Since its debut on the NYSE in 2017, shares of Snap (NYSE: SNAP) have experienced significant volatility. After pricing its IPO at $17, shares of the company opened on NYSE at $24, up 41% from pricing, and closed the day up 44% from the IPO price. At the close of its first day of trading, the company had a market capitalization of about $28 billion. In the five years since Snap has reached a market capitalization high of about $130 billion and currently has a market capitalization of $17.3 billion.

Since topping out in late 2021, shares of the company have fallen over 86%, with shares now trading below the IPO price. In recent months, shares of the social media company have discovered support and have bottomed out, so now might be the opportune time to invest as the risk: reward appears attractive on a higher time frame.

Price Has Stabilized Near the Resistance

Near the end of last year, Snap broke its downtrend and began to trade sideways, indicating that support had been discovered. While the stock has so far underperformed the broader market in 2023, shares of Snap have recently impressed as the stock is up 26% over the last six months and 20.89% YTD. As of Friday's close, the stock is up 47.61% from its 52W low.

The strength is primarily a result of the significant bounce off the lows in May, when the company found support near $8 and has since rallied towards the resistance of the consolidation, near $11.

$8 support has been tested multiple times over the last year and has established itself as crucial support. $12 has been tested several times, and the stock has failed to hold above the level each time. $12 is now a critical inflection point for the stock. A move over $12 could spark a significant reversal, with the next resistance level at $16.

Snapshot Of Key Figures

Shares of Snap traded lower after the company announced weak results for the first quarter. Revenue for the first quarter was $989 million, missing estimates of $1 billion. Revenue decreased 7% from the same period last year. Notably, it was the first time revenue fell since the company went public. The company blamed the weaker-than-expected revenue on disrupted ad demands after updating the platform where it sells ads.

To boost revenue, the company focuses on their subscriptions business, Snapchat+, which currently has about 3 million subscribers. Importantly, Snap continues to grow its user base. The company reported its daily user count grew 15% YoY to 383 million.

Snap currently has an RSI of 62.68, indicating that shares are not overbought or overvalued in the short term. Its debt-to-equity ratio is now 1.45, slightly higher than an optimal sub-one ratio, indicating potential risk regarding the company's financial leverage. However, Snap's current ratio is 4.71, which suggests that the company should have no problem paying its immediate debts and liabilities.

Analysts Ratings and Insider Transactions

Based on 37 analyst ratings, Snap has a current rating of Hold, with just 4 rating the stock as Buy and 2 as Sell. Based on the consensus price target of $10.27, the predicted downside is 5%.

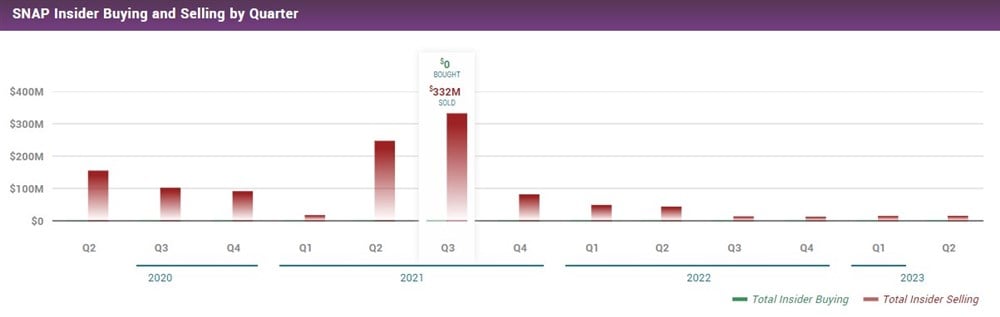

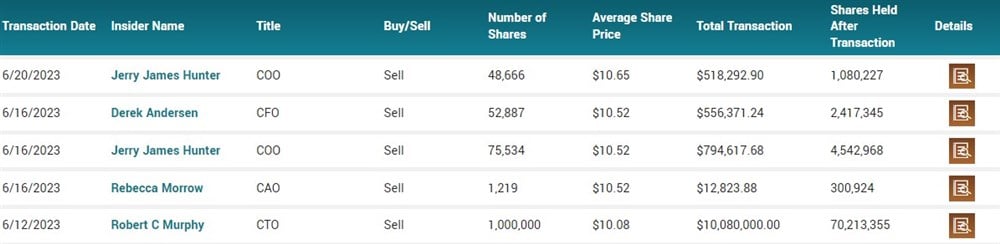

Over the last three years, since Q2 2020, insiders have sold a total of $1.165 billion of stock. During that same period, insiders have not purchased a single share of stock in the company. While the recent slowdown in insider selling might be a slight positive, investors certainly won't gain any confidence from the lack of insider purchasing.

Most recently, 1,278,305 shares of Snap were sold so far in June by company executives.

Should You Invest In Snap?

Considering the historical volatility in the share price and weaker-than-expected Q1 results, investing in Snap carries substantial risks. However, recent stability and the stock's rebound from its lows suggest a potential reversal opportunity. With price stabilizing near resistance and a growing user base, there is potential for a significant reversal if the stock can break through critical resistance and establish newfound support.