Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Tennant (NYSE: TNC) and the best and worst performers in the water infrastructure industry.

Trends towards conservation and reducing groundwater depletion are putting water infrastructure and treatment products front and center. Companies that can innovate and create solutions–especially automated or connected solutions–to address these thematic trends will create incremental demand and speed up replacement cycles. On the other hand, water infrastructure and treatment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 5 water infrastructure stocks we track reported a satisfactory Q3. As a group, revenues were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady as they are up 1.4% on average since the latest earnings results.

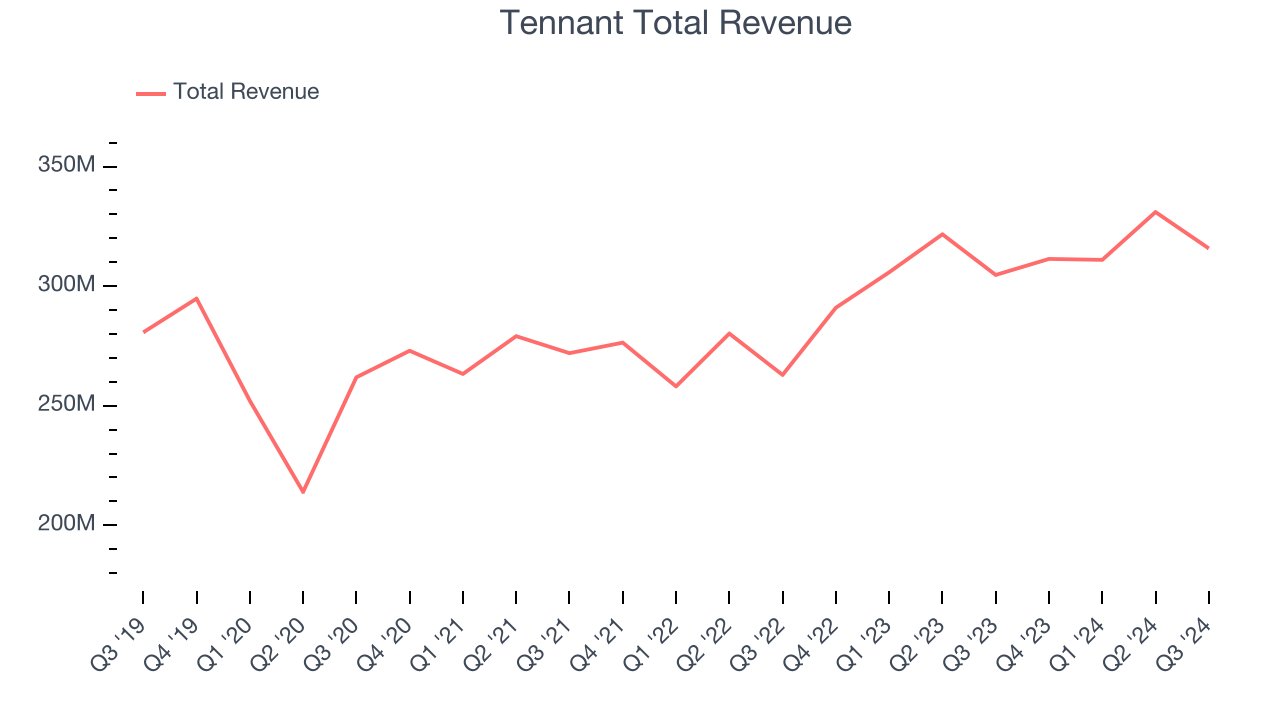

Tennant (NYSE: TNC)

As the world’s largest manufacturer of autonomous mobile robots, Tennant (NYSE: TNC) designs, manufactures, and sells cleaning products to various sectors.

Tennant reported revenues of $315.8 million, up 3.6% year on year. This print fell short of analysts’ expectations by 1.1%. Overall, it was a slower quarter for the company with a miss of analysts’ EPS and EBITDA estimates.

“We are pleased to report Tennant's strong third quarter results, continuing the trend from the first half of 2024 of delivering growth in organic net sales and Adjusted EBITDA as we progress toward normalized backlog levels by the end of 2024," said Dave Huml, Tennant President and Chief Executive Officer.

Tennant pulled off the highest full-year guidance raise of the whole group. The results were likely priced in, however, and the stock is flat since reporting. It currently trades at $87.19.

Read our full report on Tennant here, it’s free.

