Colorado-based UDR, Inc. (UDR) is a publicly traded multifamily real estate investment trust (REIT) valued at a market cap of $12.1 billion. The company owns, operates, acquires, develops, redevelops, and manages a diversified portfolio of high-quality apartment communities across the United States, focusing on delivering dependable long‑term returns and superior resident experiences. The company is expected to announce its fiscal Q4 earnings for 2025 soon.

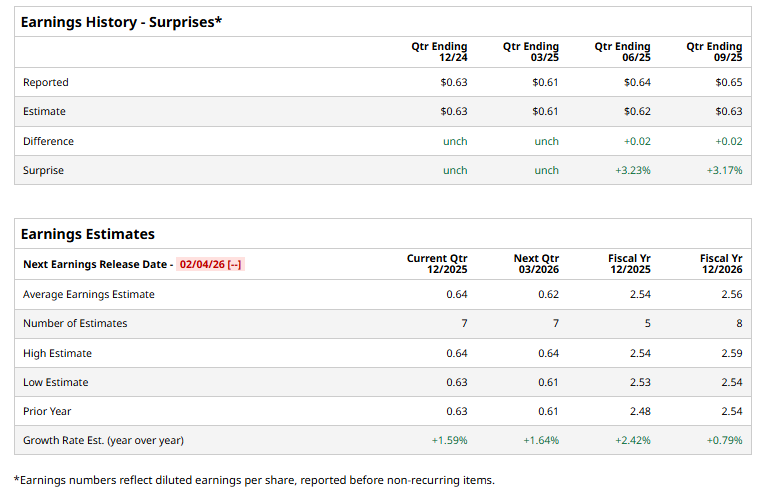

Before this event, analysts expect this residential REIT to report an FFO of $0.64 per share, up 1.6% from $0.63 per share in the year-ago quarter. The company has met or exceeded Wall Street’s FFO estimates in each of the last four quarters.

For FY2025, analysts expect UDR to report an FFO of $2.54 per share, up 2.4% from $2.48 per share in fiscal 2024.

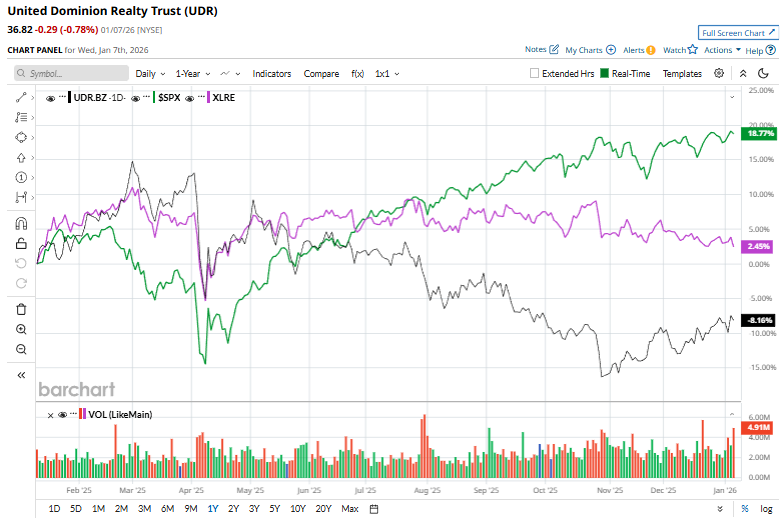

Shares of UDR have declined 10.4% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 17.1% return and the Real Estate Select Sector SPDR Fund’s (XLRE) marginal uptick over the same time frame.

UDR has lagged the broader market over the past year, influenced by weaker rental and rent‑growth trends in key markets and elevated new apartment supply, which have tempered rent and net operating income momentum.

Wall Street analysts are moderately optimistic about UDR’s stock, with a "Moderate Buy" rating overall. Among 24 analysts covering the stock, seven recommend "Strong Buy," 15 indicate "Hold," and two suggest a "Strong Sell” rating. The mean price target for UDR is $40.30, implying a 9.5% potential upside from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart