Amcor plc (AMCR) is a global leader in responsible packaging solutions, serving consumer goods, food and beverage, pharmaceutical, medical, and personal care markets. Headquartered in Switzerland, the company designs and manufactures flexible and rigid packaging products that emphasize product protection, convenience, and sustainability. Valued at $19.4 billion by market cap, Amcor operates through two primary segments, Flexibles and Rigid Packaging, offering a broad portfolio that includes films, pouches, cartons, closures, and specialty containers.

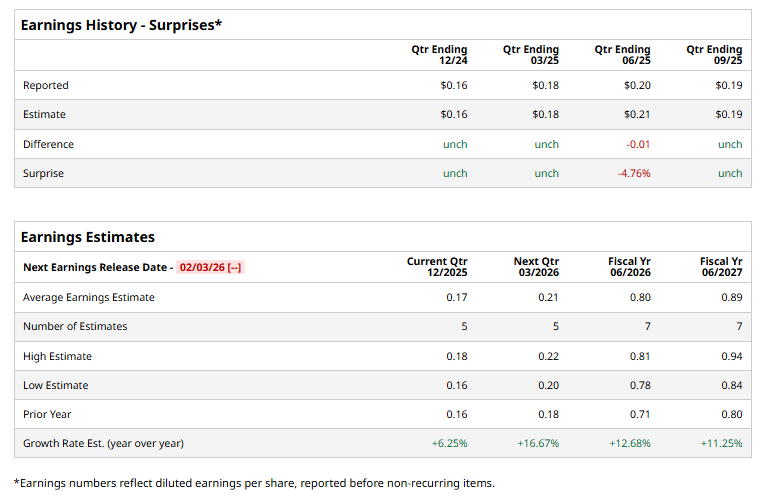

The consumer and healthcare packaging titan is expected to announce its fiscal 2026 second-quarter earnings in the near future. Ahead of the event, analysts expect AMCR to report a profit of $0.17 per share on a diluted basis, up 6.3% from $0.16 per share in the year-ago quarter. The company met the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For the current year, analysts expect AMCR to report EPS of $0.80, up 12.7% from $0.71 in fiscal 2025. Its EPS is expected to rise 11.3% year over year to $0.89 in fiscal 2027.

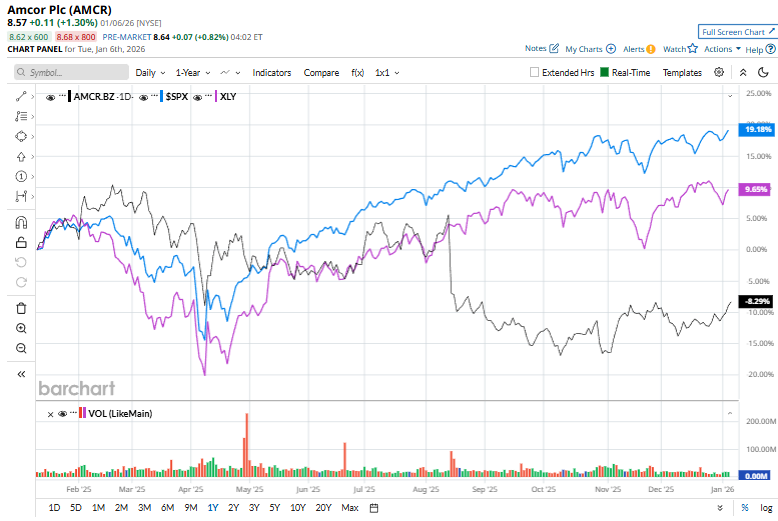

AMCR stock has dipped 9.1% over the past year, significantly underperforming the S&P 500 Index’s ($SPX) 16.2% gains and the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 6.8% gains over the same time frame.

On Dec. 11, Amcor shares gained 1.6% after the packaging major announced it will move forward with a 1-for-5 reverse stock split that was previously approved by shareholders at its annual general meeting on Nov. 6, 2025. The company expects to file an amendment to its memorandum of association to effect the split after the close of trading on Jan. 14, 2026, with Amcor ordinary shares set to begin trading on a split-adjusted basis on Jan. 15, 2026. Amcor also confirmed that its CHESS Depositary Interests (CDIs) will be consolidated on the same 1-for-5 basis, with each CDI continuing to represent an interest in one Amcor ordinary share following the transaction.

Analysts’ consensus opinion on AMCR stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 16 analysts covering the stock, 10 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and five give a “Hold.” AMCR’s average analyst price target is $10.40, indicating a notable potential upside of 21.4% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart