Home security and automation software provider Alarm.com (NASDAQ: ALRM) reported Q3 CY2024 results exceeding the market’s revenue expectations, with sales up 8.4% year on year to $240.5 million. The company’s full-year revenue guidance of $934.8 million at the midpoint came in slightly above analysts’ estimates. Its GAAP profit of $0.67 per share was also 60.6% above analysts’ consensus estimates.

Is now the time to buy Alarm.com? Find out by accessing our full research report, it’s free.

Alarm.com (ALRM) Q3 CY2024 Highlights:

- Revenue: $240.5 million vs analyst estimates of $231.4 million (3.9% beat)

- EPS: $0.67 vs analyst estimates of $0.42 (60.6% beat)

- EBITDA: $49.98 million vs analyst estimates of $41.69 million (19.9% beat)

- The company slightly lifted its revenue guidance for the full year to $934.8 million at the midpoint from $926 million

- EBITDA guidance for the full year is $175 million at the midpoint, above analyst estimates of $166.2 million

- Gross Margin (GAAP): 64.8%, up from 63.3% in the same quarter last year

- Operating Margin: 13.8%, up from 7.3% in the same quarter last year

- EBITDA Margin: 20.8%, up from 18.7% in the same quarter last year

- Free Cash Flow Margin: 31%, up from 9% in the previous quarter

- Billings: $241.6 million at quarter end, up 8.2% year on year

- Market Capitalization: $2.86 billion

Company Overview

Founded in 2000 as a business unit within MicroStrategy, Alarm.com (NASDAQ: ALRM) is a software-as-a-service platform that enables users to control their security systems and smart home appliances from a single app.

Vertical Software

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

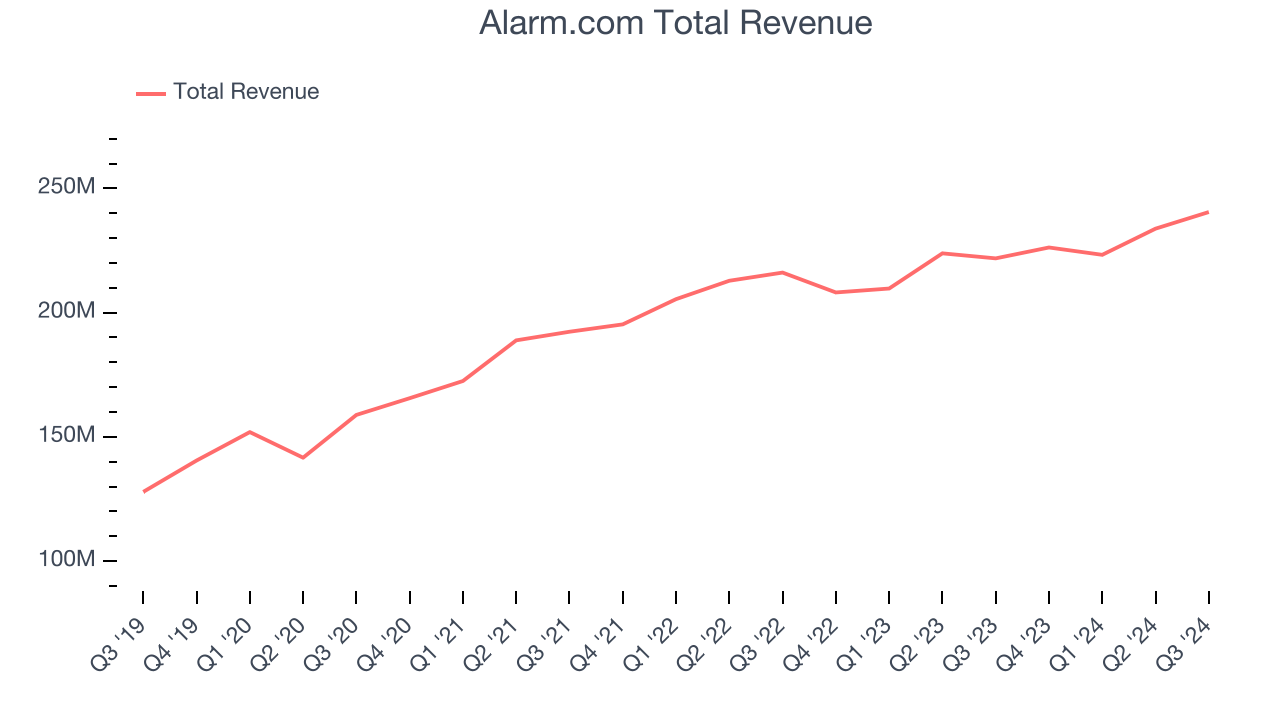

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Unfortunately, Alarm.com’s 8.7% annualized revenue growth over the last three years was sluggish. This shows it failed to expand in any major way, a rough starting point for our analysis.

