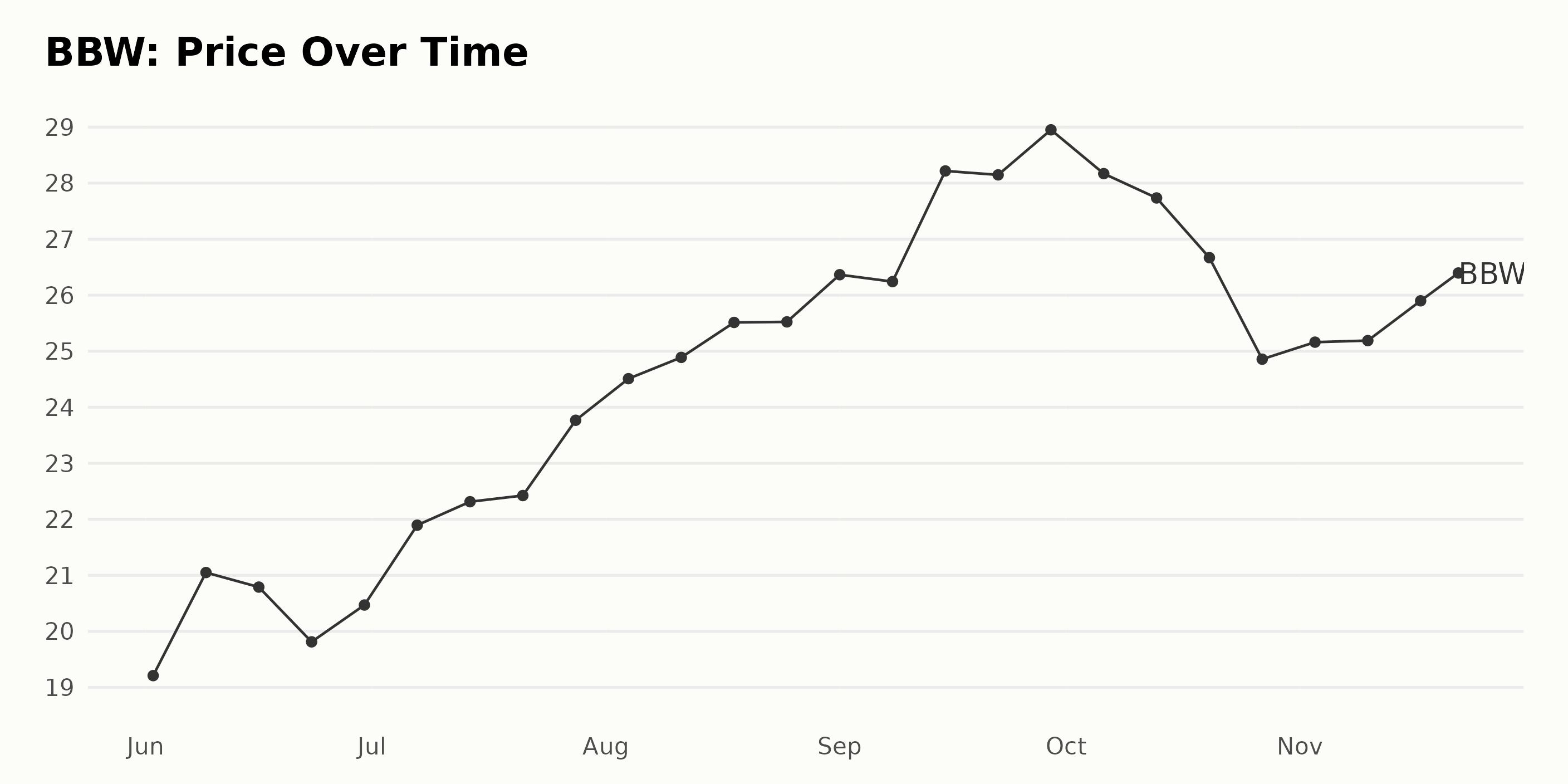

Build-A-Bear Workshop Inc.'s Share Price: A Volatile but Upward Journey, June-November 2023

Analyzing the share prices of Build-A-Bear Workshop Inc. (BBW) from June to November 2023 shows an overall upward tendency despite some periods of volatility.

- In June 2023, the price began at $19.21 and experienced a rise and slight dip, concluding the month at $20.47.

- In July 2023, BBW's stock observed steady growth from $21.895 to $23.768.

- During August 2023, the stock price accelerated from $24.51 to $25.524, with some ups and downs in between, a gradual increase.

- In September 2023, the BBW's share price saw another ascending trend, although with a slight deceleration towards the end of the month. The month started at $26.366 and closed at $28.952.

- In October 2023, the share price fluctuated a lot, beginning the month at $28.17, peaking around mid-month, but finally dropping to $24.858 by the end of October.

- In November 2023, despite starting with a modest decline, the share price gradually picked up, closing the month at $26.29.

The general direction of prices shows an upward trajectory over these months, as the closing price in November was higher than that in June. However, the growth rate slowed down around October and early November before it picked up again near the end. With this bumpy but upward trend, the investor must closely monitor this volatile period. Here is a chart of BBW's price over the past 180 days.

