With a market cap of $17.7 billion, Lennox International Inc. (LII) is a global provider of climate control and refrigeration solutions, serving residential, commercial, and industrial markets. Headquartered in Richardson, Texas, the company designs, manufactures, and markets heating, ventilation, air conditioning, and refrigeration (HVACR) equipment, with a strong focus on energy efficiency, sustainability, and advanced climate technologies.

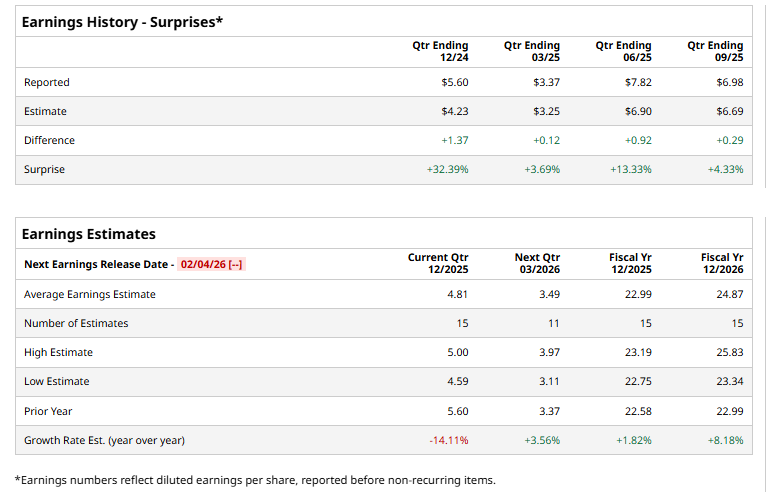

The company is poised to report its fiscal 2025 Q4 earnings soon. Ahead of this event, analysts expect the company to report a profit of $4.81 per share, down 14.1% from $5.60 per share in the year-ago quarter. On the bright side, the company has surpassed the Street’s bottom-line projections in all of the past four quarters.

For fiscal 2025, analysts expect LII to report a profit of $22.99, up 1.8% from $22.58 in fiscal 2024. Furthermore, its EPS is expected to grow 8.2% year over year to $24.87 in fiscal 2026.

LII stock has dipped 17.4% over the past 52 weeks, underperforming the Industrial Select Sector SPDR Fund’s (XLI) 20.6% surge and the S&P 500 Index’s ($SPX) 17% uptick during the same time frame.

On Jan. 8, Lennox shares rose 2.3% after the company announced the launch of the Dave Lennox Signature® SLP99VK Gas Furnace, a high-efficiency heating system featuring an integrated Refrigerant Detection System (RDS) that reduces installation complexity and costs by eliminating the need for a separate kit. The new model delivers up to 99% efficiency and is dual-fuel compatible, enabling it to pair with an electric heat pump to optimize performance and energy use across varying weather conditions.

Wall Street analysts are fairly bullish about LII’s stock, with a "Moderate Buy" rating overall. Among 19 analysts covering the stock, six recommend "Strong Buy," 11 suggest “Hold,” one advises “Moderate Sell,” and the remaining analyst suggests “Strong Sell.” Its mean price target of $566.47 implies an upswing potential of 9.6% from the current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart