A new year usually comes with a fresh set of investing goals. For many income investors, that means being more meticulous, focusing less on flashy yields, and paying closer attention to what they actually own. And that perspective led me to this list. Instead of chasing trends and hype, I looked at the Dividend Kings, companies that have increased their dividends for at least five decades, overcoming recessions, rate changes, and shifting market conditions along the way. That kind of track record does not happen by accident. It usually reflects steady demand, disciplined management, and business models built to last.

With that in mind, I asked a simple question: which of these Dividend Kings are still trading at prices that make sense today?

How I came up with the following stocks

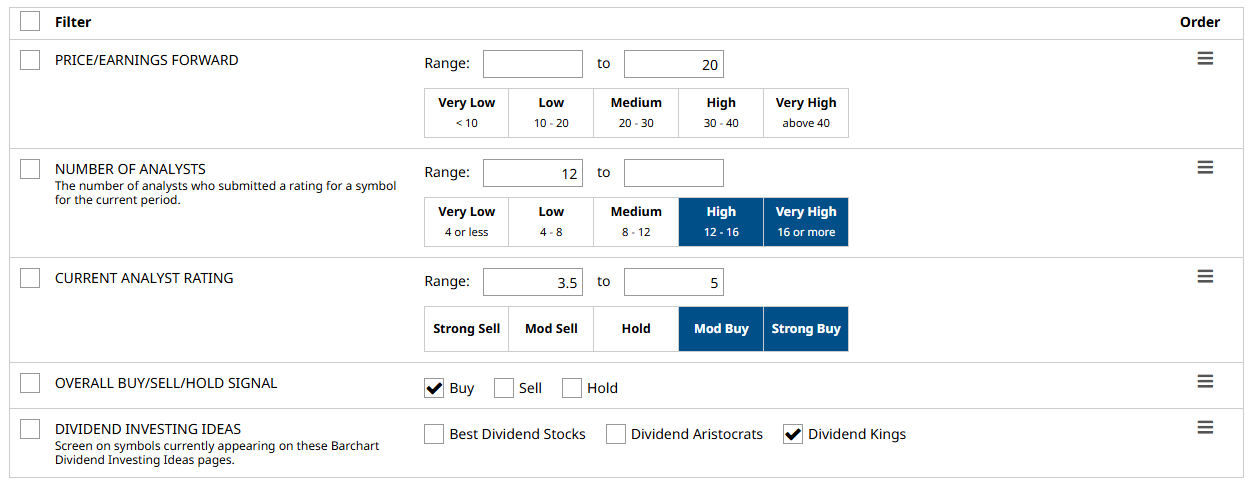

Using Barchart’s Stock Screener, I selected the following filters to get my list:

- Price/Earnings Forward: This indicates whether a stock is undervalued based on its expected earnings relative to its current market price. The P/E ratio is a popular valuation metric for analyzing whether a stock is a good buy at the moment. A lower forward P/E than the sector average suggests it is undervalued.

- Number of Analysts: 12 or more. The more analysts there are, the stronger the consensus.

- Current Analyst Rating: 3.5 - 5. Stocks that are “Moderate” to “Strong Buy”.

- Overall Buy/Sell/Hold Signal: Buy.

- Dividend Investing Ideas: Dividend Kings.

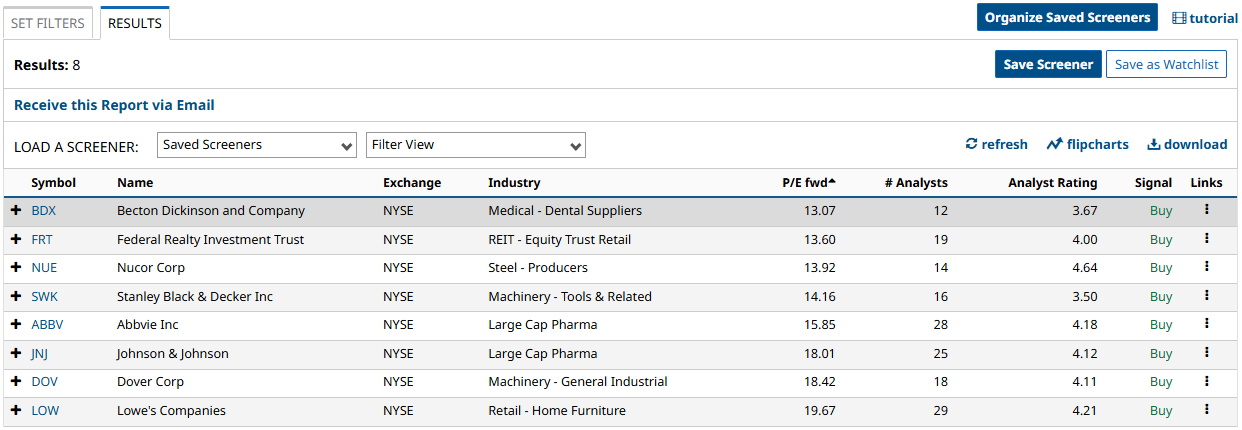

I ran the screen, and it matched 8 results. I arranged the results from lowest to highest forward price-to-earnings.

Let’s start with the first Dividend King:

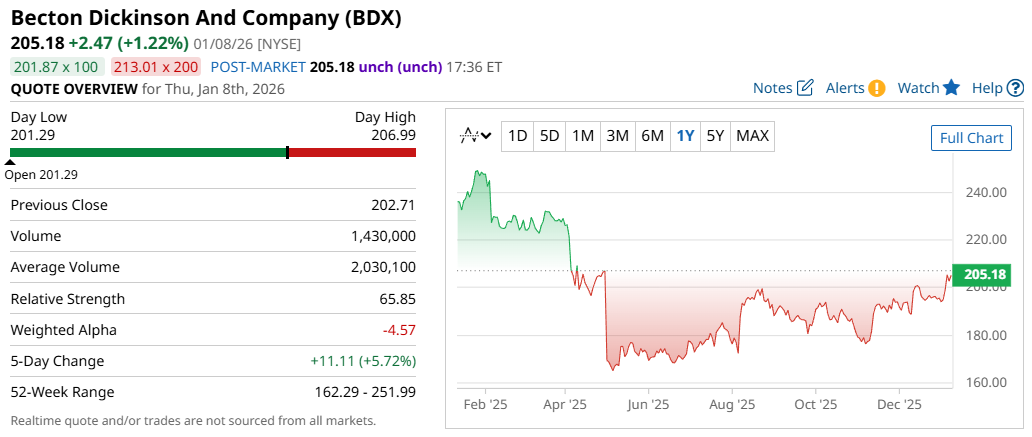

Becton Dickinson And Company (BDX)

Becton Dickinson And Company is a global medical technology leader that manufactures and supplies medical, laboratory, and diagnostic-related products. Recent milestones in its Phasix™ Mesh hernia prevention program highlight continued innovation and global market expansion.

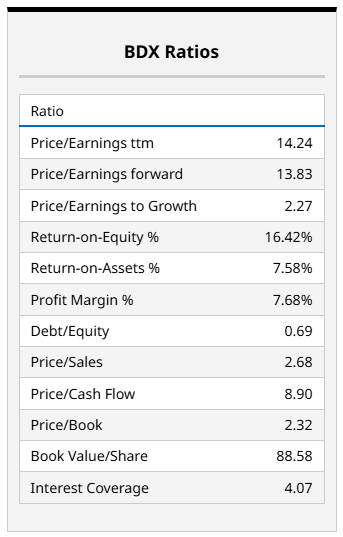

In its recent quarterly financials, sales rose around 8% YOY to $5.9 billion, while net income increased 23% to $493 million. Becton, Dickinson & Company also pays a forward annual dividend of $4.20, translating to a yield of around 2%. The stock has a forward P/E of around 14, below the sector average of 27.10, indicating it is undervalued.

Meanwhile, a consensus among 12 Wall Street analysts rates the stock a “Moderate Buy”. Barchart’s Overall Average Opinion also gives it a buy signal, suggesting that the stock is in a strong upward trend across technical indicators.

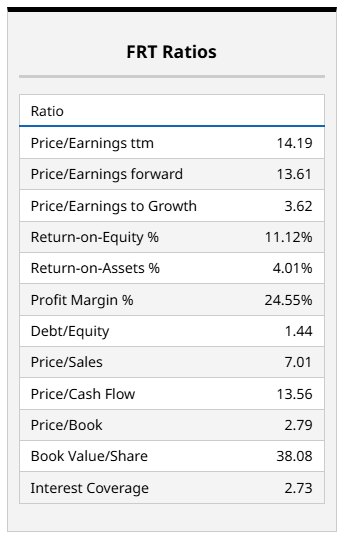

Federal Realty Investment Trust (FRT)

The second Dividend King is Federal Realty Investment Trust, a leader in the real estate industry that owns and innovates high-quality retail and commercial properties. The company is actively raising capital through strategic asset sales to fund higher-growth opportunities and support long-term value creation.

In its most recent quarterly financials, Federal Realty reported that sales grew 6.1% YOY to $322 million while net income was relatively flat at $61 million.

The company also pays a forward annual dividend of $4.52, which translates to a yield of about 4.5%, the highest on this list. Meanwhile, the stock trades at a forward P/E of 13.6, below the sector average of 18.44, making it a strong bargain.

Finally, a consensus among 19 analysts rates the stock a “Moderate Buy”, which also aligns with the Barchart Opinion “Buy” signal.

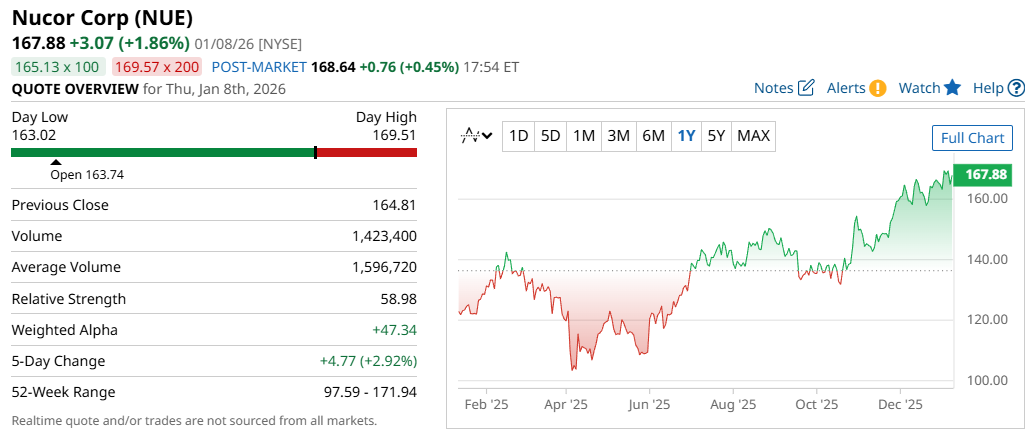

Nucor Corp (NUE)

Last but definitely not least is Nucor Corp, one of the largest manufacturers and a globally sustainable steel company. It is also known for other services, such as industrial gases, and is well-positioned to benefit from long-term steel demand and infrastructure investment.

In its quarterly financials, the company reported that sales increased 14% YOY to $8.5 billion, while net income grew 143% to $607 million.

Nucor also pays a forward annual dividend of $2.24, translating to a yield of around 1.3%. The stock is also trading at 14x earnings, below the industry average of 24x.

A consensus among 14 analysts rates the stock a “Strong Buy,” which coincides with the Barchart Opinion “Buy” signal, making it the highest-rated on this list. Overall, the cheap valuation, overwhelmingly positive Wall Street and Barchart Opinion ratings, and decent dividend yield make a compelling case for buying Nucor stock.

Final Thoughts

So, there you have it, three undervalued Dividend Kings trading at attractive valuations based on forward price-to-earnings. Supported by proven, resilient businesses and long dividend track records, these stocks offer a solid margin of safety at today’s prices, along with dependable income and the bonus potential for upside. These qualities make them a good addition to an income-focused investor's portfolio.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart