Bellevue, Washington-based T-Mobile US, Inc. (TMUS) provides wireless communications services. Valued at a market cap of $220.7 billion, the company offers voice, messaging, and data services to postpaid, prepaid, wholesale and other services customers. It is ready to announce its fiscal Q4 earnings for 2025 after the market closes on Wednesday, Feb. 4.

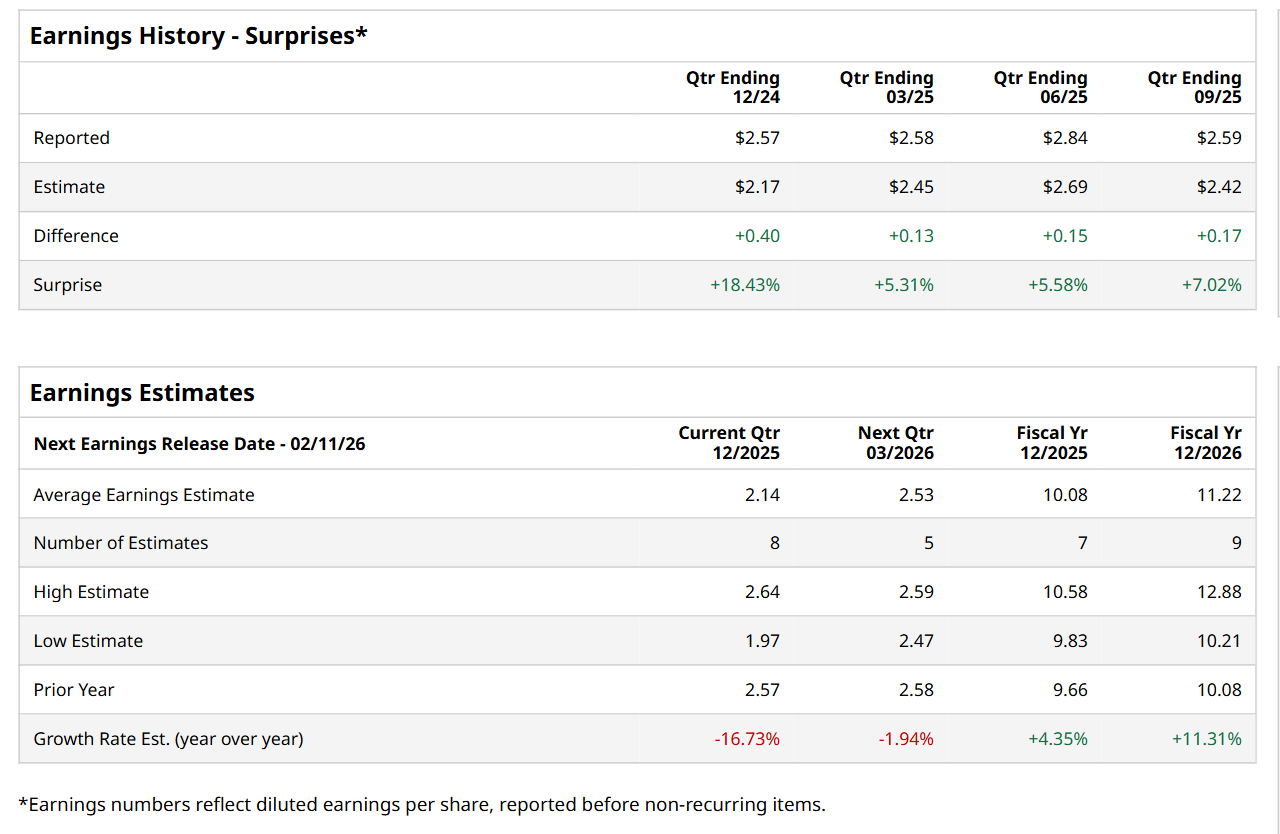

Before this event, analysts expect this telecom giant to report a profit of $2.14 per share, down 16.7% from $2.57 per share in the year-ago quarter. The company has topped Wall Street’s bottom-line estimates in each of the last four quarters. In Q3, its EPS of $2.59 exceeded the consensus estimates by 7%.

For the current fiscal year, ending in December, analysts expect TMUS to report a profit of $10.08 per share, representing a 4.4% increase from $9.66 per share in fiscal 2024. Furthermore, its EPS is expected to grow 11.3% year-over-year to $11.22 in fiscal 2026.

Shares of TMUS have declined 8.5% over the past 52 weeks, considerably underperforming both the S&P 500 Index's ($SPX) 17.1% return and the State Street Communication Services Select Sector SPDR ETF’s (XLC) 20.5% uptick over the same time period.

On Oct. 23, shares of TMUS plunged 3.3% despite posting better-than-expected Q3 earnings results. The company’s total revenue improved 8.9% year-over-year to $22 billion, supported by robust postpaid growth and solid net customer additions. Its adjusted EBITDA also increased 5.3% from the year-ago quarter to $8.7 billion. However, its EPS dropped 7.7% from the same period last year to $2.41, which might have weighed on investor sentiment.

Wall Street analysts are moderately optimistic about TMUS’ stock, with an overall "Moderate Buy" rating. Among 29 analysts covering the stock, 16 recommend "Strong Buy," three indicate “Moderate Buy,” and 10 suggest "Hold.” The mean price target for TMUS is $270.08, indicating a 35.7% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- MicroStrategy Gets to Stay in MSCI Indexes. Is That Win Enough to Keep Buying MSTR Stock in 2026?

- It Looks Like It’s Too Late to Buy This Little-Known Stock Up 180% Since Dec. 8

- The 3 Best Nuclear Energy Stocks to Buy for 2026

- Cathie Wood Just Had a Comeback Year. This Controversial Stock Is Still Her Top Holding.