This quarter, Alarm.com reported year-on-year revenue growth of 8.4%, and its $240.5 million of revenue exceeded Wall Street’s estimates by 3.9%.

Looking ahead, sell-side analysts expect revenue to grow 4.4% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and indicates the market believes its products and services will see some demand headwinds.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

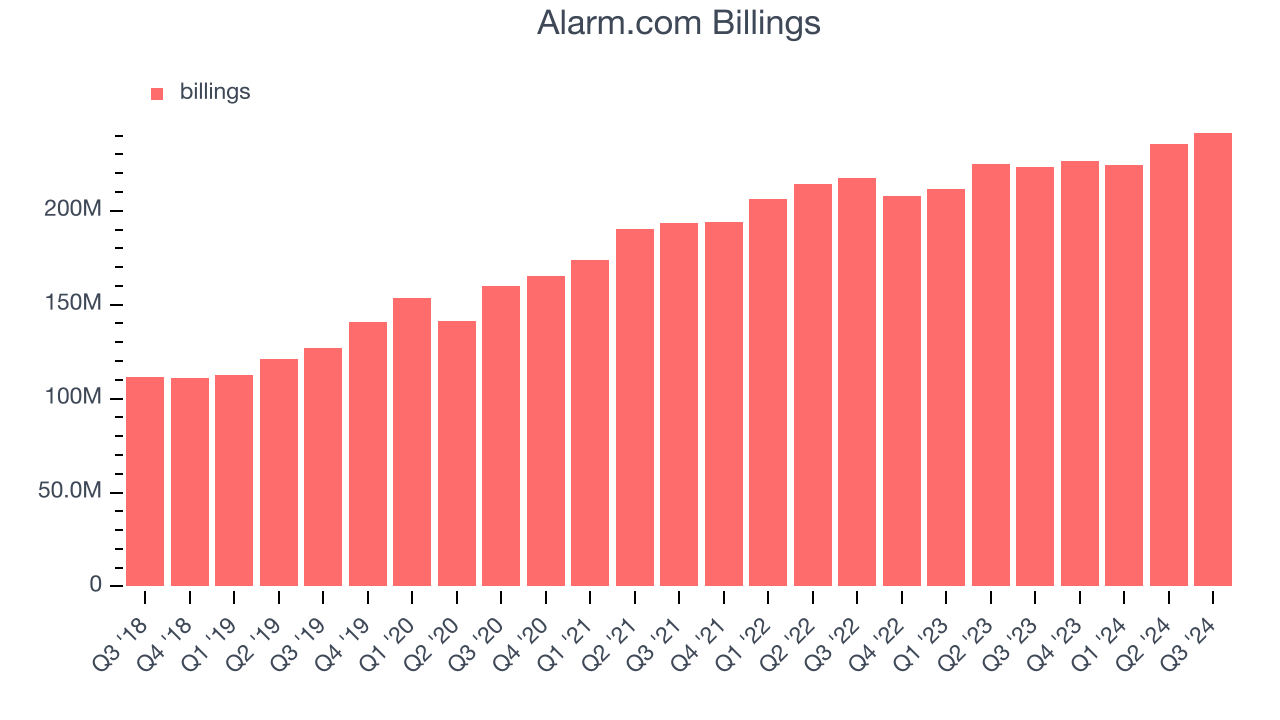

Billings

In addition to revenue, billings is a non-GAAP metric that sheds additional light on Alarm.com’s business quality. Billings is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Over the last year, Alarm.com’s billings growth has flat-out bad, averaging 6.9% year-on-year increases and coming in at $241.6 million in the latest quarter. This performance mirrored its revenue and suggests there may be increasing competition that is causing challenges in acquiring or retaining customers. If Alarm.com wants to accelerate billings growth, it must enhance its offerings and marketing strategies.

Customer Acquisition Efficiency

Customer acquisition cost (CAC) payback represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for marketing and sales investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Alarm.com is extremely efficient at acquiring new customers, and its CAC payback period checked in at 3.9 months this quarter. The company’s efficiency indicates that it has a highly differentiated product offering and strong brand reputation, giving it the freedom to invest resources into new growth initiatives while maintaining optionality.

Key Takeaways from Alarm.com’s Q3 Results

We were impressed by how significantly Alarm.com blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance exceeded Wall Street’s estimates. Zooming out, we think this was a good quarter with some key areas of upside. The stock traded up 8.5% to $61.97 immediately following the results.

Alarm.com put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.