Since June 2024, KB Home has been in a holding pattern, posting a small return of 4.1% while floating around $70.80. The stock also fell short of the S&P 500’s 10.3% gain during that period.

Is there a buying opportunity in KB Home, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.We're sitting this one out for now. Here are three reasons why KBH doesn't excite us and a stock we'd rather own.

Why Is KB Home Not Exciting?

The first homebuilder to be listed on the NYSE, KB Home (NYSE: KB) is a homebuilding company targeting the first-time home buyer and move-up buyer markets.

1. Backlog Declines as Orders Drop

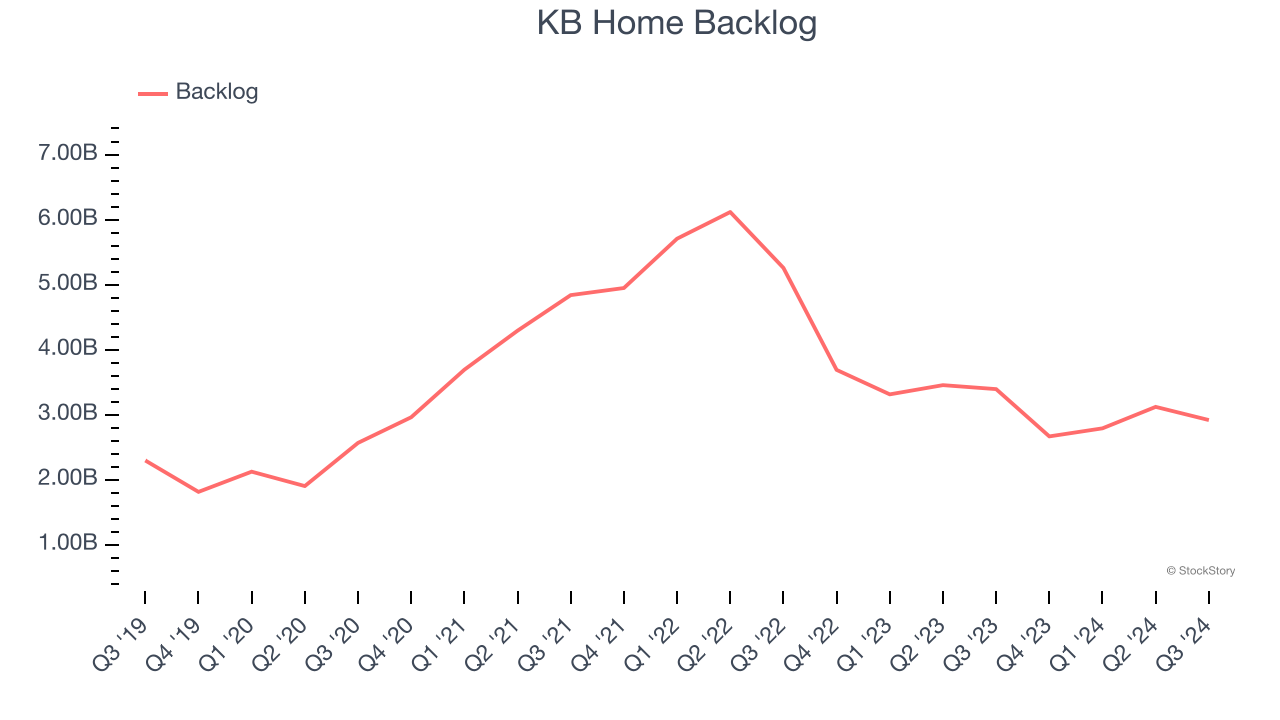

Investors interested in Home Builders companies should track backlog in addition to reported revenue. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into KB Home’s future revenue streams.

KB Home’s backlog came in at $2.92 billion in the latest quarter, and it averaged 26.7% year-on-year declines over the last two years. This performance was underwhelming and shows the company is not winning new orders. It also suggests there may be increasing competition or market saturation.