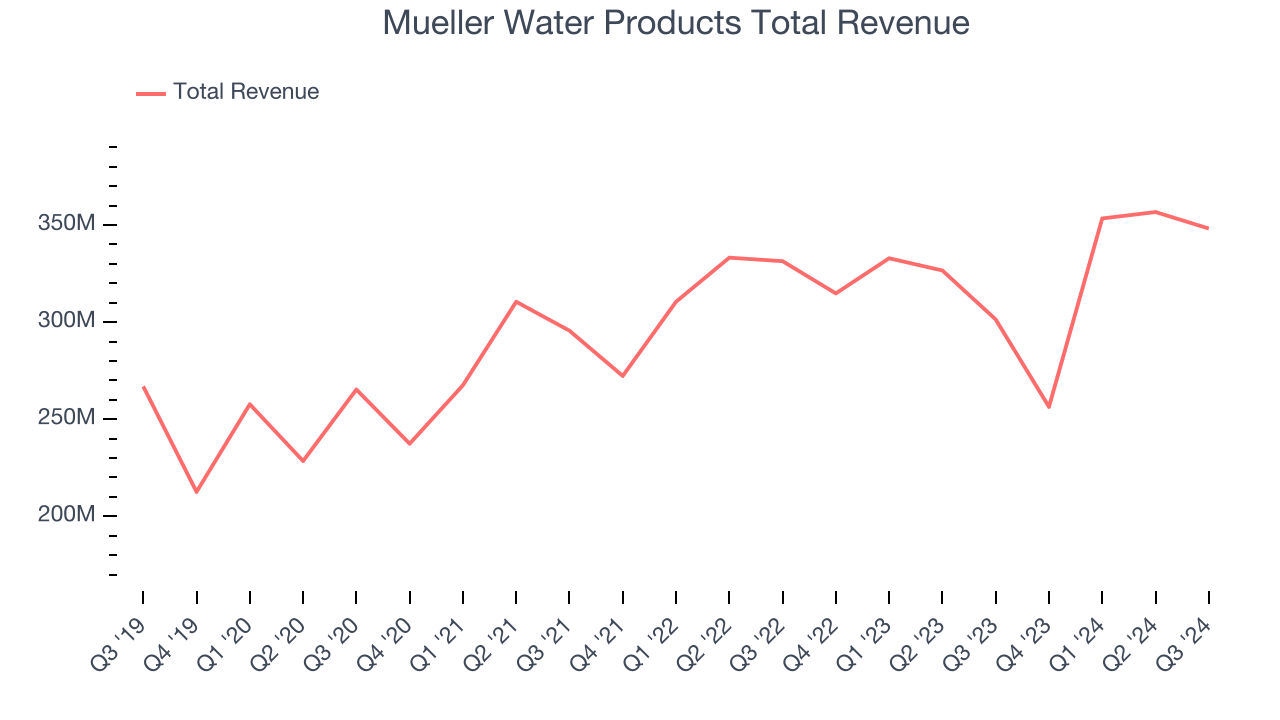

Best Q3: Mueller Water Products (NYSE: MWA)

As one of the oldest companies in the water infrastructure industry, Mueller (NYSE: MWA) is a provider of water infrastructure products and flow control systems for various sectors.

Mueller Water Products reported revenues of $348.2 million, up 15.5% year on year, outperforming analysts’ expectations by 6.5%. The business had a very strong quarter with an impressive beat of analysts’ organic revenue and EBITDA estimates.

Mueller Water Products achieved the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems content with the results as the stock is up 1.8% since reporting. It currently trades at $24.42.

Is now the time to buy Mueller Water Products? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Xylem (NYSE: XYL)

Formed through a spinoff, Xylem (NYSE: XYL) manufactures and services engineered products across a wide variety of applications primarily in the water sector.

Xylem reported revenues of $2.10 billion, up 1.3% year on year, falling short of analysts’ expectations by 3.2%. It was a slower quarter as it posted a significant miss of analysts’ organic revenue and adjusted operating income estimates.

Xylem delivered the weakest performance against analyst estimates, slowest revenue growth, and weakest full-year guidance update in the group. As expected, the stock is down 6.7% since the results and currently trades at $121.63.

Read our full analysis of Xylem’s results here.

Watts Water Technologies (NYSE: WTS)

Founded in 1874, Watts Water (NYSE: WTS) specializes in manufacturing water products and systems for residential, commercial, and industrial applications globally.

Watts Water Technologies reported revenues of $543.6 million, up 7.8% year on year. This result met analysts’ expectations. It was a satisfactory quarter as it also logged a decent beat of analysts’ adjusted operating income estimates.

The stock is up 6.1% since reporting and currently trades at $209.60.

Read our full, actionable report on Watts Water Technologies here, it’s free.

Energy Recovery (NASDAQ: ERII)

Having saved far more than a trillion gallons of water, Energy Recovery (NASDAQ: ERII) provides energy recovery devices to the water treatment, oil and gas, and chemical processing sectors.

Energy Recovery reported revenues of $38.58 million, up 4.2% year on year. This number missed analysts’ expectations by 1.4%. More broadly, it was actually a very strong quarter as it logged a solid beat of analysts’ EPS and EBITDA estimates.

The stock is up 5.8% since reporting and currently trades at $18.91.

Read our full, actionable report on Energy Recovery here, it’s free.

Market Update

In response to the Fed's rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed's 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.