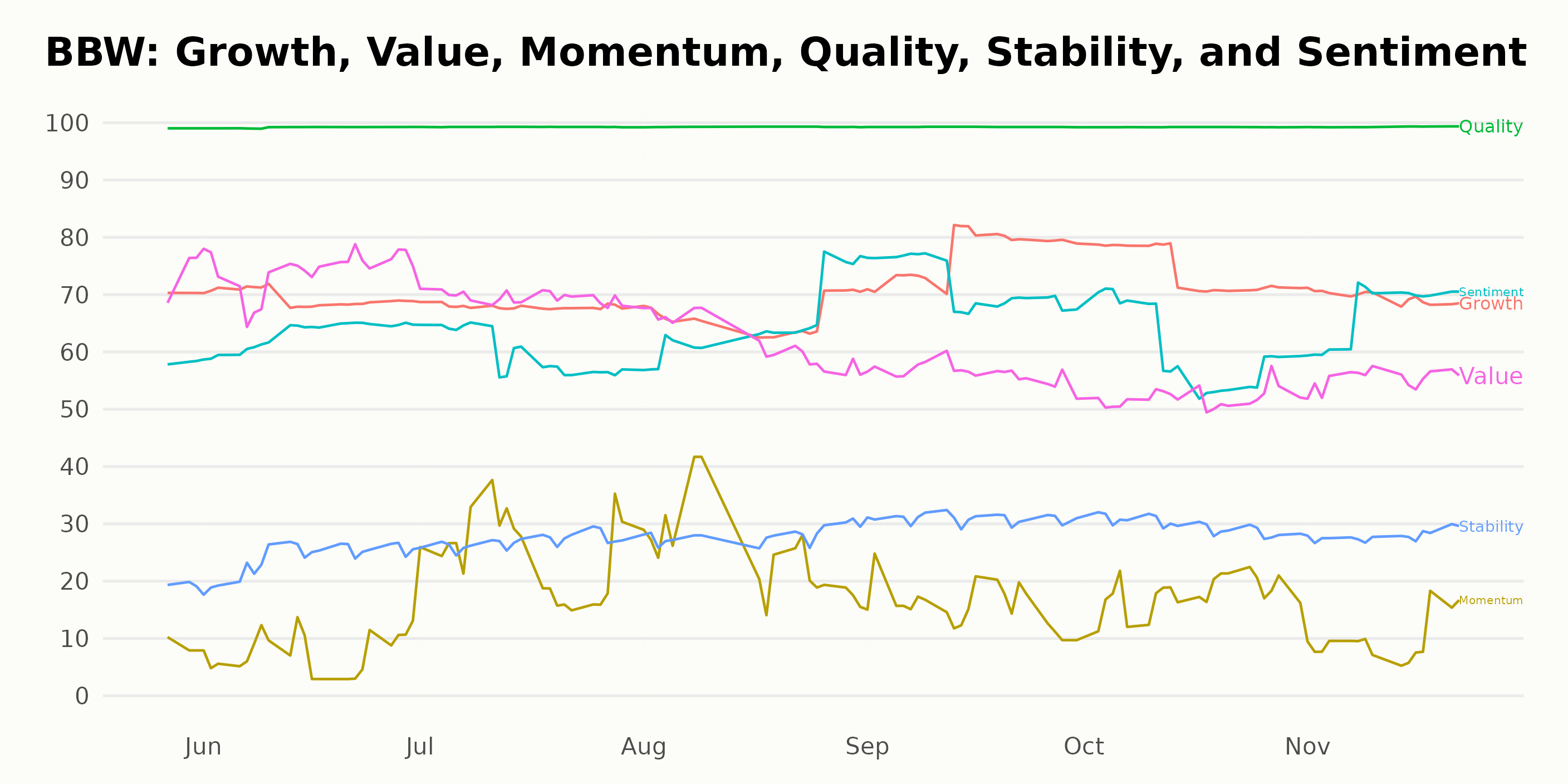

Analyzing Build-A-Bear Workshop's Top POWR Ratings: Quality, Value, and Growth

BBW has an overall B rating, translating to a Buy in our POWR Ratings system. It is ranked #9 out of the 42 stocks in the Specialty Retailers category.

Based on the POWR Ratings for Build-A-Bear Workshop Inc. (BBW), three dimensions stand out in terms of their highest ratings: Quality, Value, and Growth.

Quality: Remarkably, BBW consistently scored 99 in this dimension from May to November 2023, indicating exceptional quality.

- In May 2023, the Quality rating is 99.

- The same score continues throughout June to November 2023.

Value: The Value dimension shows variations over the same period, albeit ranking high in most cases.

- In May 2023, the Value rating starts at 74.

- This maintains in June 2023; however, decreases to 70 in July 2023.

- Further decrease is seen as it drops to 62 in August 2023 and 56 in September 2023.

- In October 2023, it declined to its lowest rating of 52, before slightly increasing to 55 in November 2023.

Growth: The Growth dimension also records decent scores with some visible fluctuations during the period.

- In May 2023, the Growth rating stands at 70.

- It experiences a slight drop to 69 in June 2023 and continues to decline to hit 66 by August 2023.

- However, in September 2023, there is a noticeable spike to 77 before dipping again to 74 in October, and back to 70 in November 2023.

In short, while BBW maintains an unflinching high score in Quality, both Value and Growth show clear trends of slight ups and downs. Still, these three dimensions have consistently been the highest and, thus are the most noteworthy.

How does Build-A-Bear Workshop Inc. (BBW) Stack Up Against its Peers?

Other stocks in the Specialty Retailers sector that may be worth considering are Pan Pacific International Holdings Corporation (DQJCY), Aeon Co. Ltd. (AONNY), and Betterware de Mexico, S.A.B. de C.V. (BWMX) -- they have better POWR Ratings.

What To Do Next?

43 year investment veteran, Steve Reitmeister, has just released his 2024 market outlook along with trading plan and top 11 picks for the year ahead.

BBW shares were trading at $26.29 per share on Thursday afternoon, down $0.00 (0.00%). Year-to-date, BBW has gained 10.28%, versus a 20.30% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Is Build-A-Bear Workshop (BBW) a Smart Addition to Your Portfolio? appeared first on StockNews.com