2. EPS Took a Dip Over the Last Two Years

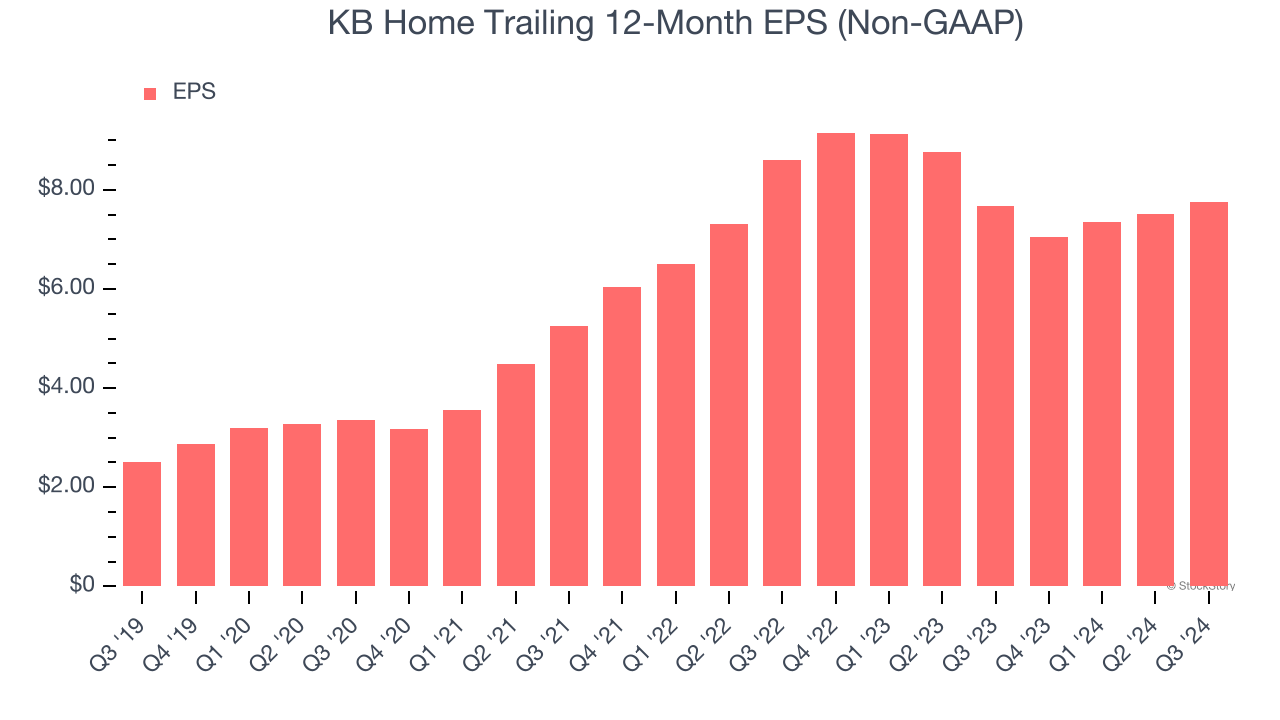

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for KB Home, its EPS declined by 5.1% annually over the last two years while its revenue was flat. This tells us the company struggled to adjust to choppy demand.

3. Free Cash Flow Margin Dropping

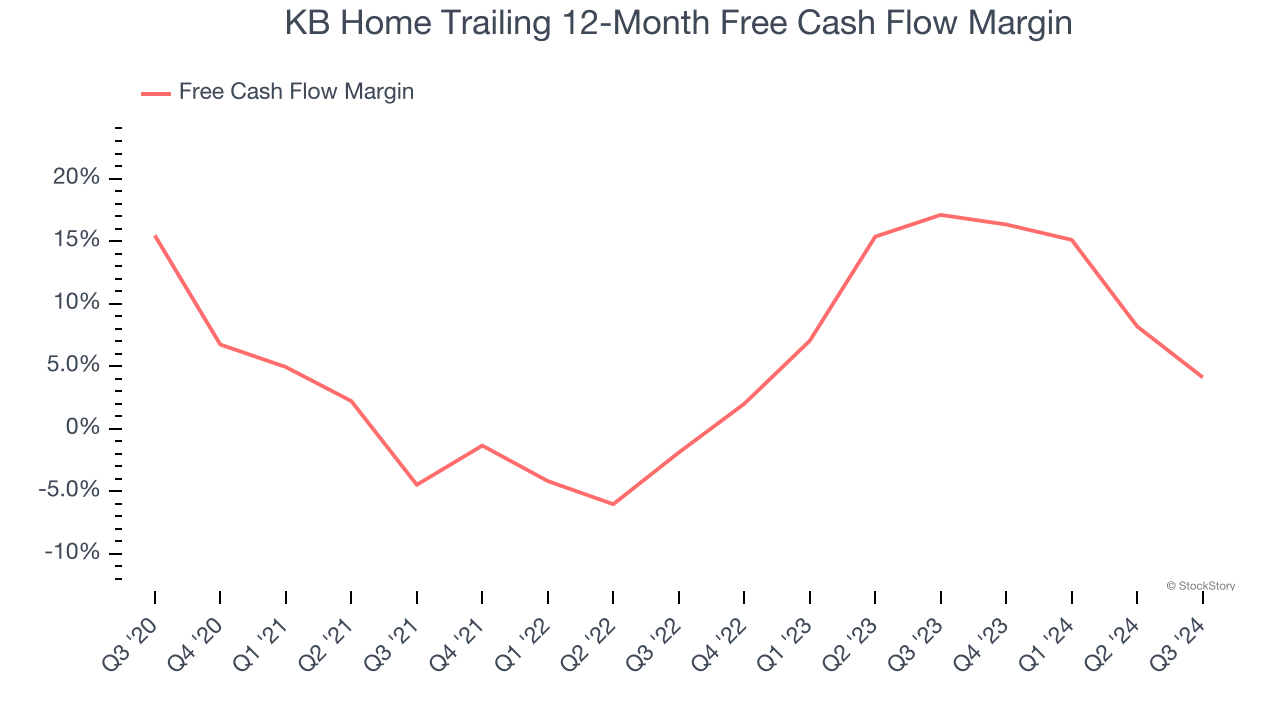

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, KB Home’s margin dropped by 11.3 percentage points over the last five years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business. KB Home’s free cash flow margin for the trailing 12 months was 4.1%.

Final Judgment

KB Home isn’t a terrible business, but it doesn’t pass our quality test. With its shares lagging the market recently, the stock trades at 8.2× forward price-to-earnings (or $70.80 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at CrowdStrike, the most entrenched endpoint security platform.

Stocks We Would Buy Instead of KB Home

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.