Over the past two years, artificial intelligence (AI) stocks surged as investors rushed in, afraid of missing out on the next big tech boom. Valuations climbed quickly, and excitement around AI pushed many big names sharply higher. Recently, tech and AI stocks have taken a hit amid concerns about high valuation and questions over whether aggressive AI investments are delivering results fast enough. However, seasoned investors know that the real opportunity often appears when the excitement cools down.

So what is smart money doing now?

Why Are Tech Stocks Falling Right Now?

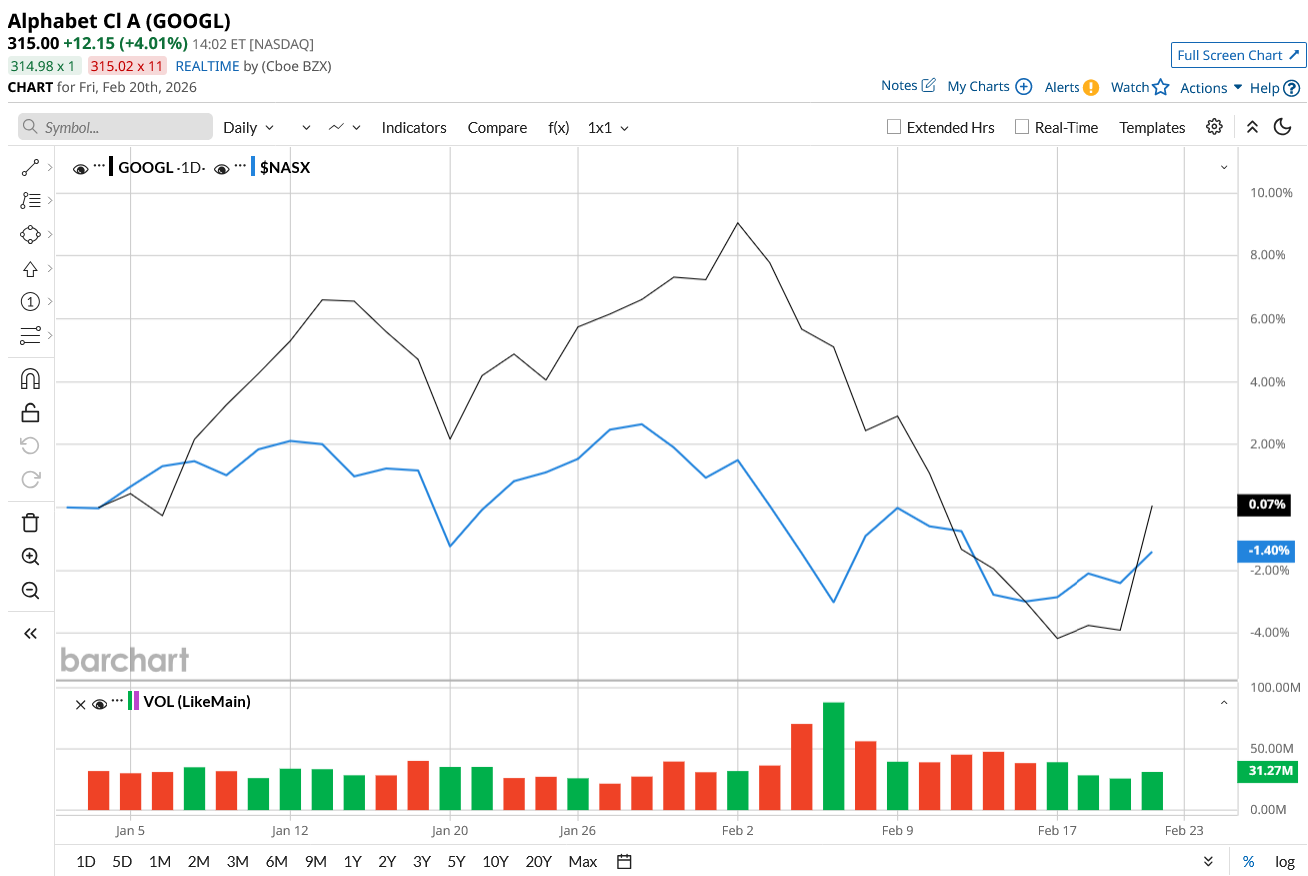

Several factors have influenced the recent tech and AI selloffs. Most tech companies have invested heavily in AI, putting pressure on their margins and balance sheets but not generating sufficient revenue or earnings growth at the moment. These AI stocks are being scrutinized for their lofty valuations. Other factors that affected it were large funds locking in profits after strong rallies, a market cycle shift from high-growth AI stocks to more defensive and value plays, and geopolitical uncertainty.

Despite the panic selling, long-term savvy investors know that these corrections do not necessarily weaken the long-term AI story, at least not for legacy players like Alphabet (GOOG) (GOOGL). They focus on fundamentals, cash flow strength, competitive advantage, and long-term earnings power and not daily price swings.

Why Smart Money is on Google

GOOGL stock has returned 745% over the last 10 years and has gone through numerous correction cycles. What kept its stock rising is the company’s consistent revenue and earnings growth, cash flow strength, infrastructure leadership, and long-term growth visibility. Alphabet’s revenue has increased from $74.9 billion in fiscal 2015 to $402 billion in fiscal 2025. Similarly, earnings have risen from $1.14 per share to $10.81 per share over the same period.

While the tech selloff has kept GOOGL stock just about flat so far this year, the company actually reported what CEO Sundar Pichai called a “tremendous quarter,” proving that the underlying AI engine continues to accelerate across every major business line. In fact, Google integrated AI long before it became a sensation. Since 2017, Alphabet has begun utilizing AI in Gmail and Google Search. And now Alphabet has become a full-stack AI leader with proprietary TPUs, Nvidia (NVDA) GPUs, frontier Gemini models processing over 10 billion tokens per minute, and a diverse portfolio of AI-powered products across Search, Workspace, Ads, YouTube, Android, and Pixel.

In the fourth quarter of fiscal 2025, revenue climbed 18% year-over-year (YoY) to $113.8 billion, while earnings increased 31% to $2.82 per share. For the full year, revenue reached $403 billion, up 15%, surpassing $400 billion for the first time in company history. Search remains Alphabet’s strongest growth driver with an 89.8% market share. Search revenue increased 17% to $63.1 billion in Q4. AI has expanded Search with AI Mode queries per user having doubled in the U.S. since launch.

Google Cloud remains another strong indicator of Alphabet's AI strength, with revenue up 48% to $17.7 billion. Cloud backlog doubled YoY to $240 billion, a solid indicator of future revenue. At the same time, enterprise AI demand continues to gain momentum. Nearly 75% of Google Cloud customers now use its vertically integrated AI solutions, and those AI-focused clients adopt 1.8 times more products compared to regular customers. During the quarter, revenue from products built on generative AI models jumped nearly 400% YoY. Even more striking, Gemini now supports more than 120,000 organizations, including 95% of the top 20 SaaS companies, highlighting its growing role as a core AI engine for the software industry.

One of the main concerns behind the recent pullback in tech stocks is heavy investment in AI. And Alphabet is investing extensively in AI infrastructure, with capital expenditures totaling $91.4 billion by 2025, mostly in technical infrastructure like servers (60%) and data centers/networking (40%). Nonetheless, Alphabet allocated its capital wisely, which is what smart money notices. It generated $73.3 billion in free cash flow, ending Q4 with $126.8 billion in cash and marketable securities. The company returned $5.5 billion in share repurchases and $2.5 billion in dividends in Q4.

Management expects capital expenditure to range between $175 billion and $185 billion in 2026, ramping throughout the year. Analysts expect Google’s revenue to increase by 16.6% in 2026 to $469.8 billion, with earnings rising by 6%. In fiscal 2027, revenue could further increase by another 14.8% to $539.7 billion, with earnings rising by 15.8%. Trading at 22 times forward earnings, GOOGL is a reasonable buy if you consider the bigger picture.

The Bigger Picture

A long-term investor believes that if a company is strong, time is your friend. And Alphabet checks every box. This pullback may be a great opportunity to accumulate shares of a dominant, full-stack AI platform that is already generating hundreds of billions in revenue while investing aggressively to lead the next decade of AI.

What Does Wall Street Say About GOOGL Stock?

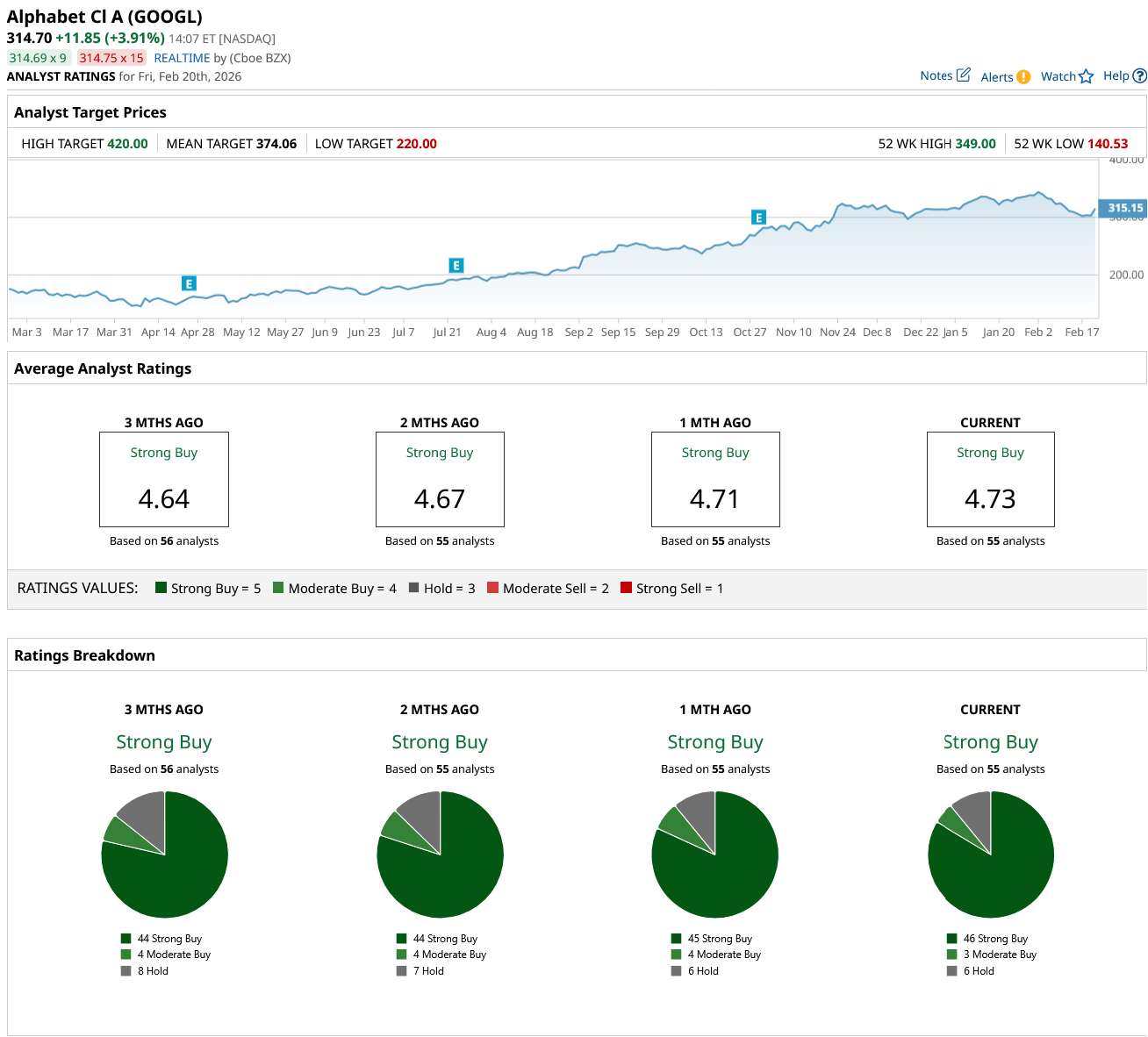

Wall Street is highly optimistic about the long-term AI story and rates GOOGL stock an overall “Strong Buy.” Out of the 55 analysts covering Alphabet stock, 46 have a “Strong Buy” recommendation, three recommend “Moderate Buy,” and six rate it a “Hold.” The stock has no sell recommendations. Based on analysts' average price target of $374.06, Wall Street sees a potential upside of about 19% in the next 12 months. Plus, its high price estimate of $420 suggests the stock can climb by 33% from current levels.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Why Smart Money Buys When AI Stocks Pull Back

- S&P 500 Futures Slide After U.S. GDP Growth Misses Forecasts and Geopolitical Tensions Rise

- Stocks Slip Before the Open on U.S.-Iran Fears, Economic Data and Walmart Earnings on Tap

- Stock Index Futures Climb as AI Jitters Ease, FOMC Minutes and U.S. Economic Data in Focus